Bitcoin faces bearish pressure, yet market analysts have continued to present bold all-time high predictions.

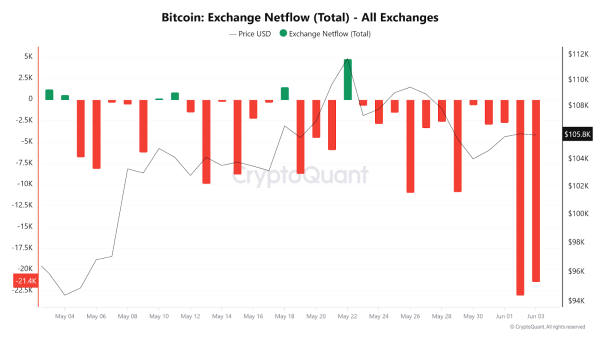

Notably, Bitcoin’s price action over the past week showed signs of short-term weakness, dropping from just under $110,000 to a low near $103,000. It later saw a slight recovery to around $105,000. Amid this pullback, industry watchers have laid out bold forecasts for Bitcoin’s medium- and long-term trajectories.

Fred Krueger Outlines Speculative Timeline

Amid the market downturn, Fred Krueger, a prominent mathematician and analyst who holds a Standford PhD, maintained an assertive stance on Bitcoin’s outlook. On X, where he holds over 163,000 followers, he predicted that Bitcoin could reach an all-time high within the week.

Bitcoin ATH this week

— Fred Krueger (@dotkrueger) June 1, 2025

This followed his earlier April estimate that placed a 77% probability on Bitcoin reaching a new ATH in 2025.

Recall, Krueger previously detailed a speculative projection titled “The Final Run,” which he believes could drive Bitcoin toward a $600,000 valuation. According to his outline, the scenario begins on July 21, 2025, with a $200 billion U.S. Treasury auction failing to secure buyers.

This, he suggests, would spark a broader confidence crisis in the U.S. dollar. Following this, BRICS nations are expected to introduce a payment system settled in Bitcoin and gold. By August, countries such as Nigeria, Turkey and Venezuela could reportedly shift a portion of their foreign reserves into Bitcoin.

Krueger further anticipates that Treasury yields may surge above 8.5% in September, coinciding with a projected 35% collapse in U.S. real estate prices within a three-week period.

During this phase, major tech companies are also expected to integrate Bitcoin into their financial systems. All events, according to his scenario, culminate in an October summit modeled after Bretton Woods, where the U.S. could propose a partial Bitcoin and gold backing for the dollar.

Bitcoin Hits a Record Close

While Krueger’s roadmap remains speculative, Bitcoin recently recorded its highest monthly close at $104,591. This price milestone signals increased institutional and retail interest, as well as strong support at higher valuation levels.

It also indicates that investor sentiment around Bitcoin remains active despite recent volatility. As of this press, Bitcoin is trading at $105,475.

Bitcoin’s Role in Future Finance

Elsewhere, Cardano founder Charles Hoskinson, speaking at a Bitcoin conference, outlined his perspective on Bitcoin’s long-term market value and ecosystem growth. He projected a potential future valuation between $250,000 and $500,000, within a broader $10 trillion Bitcoin economy.

Hoskinson emphasized Bitcoin’s foundational principles—exclusive use of BTC for transactions, fees, and yield—as essential constraints that limit current DeFi integration.

However, he pointed to ongoing development efforts, including modular wallet infrastructure and enhanced smart contract tools, as ways to enable DeFi features while preserving Bitcoin’s core standards.

He referenced work from infrastructure teams such as Sergey Lerner’s group, Sundial, and the Bitcoin Operating System. In particular, Hoskinson discussed wallet innovations designed to allow users to switch between standard and DeFi modes. These developments aim to support new use cases without compromising Bitcoin’s underlying design.