R. Kiyosaki warns ‘brutal crash here now,’ reveals what to do next

![]() Stocks Feb 3, 2025 Share

Stocks Feb 3, 2025 Share

Given the performance of most major stocks and cryptocurrencies in the early hours of Monday, February 3, it would appear that Robert Kiyosaki’s oft-repeated prophecy that a ‘massive crash’ is looming is finally coming true.

Indeed, the prominent investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad,’ himself made an X post on Sunday evening opening with:

‘brutal crash here now.’

Picks for you

Here's how much Bitcoin is down since Jim Cramer said 'BTC is great thing to have' 45 mins ago Ethereum leads crypto liquidation spree with $617M losses in 24 hours 2 hours ago Is Bitcoin headed below $90,000 amid Trump’s tariffs? 4 hours ago DeepSeek AI picks 2 altcoins to make you a millionaire by 2030 21 hours ago

BRUTAL CRASH HERE NOW. The stock, bond, real estate, gold, silver, and Bitcoin markets are crashing.

The best assets in the world are going on sale.

Millions will lose their jobs.

This is the best time to get rich.

Don’t be a loser. Stay cool. Take care.

— Robert Kiyosaki (@theRealKiyosaki) February 3, 2025

Backing the observation, Kiyosaki pointed towards the performance of various high and low-risk assets but, in his typical fashion, urged his followers not to despair – ‘don’t be a loser’ – and to ‘stay cool.’

Can investors get rich by buying the Trump tariff dip?

The famous author has been describing crashes as ‘sales’ while explaining that crises and recessions are the best times to get rich. He has done the same in his latest X post.

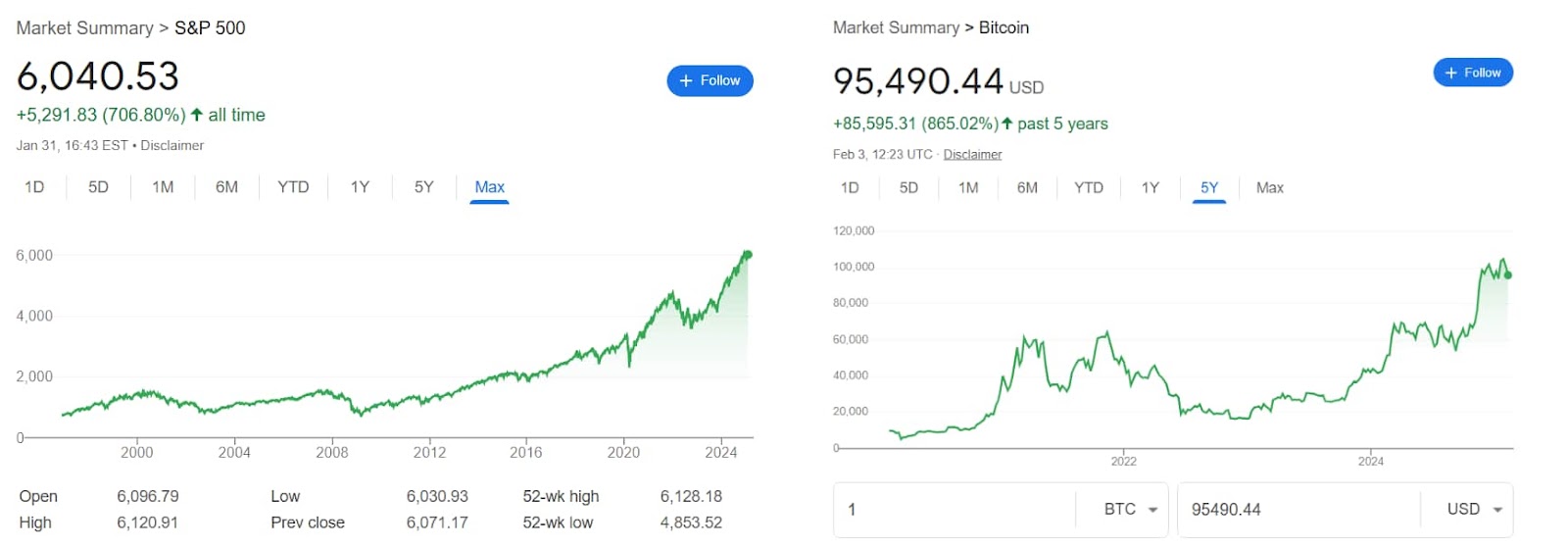

The logic behind the call for buying is sound. For example, $1,000 invested in the S&P 500 at the lows of the Great Recession would now be worth $7,989.4. Similarly, $1,000 invested in Bitcoin (BTC) as recently as late 2022 would be worth $5,588.24 as BTC went from about $16,000 to $95,490.

S&P 500 multi-decade and BTC 5-year price charts. Source: Google

S&P 500 multi-decade and BTC 5-year price charts. Source: Google

Still, the relentless rise of many assets in recent years raises the question of when and if investors should buy. For example, despite many being fearful and not buying the Nvidia (NASDAQ: NVDA) August dip, such a trade would have been profitable even at press time when the semiconductor giant is changing hands at $115.42.

NVDA stock 12-month price chart. Source: Goodl

NVDA stock 12-month price chart. Source: Goodl

Elsewhere, with many major stocks recorded as substantially overvalued, there is no way to determine for certain if the ongoing downturn will be another ephemeral bump in the road or if what some experts have been describing as the ‘everything bubble’ for years is finally bursting.

Is R. Kiyosaki’s advice sound but not actionable?

Kiyosaki’s seemingly single-angle analyses have been a point of contention for a long time. Again, despite the broad accuracy of describing recessions as a good way to get rich quickly, such assessments leave those who cannot afford to bet on the market’s next direction out.

A similar setup also emerged in late 2024 when the famous author urged his followers to sell their homes and purchase Bitcoin – a piece of advice that left a poor taste for many as Kiyosaki himself claims to own thousands of homes.

Disclaimer: The featured image in this article is for illustrative purposes only and may not accurately reflect the true likeness of the individuals depicted.