- VanEck and Inter Invest launched Bitcoin exposure within French retirement plans using the VBTC Bitcoin ETF.

- The VBTC ETF, valued at $407 million, is fully collateralized, with a 1% expense ratio, and tracks the MarketVector Bitcoin VWAP Close Index.

- Despite skepticism from entities like the ECB, Bitcoin ETFs saw substantial net inflows, with US ETFs seeing $301 million in one day.

VanEck has teamed up with asset manager Inter Invest to launch Bitcoin within French retirement savings plans. The partnership uses VanEck’s VBTC Bitcoin ETF, recently introduced on Australia’s leading exchange.

Breaking: VanEck partners with Inter Invest to introduce the first Bitcoin ETF exposure for French pension plans via the VBTC Bitcoin ETF, recently launched on Australia’s top exchange. #Bitcoin #ETF #France #PensionPlans #BTC

— Ox HaK (@oxhak) July 17, 2024

Valued at $407 million, the VBTC ETF aims to offer French Pension Savings Plan (PER) investors the chance to include digital assets in their retirement portfolios. VBTC is fully collateralized and tracks the MarketVector Bitcoin VWAP Close Index, which measures the performance of a digital asset portfolio invested directly in Bitcoin.

With a total expense ratio of 1%, the VBTC ETF provides a regulated product for investors to gain exposure to the largest cryptocurrency. This mirrors the newly approved ETF market in the US, which began in January after approval from the US Securities and Exchange Commission (SEC).

The introduction of Bitcoin ETFs into French pension plans follows the approval of the first crypto ETF listings on the London Stock Exchange in Q2. These listings granted professional investors access to this asset class. The European Central Bank (ECB) referred to the approval of spot Bitcoin ETFs by the SEC as ‘the naked emperor’s new clothes.’

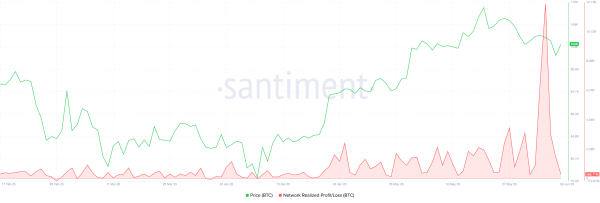

Despite this skepticism, recent data shows the continued success of the newly licensed market, despite periods of significant outflows. On Monday, US Bitcoin ETFs saw a substantial net inflow of $301 million, marking seven consecutive days of net inflows.

Notably, BlackRock’s IBIT and Ark Invest ETFs, and 21 Shares’ ARKB ETF, each saw substantial net inflows of $117 million. Bloomberg expert Eric Balchunas noted that Bitcoin ETFs are progressing, crossing the milestone of $16 billion year-to-date.

In conclusion, VanEck and Inter Invest’s collaboration marks a significant step in integrating digital assets into traditional investment vehicles. Despite ongoing skepticism, the success of Bitcoin ETFs in the US and UK markets suggests a growing acceptance and demand for cryptocurrency exposure in retirement portfolios.