Synopsis

WazirX completed its asset rebalancing post a $230 million security breach and seeks user approval for a distribution scheme covering 85% of investor balances. Token redistribution will begin within 10 business days. Partnering with zeroShadow, WazirX has recovered $3 million. Future distributions will span three years, supported by asset recovery and operational profits.

Crypto exchange WazirX has announced the completion of its asset rebalancing process, marking a key step toward recovering from last year’s security breach, which resulted in losses exceeding $230 million. The exchange will now seek user approval for a distribution scheme.

The redistribution of assets will be made in the form of tokens, the company said, conditional to its majority users voting in affirmative to its scheme.

The scheme would represent about 85% of the balances of investors on the crypto exchange, valued as of July 18, 2024 at 1 PM Indian Standard Time (IST). This was the day when the firm was impacted by the alleged breach.

Crypto Tracker![]() TOP COIN SETSNFT & Metaverse Tracker1.62% BuyAI Tracker-0.12% BuyWeb3 Tracker-0.56% BuySmart Contract Tracker-1.61% BuyCrypto Blue Chip – 5-1.76% BuyTOP COINS (₹) XRP216 (2.7%)BuyEthereum234,462 (1.42%)BuySolana17,765 (0.4%)BuyBitcoin8,530,076 (0.14%)BuyTether87 (-0.88%)BuyThe exchange said that the distribution process would start within 10 business days of the scheme being effective, which the platform claimed would be the fastest recovery in the history of the industry.

TOP COIN SETSNFT & Metaverse Tracker1.62% BuyAI Tracker-0.12% BuyWeb3 Tracker-0.56% BuySmart Contract Tracker-1.61% BuyCrypto Blue Chip – 5-1.76% BuyTOP COINS (₹) XRP216 (2.7%)BuyEthereum234,462 (1.42%)BuySolana17,765 (0.4%)BuyBitcoin8,530,076 (0.14%)BuyTether87 (-0.88%)BuyThe exchange said that the distribution process would start within 10 business days of the scheme being effective, which the platform claimed would be the fastest recovery in the history of the industry.

Did you Know?

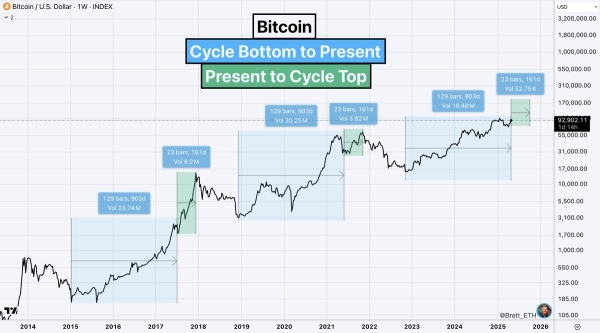

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Nischal Shetty, Founder of WazirX, stated, “Completing the rebalancing process and preparing for distribution demonstrates our deep commitment to protecting creditor interests and restoring the trust placed in the platform. By targeting one of the fastest distribution timelines in the crypto industry, we hope to set a precedent for accountability, efficiency, and resilience in times of crisis.”![]()

Also Read: US crypto policies under Trump: A new era for global innovation

Beyond the initial distribution, the Scheme outlines subsequent distributions over a three-year period. These will be funded through the recovery of illiquid assets, including the stolen tokens, and profits generated from future operations.

WazirX has partnered with leading blockchain forensics firm zeroShadow to trace and recover the stolen funds. To date, approximately USDT 3 million of the stolen assets have been successfully frozen.

Jarno Laatikainen, COO of zeroShadow, commented, “Leveraging our expertise and strong relationships with law enforcement agencies, exchanges, and projects, zeroShadow is proud to have played a key role in aiding WazirX to freeze the stolen assets and take a significant step toward recovery for affected users.”

The rebalancing process, finalized in January 2025, involved comprehensive efforts to align the token denominations of assets with platform liabilities. WazirX collaborated with financial advisors, specialist brokerages, and other professionals to execute trades securely and realign holdings. This meticulous approach ensures that token distributions are fair, transparent, and aligned with current market conditions.

Jason Kardachi, Managing Director and Co-Head of Kroll’s global restructuring practice, noted, “Aligning the value of assets with liabilities in a volatile crypto market over nearly 350 tokens, many with challenging liquidity profiles, is no small feat. This marks a critical step forward in the recovery process and sets a new benchmark for addressing such complex challenges in the crypto industry.”

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)