One Ethereum rival to turn $100 into $1,000 in 2025

![]() Cryptocurrency Oct 5, 2024 Share

Cryptocurrency Oct 5, 2024 Share

Ethereum (ETH) has grown to be the most competitive Bitcoin (BTC) rival, allowing for programmable money and smart contracts. After that, other cryptocurrencies surged as Ethereum rivals, challenging its dominance with advanced technologies fostering innovation, scalability, decentralization, and security.

Some of these competitors have already escalated the crypto market cap ranks, achieving remarkable gains in the past few years. Namely, Solana (SOL), Toncoin (TON), Cardano (ADA), Avalanche (AVAX), Near Protocol (NEAR), Sui (SUI), and Aptos (APT).

So, while they can still perform well in the next year, these Ethereum rivals have limited growth potential compared to the ones with a smaller capitalization. Moreover, Solana, Sui, Toncoin, Near, and Aptos suffer from high supply inflation and unlocks, which dilute their value and potential.

Picks for you

Bitcoin analyst gives ‘final warning’ before ‘major crash’ to this low 51 mins ago Sell signal: Ethereum long-term investors offload massive ETH positions 19 hours ago Bitcoin pattern in 'full motion' sets BTC price for the end of 2024 20 hours ago Short squeeze alert for two highly shorted cryptocurrencies 22 hours ago

In this context, Finbold identified one promising and yet undiscovered Ethereum rival with high growth potential for 2025. If expectations are met, it could render over 10-fold returns for investors, who could turn $100 into $1,000.

Ethereum rival: MultiversX (EGLD)

This Ethereum rival is MultiversX (EGLD), formerly Elrond, arguably “the most technically advanced blockchain today,” according to Justin Bons, founder and CIO of Europe’s oldest crypto fund, as posted on October 4.

“What would you say if I told you the most technically advanced blockchain today is from a small team in Romania that raised $5M in 2019. Achieving what ETH gave up on & NEAR only recently achieved: Full execution sharding! EGLD is that chain & it deserves more of our support!”

– Justin Bons

Notably, the token eGold (EGLD) has a capped supply with a theoretical maximum of 31.4 million EGLD. The Romania-based Ethereum rival stands out as “the technological Holy Grail of crypto” pioneering on advanced features and user experience.

For example, MultiversX offers highly scalable adaptative sharding, secure proof-of-stake, native assets, cross-chain interoperability, onchain two-factor-authentication (2FA) security, opt-in gasless transactions, maximum-extractable-value (MEV) built-in protection, among other things.

In its roadmap, the team is now implementing sub-second block time to increase its transaction efficiency and become more competitive.

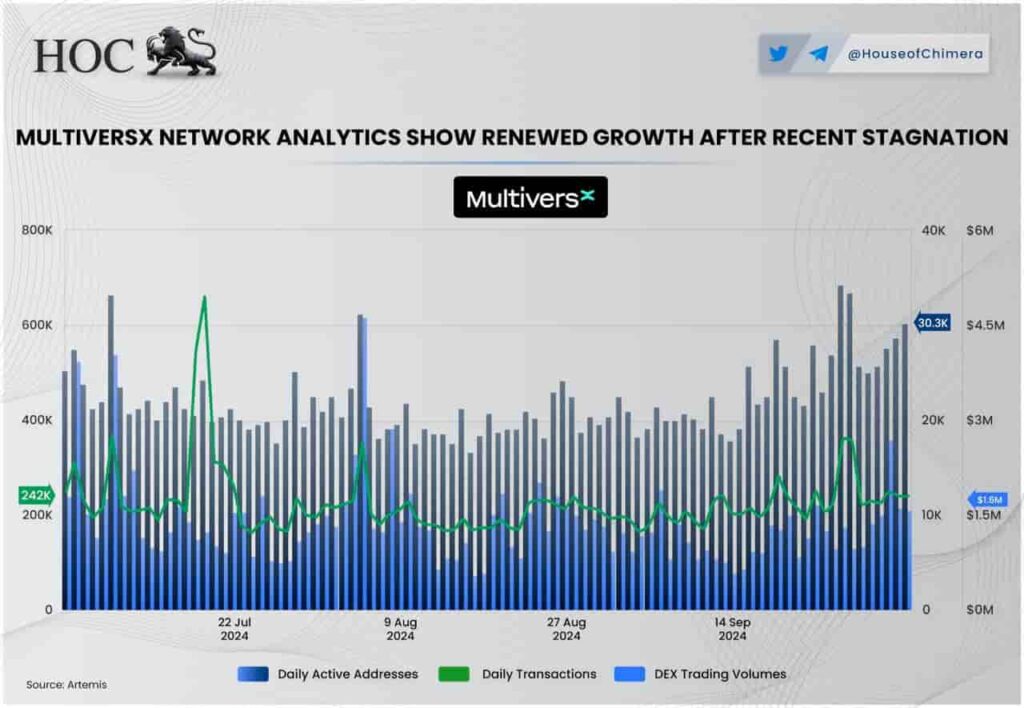

On Friday, October 4, House of Chimera reported “renewed growth” for MultiversX after “recent stagnation,” looking at network metrics. In the chart, decentralized exchange (DEX) trading volume grew to $4.5 million and daily active addresses to 30,300.

