OpenTrade and Littio boost Latin American financial access via Avalanche

![]() Cryptocurrency Oct 10, 2024 Share

Cryptocurrency Oct 10, 2024 Share

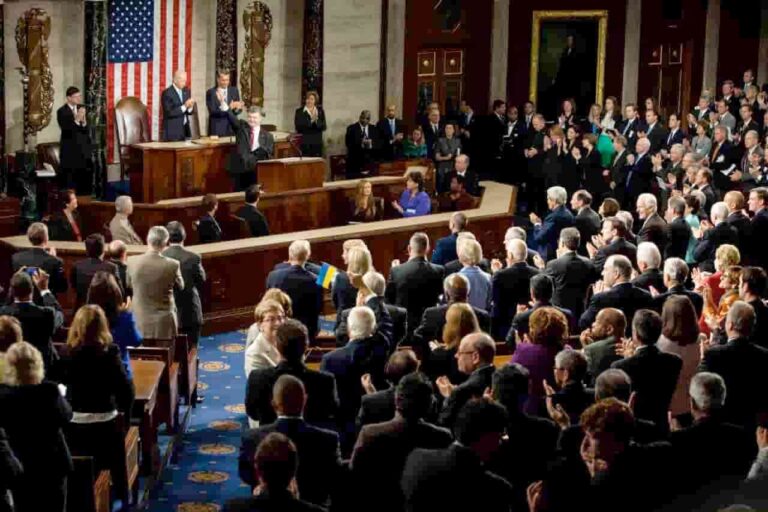

Littio, a Colombian neobank, has switched from Ethereum (ETH) vaults to OpenTrade’s real-world asset (RWA)-backed yield vaults known as Yield Pots on the Avalanche (AVAX) blockchain, as disclosed to Finbold on Thursday, October 10.

Thanks to OpenTrade’s infrastructure, Littio offers savings Pots with yields backed by US Treasury Bills, providing users with secure, dollar-based savings options.

New on-chain financial products in Latin America

Tokenization brings new investment opportunities, especially in regions such as Latin America, where inflation pushes investors towards stable assets.

Picks for you

Bitcoin's price this Halloween: new record looms? Finance experts' survey 4 mins ago Did this Senator profit from mining stock buy before major acquisition? 2 hours ago CARV launches its native utility token 2 hours ago Mythos brings 3.6 million new users to Polkadot 3 hours ago

In 2022, Latin America contributed 9.1% of global crypto value, a 40% increase compared to 2021.

Littio seeks to give users access to dollar-based savings in Latin America, where almost 70% of the population receives no banking services due to strict policies and disproportionally high fees.

With OpenTrade’s Yield Pots, Littio provides a seamless way for users to convert pesos into USD Coin (USDC), which can be saved, transferred, or spent via the app or with a Littio debit card.

Thanks to its B2B2C model, OpenTrade likewise provides businesses with on-chain products, including US Treasury Bill lending, structured credit, and supply chain finance.

Yield Pots have processed over $80 million in transactions and generated nearly $250,000 in returns for users over the past four months.

Shifting from Ethereum to Avalanche

To support growing regional demand, Littio is shifting its operations from ETH-based vaults to AVAX, which offers EVM compatibility, fast transactions, and low fees.

Avalanche has proven effective for institutional-level projects, further advancing Littio’s mission of financial inclusion.

Morgan Krupetsky, Head of Institutions and Capital Markets at Ava Labs, expressed enthusiasm for OpenTrade’s RWA-backed yield products on the platform, stating:

“Littio and OpenTrade exemplify how Avalanche’s technology can enable underbanked populations to access compelling products and services that are otherwise unavailable or untenable via traditional rails leverage. I’m thrilled to see OpenTrade’s RWA-backed yield products and ultimately real world businesses being built on the Avalanche platform.”

Users can access OpenTrade’s USDC/EURC Yield Pots via the Littio app.