Just like oscillators, moving averages (MAs) are indispensable tools in technical analysis, providing traders with insights into price trends and potential market reversals. In this learning and insights article, we’ll delve into the history, types, and application of moving averages leveraged in bitcoin trading, highlighting their significance and utility in the crypto market.

The History of Moving Averages

The concept of moving averages (MAs) was developed in the early 20th century by American statistician Robert Rhea. Initially applied to stock prices, MAs gained prominence in the mid-20th century with the advent of more sophisticated computing technology. Similar to oscillators, the widespread use of MAs in technical analysis became more prevalent in the 1970s as traders and analysts sought methods to smooth out price data and identify trends.

Simple Moving Average (SMA) vs. Exponential Moving Average (EMA)

Moving averages come in two primary forms: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Both serve to smooth price data over a specified period, but they differ in calculation and sensitivity to recent price changes.

Simple Moving Average (SMA):

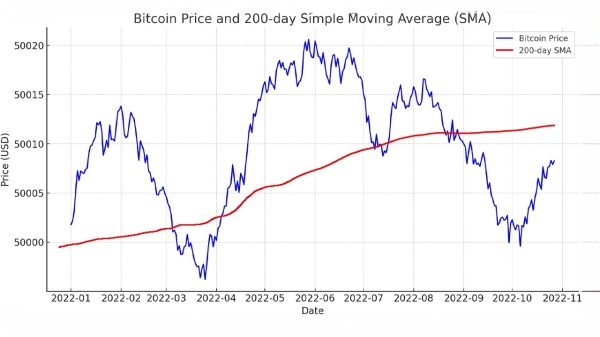

The SMA is calculated by summing the closing prices of a specific number of periods and dividing by that number. For instance, a 10-day SMA of bitcoin is the sum of the closing prices over the last 10 days divided by 10. The SMA gives equal weight to all periods, making it less sensitive to recent price changes.

Example 200-day SMA chart. The chart’s BTC price and date are just visual examples and not factual based on historical prices.

Example 200-day SMA chart. The chart’s BTC price and date are just visual examples and not factual based on historical prices.

Exponential Moving Average (EMA):

The EMA assigns more weight to recent prices, making it more responsive to new information. The calculation involves a more complex formula, incorporating a smoothing factor. In bitcoin trading, the EMA is favored for its ability to react more quickly to price fluctuations, providing timely signals for traders.

Key Moving Averages in Bitcoin Trading

MAs of different periods provide varying insights into market trends. Here are the commonly used MAs and their significance in bitcoin trading:

- 10-Day MA: The 10-day moving average is often used for short-term trading. It helps identify recent trends and potential entry or exit points for trades. bitcoin traders might use the 10-day MA to gauge the immediate market sentiment.

- 20-Day MA: This moving average is slightly longer and helps smooth out the volatility seen in the 10-day MA. It’s useful for identifying short to medium-term trends and confirming the strength of recent price movements in bitcoin.

- 30-Day MA: The 30-day MA is a balance between short and long-term analysis. It provides a broader perspective on price trends and is often used to confirm signals generated by shorter MAs.

- 50-Day MA: This intermediate-term MA is widely followed by traders. It helps identify the primary trend of bitcoin and serves as a critical level of support or resistance. Crossovers involving the 50-day MA often signal significant market shifts.

- 100-Day MA: The 100-day MA is used to analyze long-term trends. It smooths out much of the market noise and helps traders identify the overarching trend direction in bitcoin.

- 200-Day MA: The 200-day MA is a key indicator of long-term market trends. Bitcoin’s price relative to the 200-day MA is often seen as a barometer of the asset’s health. When bitcoin is above the 200-day MA, it’s considered to be in a long-term uptrend, and vice versa.

Advanced Moving Averages

In addition to the traditional MAs used by analysts every single day, advanced moving averages offer further insights into bitcoin’s charted movements:

Ichimoku Cloud: The Ichimoku Cloud, or Ichimoku Kinko Hyo, consists of multiple lines, including the Base Line (Kijun-sen), which represents the midpoint of the 26-period high-low range. It provides a comprehensive view of support, resistance, and trend direction, helping bitcoin traders make more informed decisions.

Volume Weighted Moving Average (VWMA): The VWMA takes into account the volume of trades, giving more weight to periods with higher trading activity. This can be particularly useful in bitcoin trading, where volume spikes often precede significant price movements.

Hull Moving Average (HMA): The HMA aims to reduce lag while maintaining smoothness, offering a more responsive and accurate representation of price trends. It’s beneficial for bitcoin traders seeking to minimize delays in signal generation.

Moving averages are vital tools in bitcoin trading, providing clarity amidst market volatility. Understanding the different types of MAs and their applications can help traders make informed decisions, enhancing their ability to navigate the dynamic cryptocurrency market. From short-term SMAs to advanced Ichimoku Clouds, mastering these indicators can significantly improve trading strategies and outcomes in the world of bitcoin.

At the same time, moving averages (MAs) are not a perfect science for predicting market movements. Anomalies and unexpected shifts in bitcoin’s price can occur, rendering even the most reliable technical indicators less effective. Traders should use MAs as part of a broader strategy, combining them with other tools like news alerts, social sentiment, oscillators, and other types of analysis to navigate bitcoin’s volatile landscape effectively.