MultiversX network analytics. Source: Artemis / House of Chimera

MultiversX network analytics. Source: Artemis / House of Chimera

EGLD price analysis

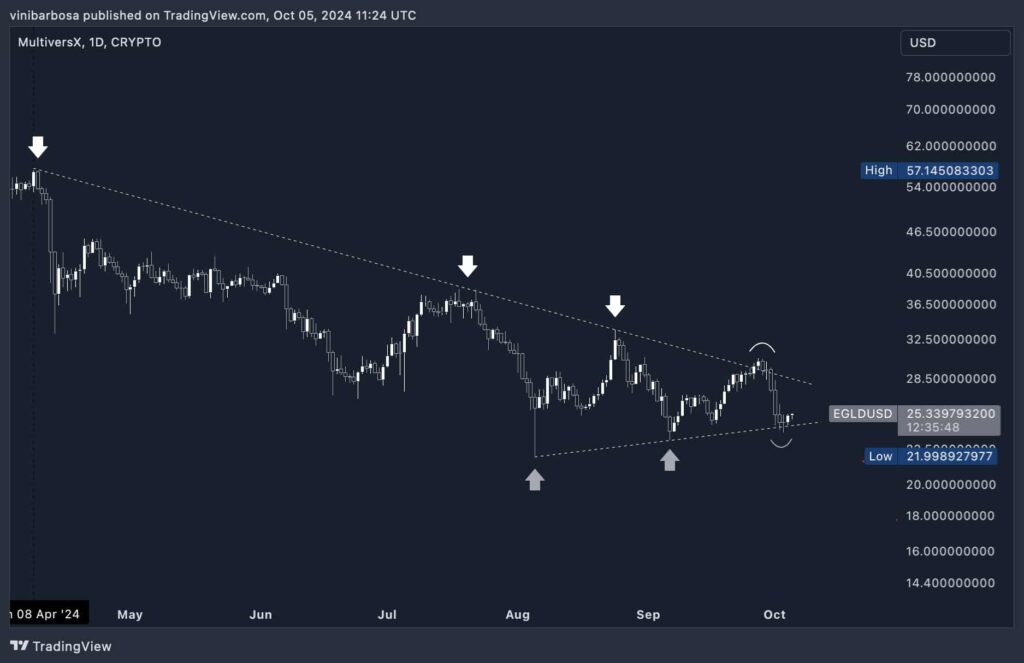

Now, EGLD trades at $25.23, down 16% in the last seven days after retracing from a failed breakout. The retracement came as the cryptocurrency market crashed, liquidating over half a billion dollars in trading positions, as Finbold reported.

EGLD has made three lower highs and one deviation from a six-month downtrend resistance line in a higher time frame. However, it has also made two higher lows after a local bottom on August 5, currently at the uptrend support.

MultiversX (EGLD) daily price chart index. Source: TradingView / Finbold

MultiversX (EGLD) daily price chart index. Source: TradingView / Finbold

This price currently makes EGLD a $700 million market cap cryptocurrency, ranking in the 96th position, according to CoinMarketCap‘s index. A 10-fold increase would put MultiversX at the same Chainlink (LINK) capitalization, which recently announced a mutual integration.

$EGLD is now available to the vast array of apps pulling data streams from @Chainlink 📡

Data Streams is a next-gen oracle solution that provides sub-second updates, all while preserving privacy and being gas efficient. pic.twitter.com/Hpl2URt97U

— Multiversᕽ (@MultiversX) September 24, 2024

Interestingly, the dominating bearish sentiment in the last six months started affecting long-term Ethereum investors, who are offloading their positions. Meanwhile, analysts warn of an altcoin season being “just around the corner,” and Finbold identified signals of an incoming altseason.

While there are no guarantees that MultiversX will thrive to deliver the expected returns, investors started positioning for 2025. Those who build crypto portfolios based on solid fundamentals have a better chance of achieving more sustainable long-term gains.