As bitcoin vaulted past $100,000, long-inactive wallets abruptly awakened, their enigmatic microtransactions igniting theories about whether elusive stakeholders are conducting trial runs or camouflaging grander financial maneuvers.

Dust-Sized Bitcoin Transfers Sometimes Precede Covert Wealth Transfers

Blockchain data from the past few months exposes a curious reanimation of idle coins, coinciding with bitcoin’s breach of the six-figure milestone. Typically, these wallets relocate their entire stashes from addresses untouched for years.

Yet lately, a subset has pivoted to shifting mere slivers of their vintage BTC reserves—a tactic that could presage efforts to veil sizable capital redistributions or rehearse transactional mechanics.

Over the past three months, analytics highlight a striking reemergence of so-called “sleeping bitcoins” after BTC scaled historic valuation peaks. In Jan. 2025 alone, 18 wallets dormant since 2014 liquidated their assets for the first time.

Parallel figures from btcparser.com show 18 transactions tied to 2017-era wallets this month. Among these aging vaults, a curious trend surfaces: trivial dust transfers appear to cloak heftier monetary shifts.

Another plausible explanation? These fractional exchanges might serve as dry runs for fresh wallets. Last month for instance, a user spent 0.50 BTC at block height 873,138—a sum hardly negligible, yet the 2011-vintage wallet harbored a far larger trove, ultimately relocating 12.45 BTC ($1.2 million).

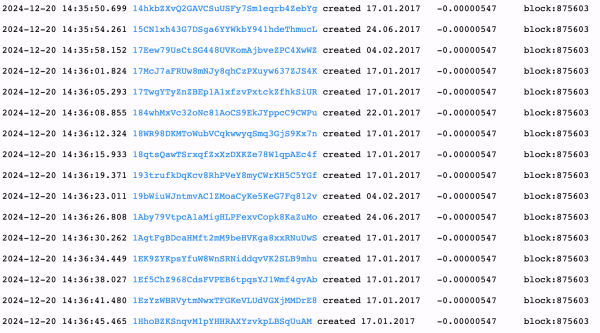

What’s even more fascinating? The address had quietly accumulated 138.54 BTC since its inception. A Dec. 20, 2024, episode saw an entity transfer 0.00000547 BTC from 19 distinct 2017 wallets. While blockchain trackers flagged the 19 microtransactions, the actual capital shift proved far weightier: 99.99 BTC.

Dec. 20, 2024 – Source: Btcparser.com

Dec. 20, 2024 – Source: Btcparser.com

These veiled transactional tactics have spilled into 2025, with petty transfers masking preparatory liquidation strategies. Consider a Dec. 12, 2013, wallet that executed a 0.00101906 BTC transaction on Jan. 5, 2025—only for the authentic exchange to involve 19.99 BTC.

Jan. 28, 2025 – Source: Btcparser.com

Jan. 28, 2025 – Source: Btcparser.com

Days later, a 2014 wallet moved 0.00106694 BTC publicly, yet in total it shuffled 48.7 BTC. By Jan. 20, a set of four 2014 bitcoin wallets each dispatched microscopic sums, but collectively transferred 40 BTC. Finally, on Jan. 28, a 2011-era wallet initiated a 0.00001641 BTC transaction, once again disguising a bulkier financial ballet.

It is well known that trial runs could precede major transactions, ensuring seamless execution while minimizing exposure. Alternatively, these micro-moves might obscure intent, complicating blockchain surveillance by blending significant actions amid trivial noise. Fractional transactions strategically fracture tracing efforts, masking larger capital reallocations or liquidation plans.

By dispersing activity across dust-sized sums, entities might evade market attention, preempt volatility triggers, or protect anonymity. This sleight of hand could also signal coded coordination among stakeholders, balancing prudence with preparation for stealthier, high-impact financial maneuvers.