XRP price to hit $1.60 ‘if Bitcoin doesn’t ruin party’

![]() Cryptocurrency Nov 25, 2024 Share

Cryptocurrency Nov 25, 2024 Share

After a multi-week winning streak in the wake of Donald Trump’s re-election and the announcement Chair Gary Gensler will be stepping down from the Securities and Exchange Commission (SEC), the cryptocurrency market entered a zone of uncertainty and high volatility over the weekend.

The situation – which appeared resolved early on Monday, November 25 but has since returned – spawned renewed analysis and speculation about what might happen to one of the most-discussed tokens – XRP.

Specifically, CrediBULL Crypto, a prominent digital assets expert on X, explained on November 24 that XRP’s continued positive momentum will depend on Bitcoin’s (BTC) performance.

Picks for you

XRP price to soar as whales make giant splash 4 hours ago MicroStrategy makes largest ever Bitcoin buy 5 hours ago Polygon set for 6,000% rally to $36, crypto expert reveals 7 hours ago Finance guru Raoul Pal says DOGE is 'harder money than Bitcoin' 7 hours ago

According to the analyst, XRP’s own performance indicates a continued rally above $2, but BTC has the potential to spoil the momentum should it collapse below $94,000.

Pretty pivotal point here- not just for $BTC but also $XRP– and it makes sense that they are both at this junction together.

XRP is at a level where if we are going to get an extended 5th for this rally and continue to $2+ without a "significant" pullback then we should be… https://t.co/wrl8TbjVlk pic.twitter.com/s6w9w0E7Ks

— CrediBULL Crypto (@CredibleCrypto) November 24, 2024

Did Bitcoin just ‘spoil’ the XRP rally?

By November 25, the analysis appeared prescient as, despite Bitcoin experiencing a substantial weekend drop, it managed to recover quickly enough that XRP appeared well on its up, with many other inventors, traders, and experts opining Monday will see the token climb to $2.

