This pattern identifies XRP’s path to $8

![]() Cryptocurrency Jun 7, 2025 Share

Cryptocurrency Jun 7, 2025 Share

Despite XRP facing short-term bearish pressure, the asset may be gearing up for a rally to $8, echoing the historic momentum of 2017.

According to an analysis by Investing Scope, the recent downturn that saw XRP nearly crash below $2 reflects weakening momentum with the token struggling to break out of a narrow consolidation range that began after its January peak.

However, in a TradingView post on June 5, the analyst indicated that the broader monthly chart tells a different, potentially bullish, story.

XRP price analysis chart. Source: TradingView

XRP price analysis chart. Source: TradingView

In this case, a recent symmetrical triangle breakout mirrors the pattern observed between 2014 and 2017. At that time, XRP moved sideways before breaking out in late 2017, forming a consolidation range and surging to an all-time high in January 2018, just beyond the 1.382 Fibonacci extension level.

XRP’s $8 target

Currently, the chart shows a similar post-breakout consolidation just below the 1.0 Fibonacci level. Based on historical fractals and Fibonacci extensions, this structure suggests a potential price target of $8, aligning with the 1.382 Fib level from the recent move.

Further strengthening the bullish outlook, the monthly relative strength index (RSI) shows a recurring pattern of peaks, consistent with prior bullish cycles.

Moreover, XRP has decisively moved above the 50-month moving average (MA), historically marking a shift from resistance to support during previous rallies.

This optimistic technical setup is notable as key on-chain activities have sparked speculation. For instance, on June 6, Ripple transferred $498 million worth of XRP to an unknown wallet.

This move deviates from the typical early-month escrow transactions and has stirred market curiosity about XRP’s next direction.

Bit late in the month for escrow moves?

— Tobias James Reily 🐂 (Orbitalnewt) (@TobyJReily) June 6, 2025

XRP price analysis

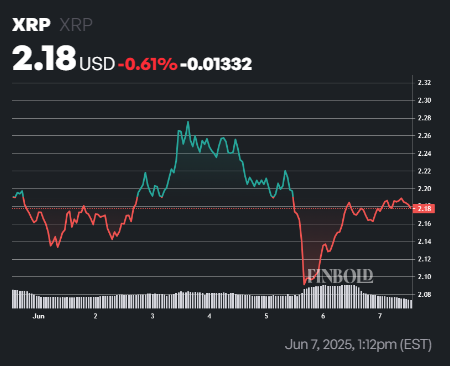

As of press time, XRP was trading at $2.18, up 0.1% over the past 24 hours, but down 0.6% on the week.

XRP price analysis. Source: Finbold

XRP price analysis. Source: Finbold

It remains below its 50-day SMA of $2.29, reflecting short-term bearish sentiment. However, it’s still comfortably above the 200-day SMA at $1.91, indicating a long-term uptrend.

Meanwhile, the 14-day RSI sits at 45.25, indicating slightly bearish yet neutral conditions, with no strong overbought or oversold signals.

Featured image via Shutterstock