Trader turns $3K into $9M while other loses $43,500 out of FOMO

![]() Cryptocurrency Oct 20, 2024 Share

Cryptocurrency Oct 20, 2024 Share

The market will have losers and winners in the speculative trading game, with capital outflowing from the former to the latter. Usually, the winning group is made of a smart trader’s minority, leveraging some sort of edge against the losing majority.

In a cautionary tale illustrating these dynamics, Lookonchain reported two highly opposing results from recent meme coin trading activities.

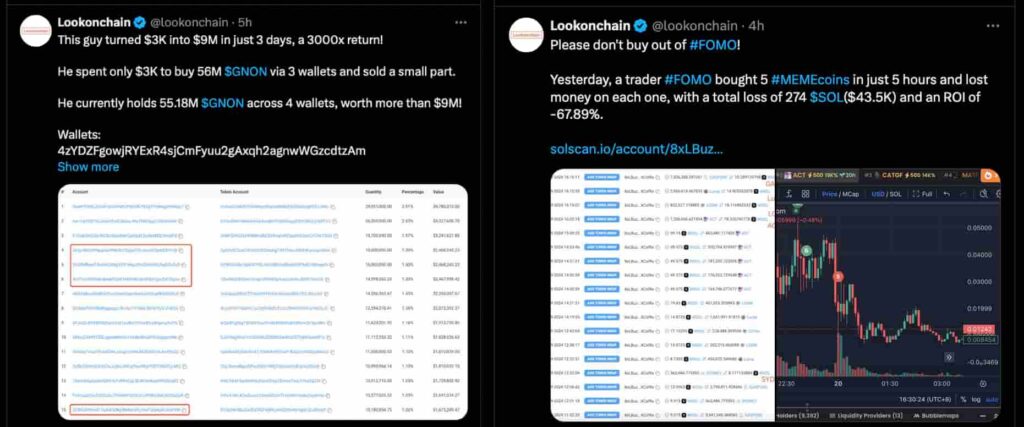

On one side, a smart trader turned a $3,000 initial purchase into $9 million of unrealized profits. Conversely, another trader lost $43,500 worth of Solana (SOL) while buying meme coins from ‘Fear Of Missing Out’ (FOMO).

Picks for you

Why Bitcoin is set to surge past $130,000 in January 2025 3 hours ago What's next for BTC amid European Central Bank's 'declaration of war' on Bitcoin 4 hours ago What Warren Buffett's Bank of America selling spree is telling us 5 hours ago AI bot becomes millionaire as cryptocurrencies skyrocket 20 hours ago  Trader turns $3K into $9M (left); Trader loses $43,500 out of FOMO (right). Source: Lookonchain / Finbold

Trader turns $3K into $9M (left); Trader loses $43,500 out of FOMO (right). Source: Lookonchain / Finbold

Meme coin trading: ‘Winners’ vs. ‘Losers’

From this recent example, Lookonchain identified an entity that achieved a 3,000-fold return while trading GNON with four wallets.

First, the trader bought 56 million GNON with $3,000 using three wallets, selling a small part of it. Currently, he still holds 55.28 million GNON across four wallets, with a nominal value of over $9 million.

This guy turned $3K into $9M in just 3 days, a 3000x return!

He spent only $3K to buy 56M $GNON via 3 wallets and sold a small part.

He currently holds 55.18M $GNON across 4 wallets, worth more than $9M!

Wallets:

4zYDZFgowjRYExR4sjCmFyuu2gAxqh2agnwWGzcdtzAm… pic.twitter.com/CrH0wQvuyf— Lookonchain (@lookonchain) October 20, 2024

On the other hand, a trader bought five meme coins in five hours after each registered significant price increases. In a FOMO demonstration, the trader made his move at the worst possible timing, buying the tokens at the top.

Then, he panic-sold part of his positions at lower prices, realizing significant losses of around 274 SOL, worth around $43,500.

Please don't buy out of #FOMO!

Yesterday, a trader #FOMO bought 5 #MEMEcoins in just 5 hours and lost money on each one, with a total loss of 274 $SOL($43.5K) and an ROI of -67.89%.https://t.co/aIh2v57Oeo pic.twitter.com/doBpWTkGSH

— Lookonchain (@lookonchain) October 20, 2024

Smart traders, insiders, influencers, and the greater fool theory

However, insiders or highly influential figures can often leverage their positions as an edge to win against retail. Finbold explored this perspective in a recent story of a smart trader or insider making $3 million in gains twice.

This edge factor, together with good and bad trade timing, illustrates the risks of trading speculative assets like meme coins.

Financial experts warn of a financial bubble dynamic when there is no real economic value proposition besides the expectation of the asset rising in price carried only by speculative demand with this sole objective. Notably, this behavior is studied by “The Greater Fool Theory,” describing how “fools” buy with the expectation that a “greater fool” will pay a higher price later.

The European Central Bank believes Bitcoin (BTC) shares this attribute with meme coins, as claimed in a recent paper. BTC analysts deemed it a “true declaration of war” on Bitcoin.

“The original promise of Nakamoto (2008) to provide the world with a better global means of payment has not materialized. Instead, the focus has increasingly shifted to Bitcoin as an investment asset promising high capital gains. Promoters of this investment vision put little effort relating Bitcoin to an economic function which would justify its valuation.”

– European Central Bank

Yet, meme coins increase these risks by being low-liquidity assets when even winners can become losers by sometimes not being able to realize their temporary profit due to liquidity issues and market manipulation activities.