This indicator suggests Bitcoin is far from a bear market

![]() Cryptocurrency Dec 31, 2024 Share

Cryptocurrency Dec 31, 2024 Share

The cryptocurrency market has been on edge regarding Bitcoin’s (BTC) price movements, with lingering fears of a possible crash after the asset repeatedly failed to reclaim the $100,000 mark.

Amid these concerns, an analyst has observed that Bitcoin may not be on the verge of a bear market based on historical price movements.

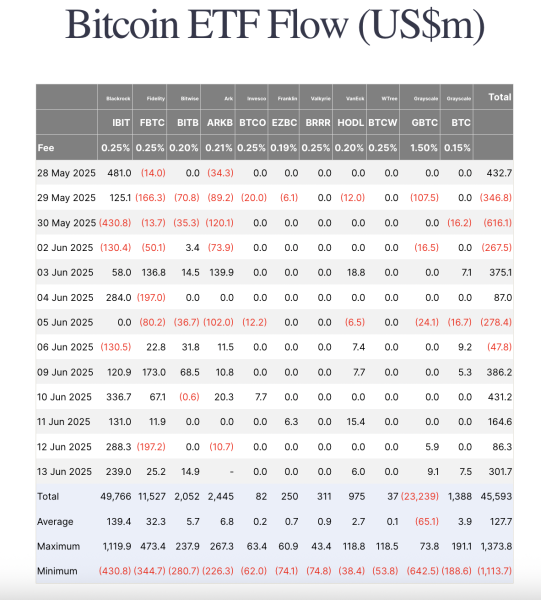

Specifically, Ali Martinez highlighted that Bitcoin’s Relative Strength Index (RSI) shows the asset has yet to reach its peak in the current cycle, as he noted in a post on X on December 31.

Picks for you

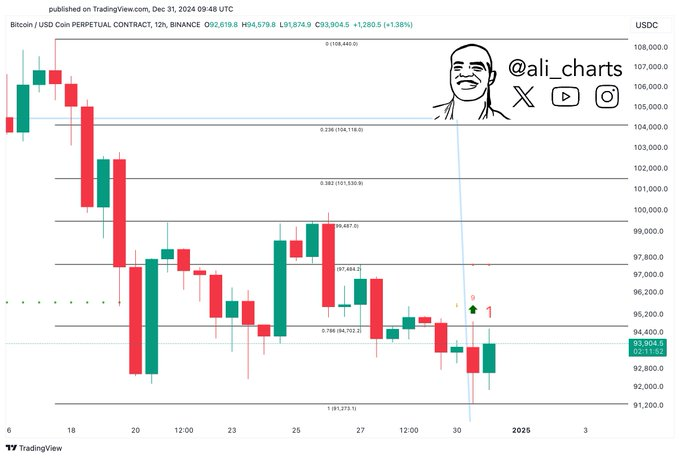

Binance Labs Fund reveals 3 key areas of focus for investments in 2025 41 mins ago ChatGPT says Gold price will hit this target by Q1 2025 1 hour ago Short squeeze alert for January 2025: Two cryptocurrencies with potential to skyrocket 2 hours ago XRP breakout alert: Key levels to watch as targets hit $5.85 3 hours ago  Bitcoin price analysis chart. Source: TradingView/Ali_charts

Bitcoin price analysis chart. Source: TradingView/Ali_charts

According to the expert, Bitcoin’s market peaks coincided with the RSI surpassing the critical 92 levels in previous cycles. In 2013, the RSI breached 92 twice, signaling a major correction and the onset of a bear market.

Similarly, in 2017, the RSI surpassed 92 in August and December, marking the end of Bitcoin’s bull market and the start of a bearish phase. Most recently, in 2021, the RSI exceeded 92, signaling the conclusion of the bull market and the beginning of a correction.

Currently, Bitcoin’s RSI stands at 74, well below the historically significant 92 threshold. Martinez noted that while markets can be unpredictable, historical trends suggest that Bitcoin is still far from entering a bear market.

Bitcoin’s bullish outlook

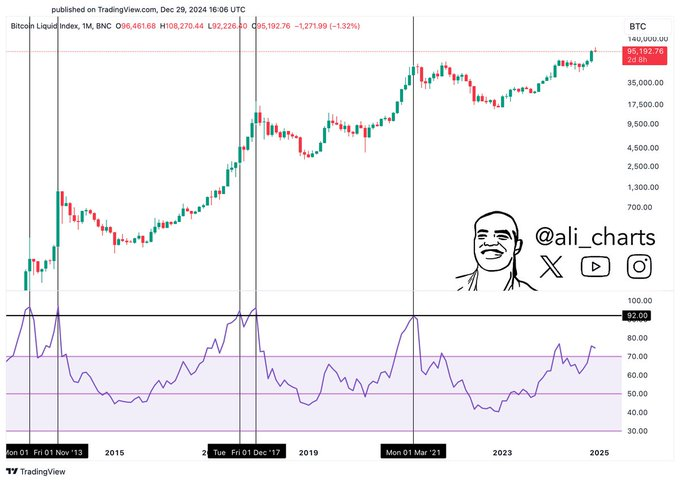

To back his bullish outlook, Martinez observed that Bitcoin’s 12-hour chart is showing signs of potential upside momentum, with the TD Sequential indicator flashing a buy signal. In a December 31 post, he noted that if Bitcoin closes above $94,700, it could pave the way for a rally to $97,500.

The TD Sequential is a technical tool that identifies potential price trend turning points. This signal comes after Bitcoin has experienced a period of consolidation around the $95,000 level.

Bitcoin price analysis chart. Source: TradingView/Ali_charts

Bitcoin price analysis chart. Source: TradingView/Ali_charts

It’s worth mentioning that several market analysts had warned that Bitcoin’s technical setup was signaling a potential crash, with the price possibly dropping as low as $18,000.

For instance, as reported by Finbold, cryptocurrency analyst MFHoz noted that Bitcoin’s failure to breach the $100,000 mark indicates that the asset’s “party is over.”

Interestingly, Bitcoin has failed to make significant moves despite bullish sentiment, such as MicroStrategy’s (NASDAQ: MSTR) continued accumulation of the asset.

Moreover, the market has speculated that a drop below $90,000 could trigger the start of a bear market. On December 30, Bitcoin dropped to a one-month low of $91,522 but later recovered as bullish strength reasserted itself.

Bitcoin price analysis

As of press time, Bitcoin was trading at $95,280, having rallied by over 2% in the last 24 hours. On the weekly chart, BTC is down about 1%.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Despite Bitcoin’s weakening strength in the short term, the asset remains largely bullish in the long run, benefiting from momentum from post-election optimism.

Some market players anticipate a rally continuation beyond the $108,000 high, projecting that the asset could soar in 2025.

Featured image via Shutterstock