Ready for a Bitcoin rally? This is how much BTC Germany already sold

![]() Cryptocurrency Jul 10, 2024 Share

Cryptocurrency Jul 10, 2024 Share

The German – or rather, the Saxon – government has been making cryptocurrency traders wary for several weeks as it has been undertaking a major sale of Bitcoin (BTC) it seized earlier in 2024.

While it is difficult to quantify the impact of Germany’s actual selling, the movement of nearly 50,000 BTC has had a major impact on the crypto markets.

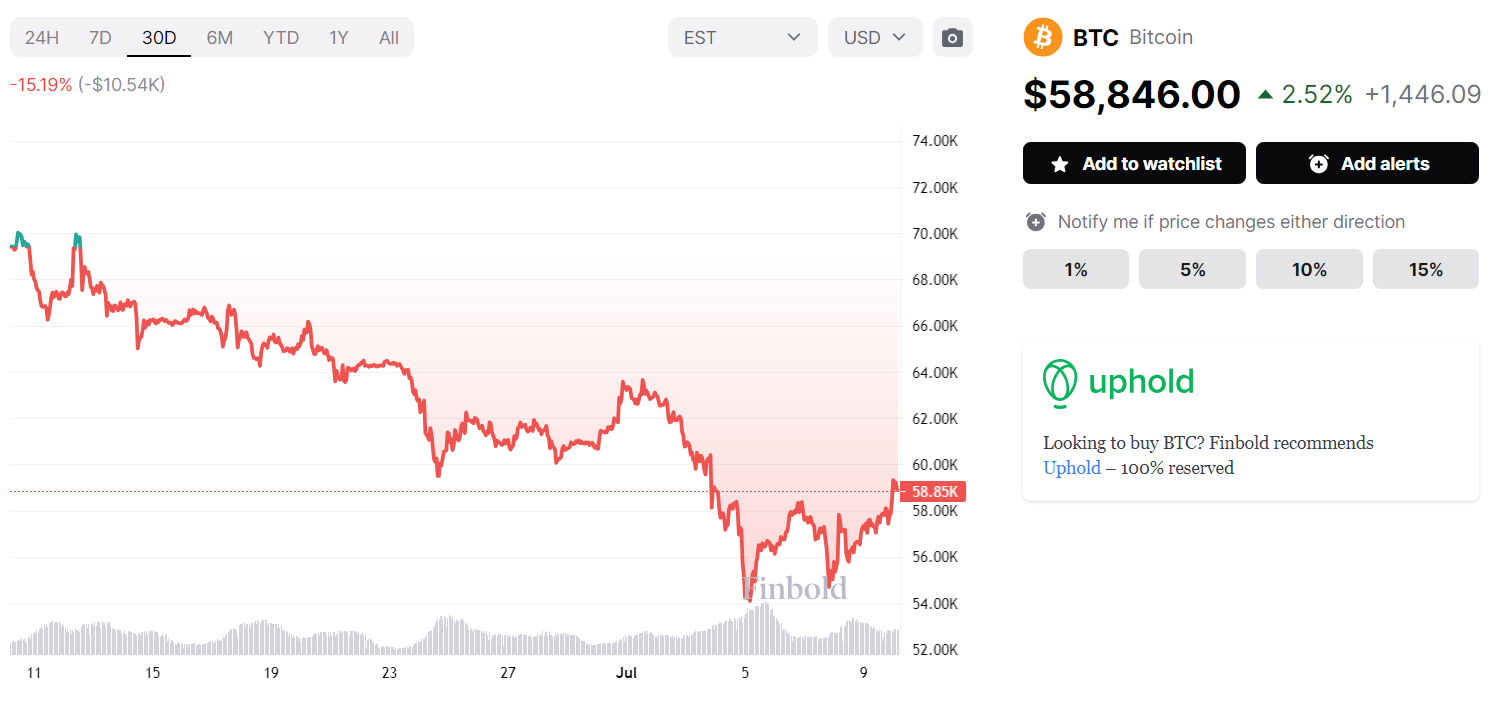

In the last 30 days, the world’s premier cryptocurrency experienced a substantial drop in price, first losing its relatively stable levels at approximately $67,000 and then it continued falling through support zone after support zone to, at one point, struggle to maintain $55,000.

Picks for you

Buy signal for 2 oversold cryptocurrencies this week 15 hours ago Investors pour $440M into cryptocurrencies despite recent crash 17 hours ago Top economist predicts S&P 500 to hit this high before worst crash since 1929 18 hours ago Solana’s bullish historical pattern sets SOL for huge breakout 20 hours ago

In total, the coin fell 15.19% in the last months of trading, and Bitcoin price today stands at $58,846.

BTC 30-day price chart. Source: Finbod

BTC 30-day price chart. Source: Finbod

By July 10, 2024, however, the downturn may be over.

How much Bitcoin did Germany already sell?

The German government is estimated to have sold approximately 23,000 Bitcoins and has just under 24,000 left. The selloff is also likely to be completed quickly, as a decrease of about 15,000 was recorded between July 8 and July 9.

Whether thanks to the fact that the government selloff is halfway done or thanks to the price of Bitcoin falling enough that investors couldn’t resist the buying opportunity, the cryptocurrency has entered an evident uptrend earlier this week.

Indeed, after a period in which it appeared that the coin could plummet toward $50,000, BTC is, by press time, up to $58,846 and has risen by more than $4,000 since Monday.

Technical analysis (TA) further reinforces the likelihood of the uptrend persisting, as Bitcoin was noted to have made a bull flag – a chart pattern indicating an incoming rally – on July 9.

Why the downturn may not be over

On the other hand, the world’s premier cryptocurrency may not be out of the woods yet. While its climb above $58,000 is promising, it is worth noting that it is, at the time of publication, trading in a zone that has proven to be a short-term resistance level.

Indeed, on July 6, BTC briefly touched $58,370, only to drop rapidly below $55,000 before starting the rise again.

Finally, the fears of selling pressure from the German government have only been part of the story as the failed crypto exchange Mt. Gox started repaying its customers in BTC and Bitcoin Cash (BCH) earlier in July.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.