Synopsis

Economist Peter Schiff has accused Donald Trump of orchestrating a crypto “pump and dump” scheme, calling for a Congressional investigation into potential market manipulation tied to Trump’s recent statements on digital assets.

Peter Schiff, Chief Economist and Global Strategist at Euro Pacific Capital, has accused U.S. President Donald Trump of orchestrating a massive “pump and dump” scheme involving cryptocurrencies. Schiff is now calling for a Congressional investigation into the matter, alleging that Trump’s recent statements on digital assets led to significant market manipulation.

In a strongly worded post on X (formerly Twitter), Schiff claimed that Trump, whom he labeled as the “first crypto President,” played a role in what he described as the “biggest crypto rug pull of all time.”

Schiff is demanding answers to several key questions, including:

Crypto Tracker![]() TOP COIN SETSCrypto Blue Chip – 5-6.53% BuySmart Contract Tracker-7.48% BuyNFT & Metaverse Tracker-7.67% BuyWeb3 Tracker-8.03% BuyAI Tracker-11.45% BuyTOP COINS (₹) Tether87 (-0.1%)BuyBNB49,417 (-5.61%)BuyBitcoin7,309,572 (-8.79%)BuyXRP205 (-8.86%)BuyEthereum182,327 (-10.75%)BuyWho authored the two Sunday afternoon posts on Trump’s Truth Social account regarding crypto?

TOP COIN SETSCrypto Blue Chip – 5-6.53% BuySmart Contract Tracker-7.48% BuyNFT & Metaverse Tracker-7.67% BuyWeb3 Tracker-8.03% BuyAI Tracker-11.45% BuyTOP COINS (₹) Tether87 (-0.1%)BuyBNB49,417 (-5.61%)BuyBitcoin7,309,572 (-8.79%)BuyXRP205 (-8.86%)BuyEthereum182,327 (-10.75%)BuyWho authored the two Sunday afternoon posts on Trump’s Truth Social account regarding crypto?

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Who had prior knowledge of the announcement, and when were they informed?![]()

How much money did those with advance notice invest in cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA), and when did they sell?

Are there any emails or messages among Trump’s staff, family, campaign donors, or Truth Social employees related to these crypto announcements?

Donald Trump, the first crypto President, just helped pull off the biggest crypto rug pull of all time. A Congressional investigation is now warranted to find out the following regarding this pump and dump scheme.

Who authored the two Sunday afternoon posts on the President's…

— Peter Schiff (@PeterSchiff) March 3, 2025

Crypto Market’s Reaction

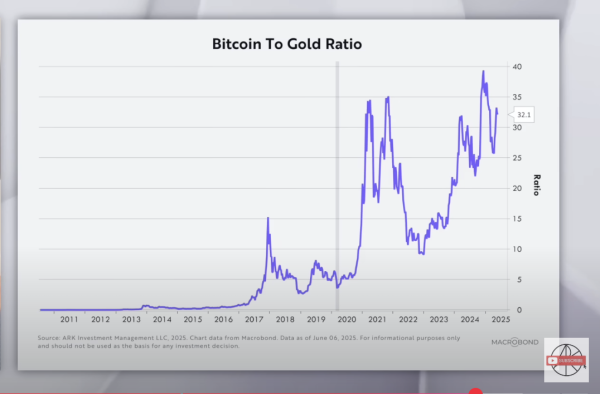

The controversy stems from Trump’s surprise announcement on Monday that his administration would include five cryptocurrencies—Bitcoin, Ethereum, XRP, Solana, and Cardano—in a proposed U.S. Crypto Strategic Reserve.

Following the statement, the crypto market saw an immediate surge, with Bitcoin jumping 10% to a high of $92,905 and Ethereum spiking 13% to $2,443. Cardano led the rally with a staggering 64% surge to $1.07, while XRP rose 25% to $2.79 and Solana gained 18%.

However, the euphoria was short-lived. By Tuesday, optimism over the initiative had faded, leading to a steep market correction. Bitcoin plunged 9.8% to $83,725, while Ethereum dropped 15% to $2,083.

The global crypto market cap shrank by 10.5% to $2.76 trillion, and other altcoins also suffered significant declines, with Cardano tumbling 25%, Solana falling 19%, Dogecoin losing 16%, and XRP slumping 18%.

Calls for Investigation

Schiff argues that the rapid rise and fall in crypto prices suggest market manipulation, with those privy to Trump’s announcement potentially making significant gains before the crash. He demanded that Congress must investigate whether individuals close to Trump or his campaign benefited from advance knowledge of the announcement.

As Schiff’s accusations gain traction, political and financial experts are divided over whether Trump’s crypto statements were merely speculative or part of a coordinated effort to influence the market. Meanwhile, crypto investors remain on edge, awaiting further developments on both the policy front and any potential investigation.

What’s Next?

If Congress takes up the investigation, it may lead to deeper inquiries into crypto-related policymaking and potential conflicts of interest within political circles.

For now, the crypto market remains volatile, with traders closely watching for any new policy moves from Trump or his allies that could once again send prices soaring or crashing.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)