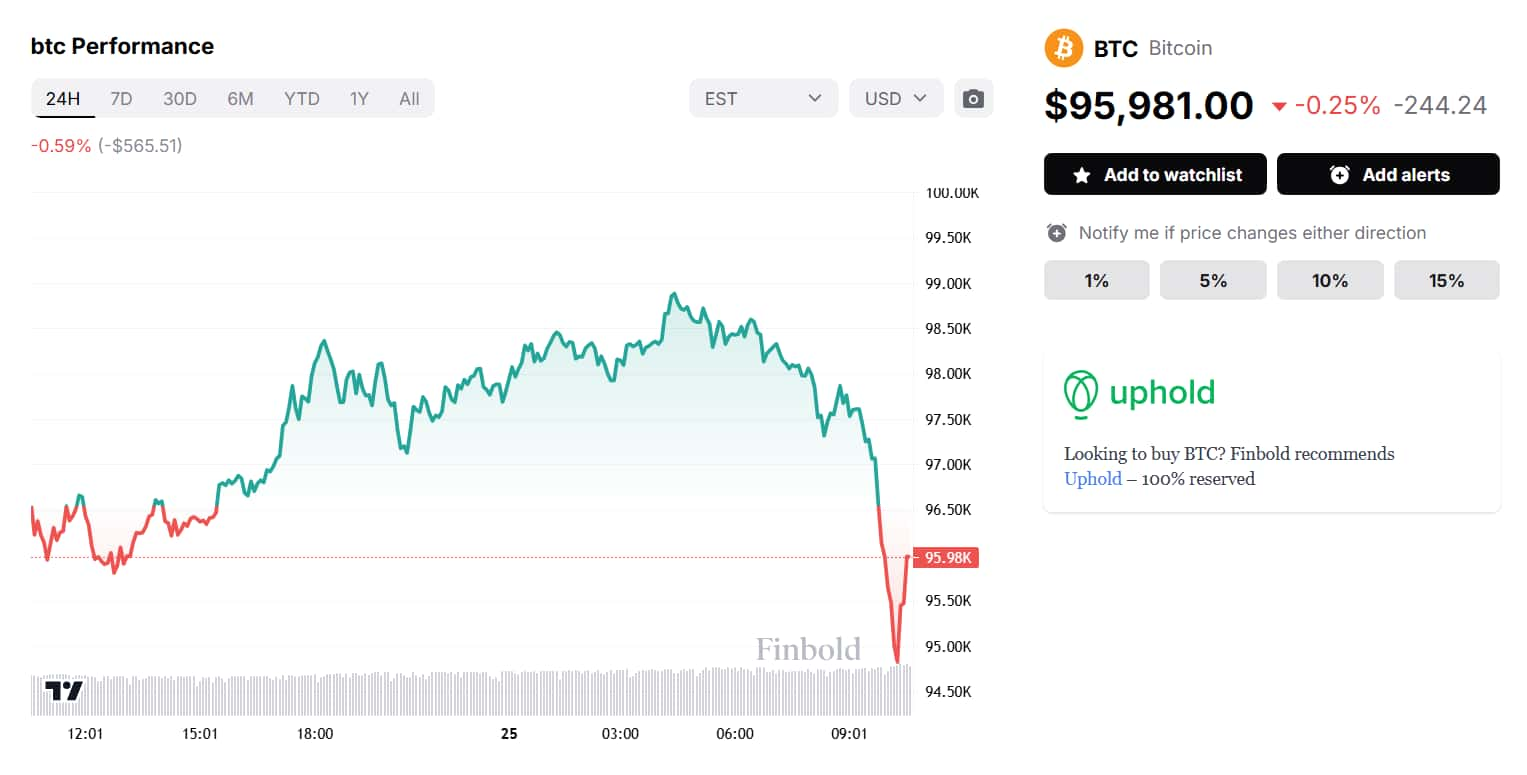

Still, uncertainty was reintroduced shortly after the market opened on November 25, as Bitcoin experienced a rapid drop from the 24-hour highs just shy of $99,000 to below $95,000.

