U.S. economist warns government is ‘getting ready’ to sell $4 billion Bitcoin

![]() Cryptocurrency Oct 9, 2024 Share

Cryptocurrency Oct 9, 2024 Share

After the United States Supreme Court’s recent decision to allow the government to sell the 69,370 Bitcoin (BTC) seized from the infamous Silk Road marketplace, a renowned economist and one of Bitcoin’s most prominent critics has warned that this might happen very soon.

Indeed, Silk Road was an anonymous online black market active from 2011 to 2013 launched by Ross Ulbricht, who is currently serving a life sentence for crimes including money laundering and distributing narcotics, and the authorities had seized Bitcoin as part of the investigation.

Specifically, Peter Schiff recently stated that it seemed like the U.S. government was preparing to sell 69,370 Bitcoin worth about $4.3 billion considering the asset’s current price, referring to the move as “smart,” according to the economist’s X post published on October 9.

Picks for you

Sui price prediction amid Grayscale and Circle announcements 3 hours ago Supra introduces Supra Containers to innovate blockchain and eliminate the need for L2S 5 hours ago Bybit’s bbSOL sees a successful first month 8 hours ago Squid Game 2 sparks crypto coin frenzy: Pump or dump? 9 hours ago

Furthermore, he suggested that Michael Saylor, the executive chair at MicroStrategy (NASDAQ: MSTR) and a vocal Bitcoin enthusiast, should have his company “borrow another $4.3 billion and buy” this BTC, alluding at Saylor’s Bitcoin buying habits.

It looks like the U.S. government is getting ready to sell 69,370 #Bitcoin, worth about $4.3 billion at current market prices. Every once in a while, the government does something smart. I think @saylor should have $MSTR borrow another $4.3 billion and buy it. Who agrees with me?

— Peter Schiff (@PeterSchiff) October 8, 2024

Silk Road seizures

As it happens, a ruling by the Northern California District Court from 2022 had ordered the government to liquidate the seized Silk Road Bitcoin under existing laws, and the Supreme Court’s recent refusal to hear an appeal regarding the ownership of the said Bitcoin cemented the decision.

Indeed, the appeal, brought by Battle Born Investments, claimed that the Bitcoin was stolen by ‘Individual X,’ who allegedly took the funds from Silk Road, as well as argued that it belonged to the company by right through a Silk Road-connected bankruptcy estate.

However, the courts ruled against the company, and the Supreme Court refused to hear the appeal, clearing the way for the government to auction off the seized Bitcoin, with the U.S. Marshals Service handling the liquidation following several formalities.

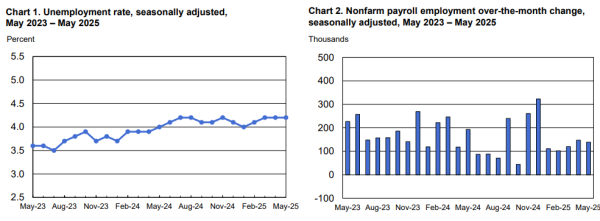

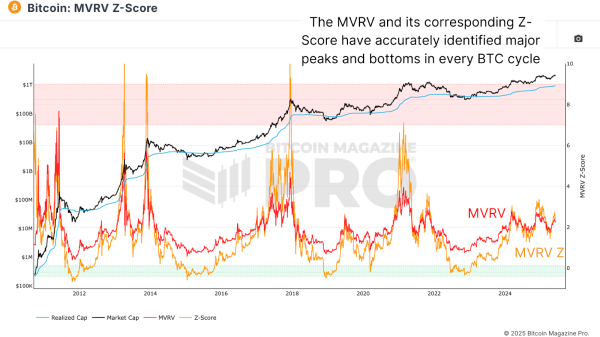

Bitcoin price analysis

Meanwhile, the maiden cryptocurrency was at press time changing hands at the price of $61,770, recording a 1.36% decline in the last 24 hours, gaining 0.45% across the previous seven days, as well as advancing 11.13% over the past month, according to the most recent data on October 9.

Bitcoin price 7-day chart. Source: Finbold

Bitcoin price 7-day chart. Source: Finbold

All things considered, the U.S. government might, indeed, rid of all the Bitcoin seized from the Silk Road case, which would cause immense market volatility, as it has happened before. However, it is still unclear what it actually intends to do, especially as the presidential election approaches.