Tether now holds more US Treasury bonds than Germany, Australia, and UAE

![]() Cryptocurrency Nov 1, 2024 Share

Cryptocurrency Nov 1, 2024 Share

Tether, the issuer of the leading stablecoin USDT, is one of the most profitable companies in the crypto industry. Tether is also the 18th largest holder of US Treasury bonds, surpassing three significant economies in Q3 2024.

According to recently shared Q3 2024 results, Tether disclosed ownership of $102.5 billion in U.S. Treasury bonds. Paolo Ardoino, Tether CEO, went to X for comments on the matter, celebrating the company’s milestone in having more US treasuries exposure than Germany, Australia, and the United Arab Emirates (UAE).

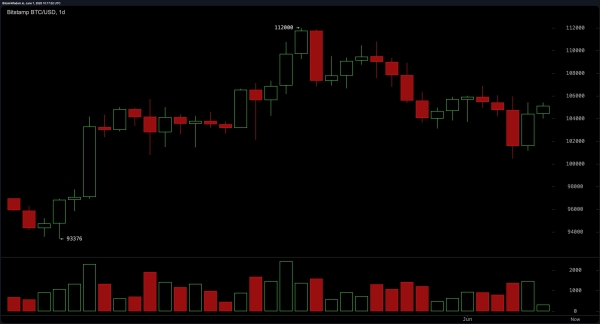

This happens as USDT increases its dominance in the cryptocurrency market, with over 70% of all stablecoins’ total capitalization. Notably, Tether’s USDT surged above the $120 billion market cap level, leading in exchange volume and increasing its relevancy.

Picks for you

Smart trader with 100% win rate bought $18.8 million of ETH today 15 mins ago Sonic SVM and Solayer boost Solana staking rewards, Adrastea introduces liquid restaking 1 hour ago SingularityDAO community votes in favor of merging with Cogito Finance and SelfKey 3 hours ago Dogecoin price set for ‘parabolic move’, according to analyst 4 hours ago  Tether’s USDT market cap and dominance, daily chart. Source: TradingView / Finbold / Vinicius Barbosa

Tether’s USDT market cap and dominance, daily chart. Source: TradingView / Finbold / Vinicius Barbosa

Tether Q3 2024 results and USDT reserves and treasur

One of the market’s biggest concerns regarding Tether is the company’s reserves to back all issued USDT, keeping the peg.

On that note, the Q3 2024 results show $134.4 billion in the Group’s consolidated total assets, including over $6 billion in excess reserves – on top of the 100% reserves in liquid assets that back all issued tokens.

In this last quarter, Tether amassed $2.4 billion in net profits. Particularly having $1.3 billion in net profits derived from its U.S. Treasury exposures, according to Paolo Ardoino. Moreover, the remaining $1.1 billion was acquired from Tether’s gold holdings, thanks to the commodity’s remarkable rally this year.

“The numbers above are extremely significant, especially because the majority of USDT usage is concentrated in developing countries and emerging markets. It’s evident that USDT is the digital dollar for hundreds of millions of people who have been left behind by the banking industry because they are too poor and not generating enough commissions on a yearly basis to justify opening a bank account for them.”

– Paolo Ardoino

Tether released attestation for Q3/2024.

Another impressive quarter.Summary as of 30 September 2024 for the companies managing stablecoins' reserves:

– $2.4 billion Q3/2024 net profits (~$1.3 billion deriving from U.S. Treasuries exposures and ~$1.1 billion from gold holdings)… https://t.co/kBRdCQfaOP

— Paolo Ardoino 🤖🍐 (@paoloardoino) October 31, 2024

The stablecoin race

The stablecoin race has intensified in the past few years in decentralized finance, with new solutions being launched and tested. Meanwhile, Circle has opened up the doors for the rise of alternative stablecoins in 2025 after raising USDC’s redemption fees.

In particular, projects like Maker’s DAI, Hatom’s USH, Ethena’s USDe, PayPal’s PYUSD, and other competitors promise interesting solutions worth watching.

This asset class is paramount as the bridge between traditional finance and DeFi, offering a profitable business model. With stablecoins, users and investors can find yield farming opportunities to earn passive income in crypto and realize their gains.

As things develop, USDT leads the stablecoin race and proves itself to be a worthy competitor even in the fiduciary world after surpassing countries like Germany, Australia, and the UAE in US Treasury holdings.

Nevertheless, stablecoins also offer risks, usually regarding the needed counterparties or elaborate mechanisms to keep the peg to the dollar.