Wall Street sets GameStop stock 12-month price target

![]() Stocks Mar 26, 2025 Share

Stocks Mar 26, 2025 Share

GameStop (NYSE: GME) stock’s performance in recent years has been marked by protracted periods of disinterest and relative inactivity, split by brief resurgences reminiscent of the original meme stock craze.

One such resurgence started on March 25 and was, on March 26, reinforced by a rare occurrence: a Wall Street analyst GME stock price target revision.

Specifically, in the early hours of Wednesday, Wedbush revealed that, while it still considers GameStop a ‘sell,’ it forecasts the equity will hit $11.50 in twelve months’ time, not $10 as previously predicted.

Picks for you

R. Kiyosaki boldly declares 'the world is in a recession' 1 hour ago SHIB price soars as $1 billion flows in overnight 3 hours ago WhiteBIT launches its crypto exchange in Australia 4 hours ago Ripple’s Legal Chief drops bombshell ‘Final’ update on SEC case 5 hours ago

However, it is probably fair to assume the analysts’ previous justification for the bearish outlook still applies:

GameStop is the rich man’s MicroStrategy. So if you’re not happy with how MicroStrategy is performing, you want to pay even more for even less, you can buy GameStop.

Wedbush’s Michael Pachter likewise pointed toward GameStop being unlikely to turn a profit within a reasonable timeframe when explaining why selling remains the wiser call:

They’re not going to make an operating profit in the year they’re about to report; they’re not going to make one this year, or next year, or ever. So if their operations continue to lose money, it’s hard to value them at several billion dollars, and the market’s just got this one wrong. The company’s strategy, which has changed about six times in three years, is they’re going to buy cryptocurrency and be just like MicroStrategy.

The new price target is likely to offer little solace to GME holders as, even after the upgrade, Wedbush still believes in a 59.45% 52-week downside.

GameStop stock soars despite Wall Street negativity

Elsewhere, GameStop stock traders do not appear bothered by analysts’ bearishness as the equity has soared more than 12% in the extended session that started late on March 25 and in the early hours of March 26.

At their press time price of $28.36, GME shares are 12.42% up in the one-week chart.

GME stock one-week price chart. Source: Finbold

GME stock one-week price chart. Source: Finbold

The swift and powerful rally was driven primarily by the company’s announcement that it would include the world’s premier cryptocurrency, Bitcoin (BTC), in its investment strategy.

An announcement regarding Bitcoin pic.twitter.com/gG8JRarIok

— GameStop (@gamestop) March 25, 2025

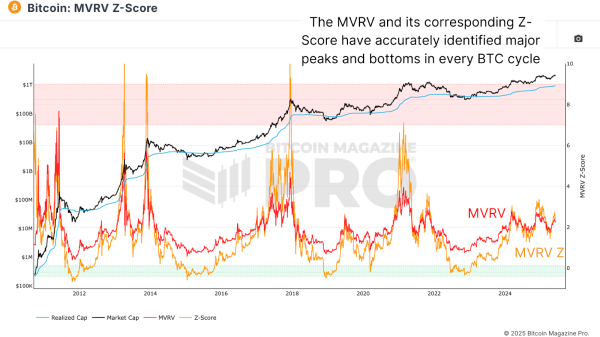

Thanks to the digital assets bull market that started late in 2023 and BTC’s recent break back toward positive performance, companies involved with cryptocurrencies have generally been doing well.

Strategy (NASDAQ: MSTR) – formerly known as MicroStrategy – is the poster child of both this tactic and of its success as MSTR shares are up an impressive 78.36% in the last 12 months to their press time price of $334.79.

MSTR stock 12-month price chart. Source: Finbold

MSTR stock 12-month price chart. Source: Finbold

Lastly, while the initial reaction was positive, it is worth remembering that the Bitcoin investment strategy isn’t GameStop’s first major venture into digital assets. Previously, the company attempted to find blockchain success with an inglorious non-fungible token (NFT) marketplace.

Featured image via Shutterstock