BTC 1-day price chart. Source: Finbold

BTC 1-day price chart. Source: Finbold

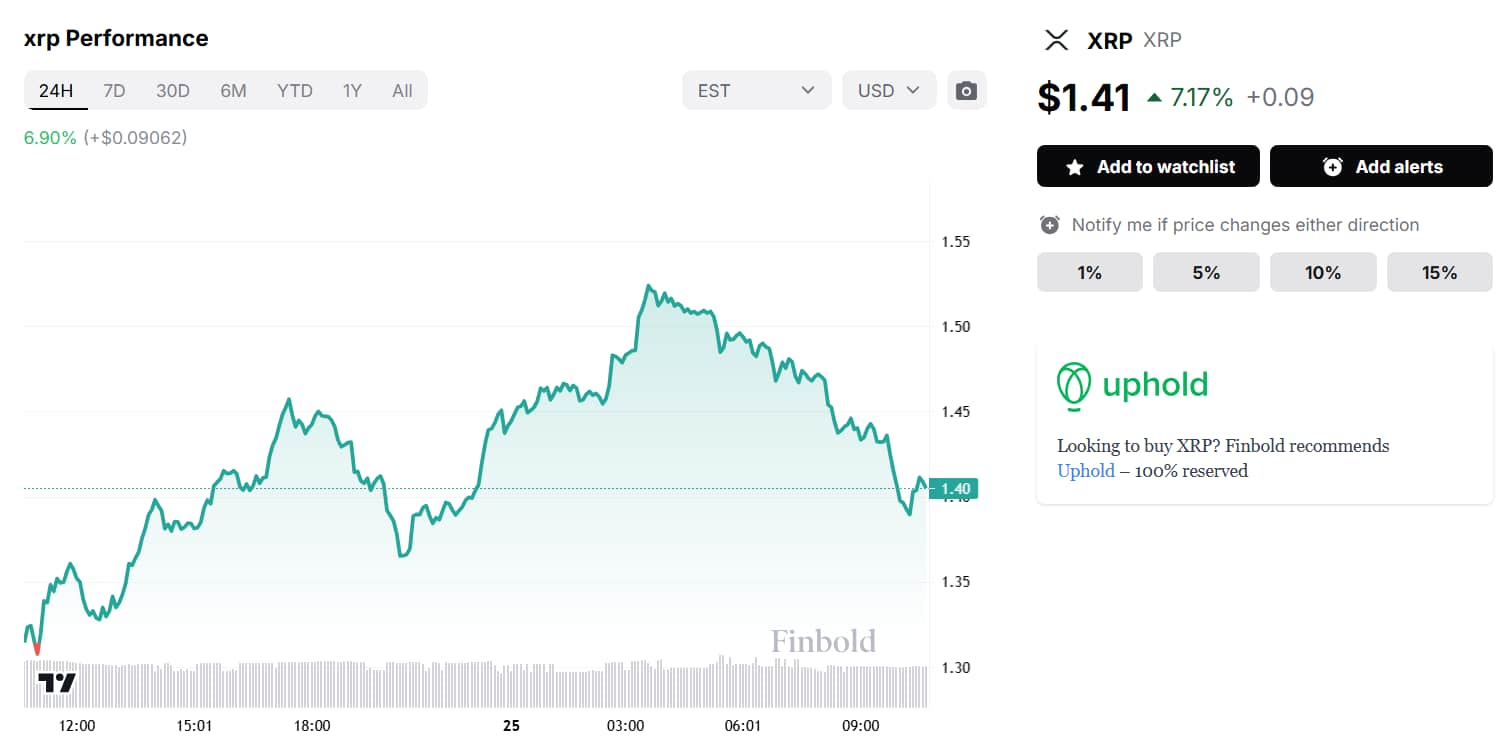

At press time, however, it appears that the sudden plunge did not spoil the XRP rally. The token followed the premier cryptocurrency both into the collapse and the subsequent recovery, dipping below $1.40 and quickly rising to $1.41.

XRP 1-day price chart. Source: Finbold

XRP 1-day price chart. Source: Finbold

Furthermore, though BTC fell, it remained above $94,000 – a level identified as critical by CrediBULL Crypto – likely ensuring the XRP rally toward $2 can persist.

Did this trade prevent a weekend Bitcoin crash?

On the other hand, trading in the cryptocurrency market in the first half of the week could be fraught. Though Bitcoin has been relatively stable above $95,000 and similarly stable in its inching toward $100,000, historical performance shows that, unless it breaches the psychologically critical level, it could experience a deep pullback before another attempt.

Though it appeared such a risk was averted by Monday as BTC recovered above $98,000, the revelation that Michael Saylor’s (NASDAQ: MSTR) MicroStrategy purchased more than $5 billion of the cryptocurrency over the weekend raised the possibility that this ‘whale’ activity alone served to stave off a deeper correction.

MicroStrategy has acquired 55,500 BTC for ~$5.4 billion at ~$97,862 per #bitcoin and has achieved BTC Yield of 35.2% QTD and 59.3% YTD. As of 11/24/2024, we hodl 386,700 $BTC acquired for ~$21.9 billion at ~$56,761 per bitcoin. $MSTR https://t.co/79ExzXk4UM

— Michael Saylor⚡️ (@saylor) November 25, 2024

At press time, it is uncertain if the latest downturn will translate into a protracted decline or if the market will quickly recover from the shock.

XRP technical analysis

Finally, though Bitcoin’s swings remain important for most other actors in the cryptocurrency markets, it is worth pointing out that XRP has its own legs to stand on.

Specifically, after trading in the green on 19 out of the last 30 days, the token is above short – 50-day – and long – 200-day – moving averages (MA), with decisively bullish momentum.

Such price action also enabled the token to climb 128.33% in the last 12 months, outperforming 61 of the top 100 cryptocurrencies within the time frame, though, notably, not Bitcoin.

Still, despite – or perhaps because – the rally has been exceptionally strong and featured a 180% in the last 30 days, XRP has also become dangerously overbought with a relative strength index at 80.95.

Such a setup could simultaneously explain its Monday dip that followed Bitcoin’s sharp drop and the reason behind the speculation and uncertainty over the token’s next move being rampant, even with the upward catalyst provided by the news of Gary Gensler’s departure.

Finally, traders should note that even if the current pullback deepens, XRP is likely to continue climbing as long as it stands above the nearest support zone close to $1.33. It is likewise probable that the token will rocket toward $2 once the $1.51 resistance is broken, and it is almost guaranteed once the $1.69 resistance is overcome.

Featured image via Shutterstock