Meta AI builds ideal portfolio for the 2024 crypto bull run

![]() Cryptocurrency Sep 7, 2024 Share

Cryptocurrency Sep 7, 2024 Share

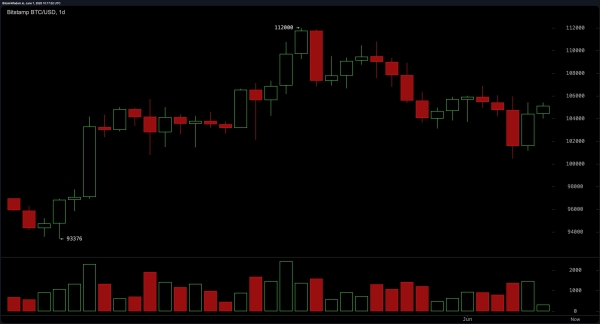

The cryptocurrency market has trended in a six-month consolidation range, recently experiencing two crashes that analysts have called a shake-out and bear traps before the awaited 2024 crypto bull run.

Looking for insights on how to better build an investiment position, Finbold turned to Meta‘s (NASDAQ: META) most advanced artificial intelligence (AI) Llama 3.1, asking for the ideal crypto portfolio given this potential opportunity.

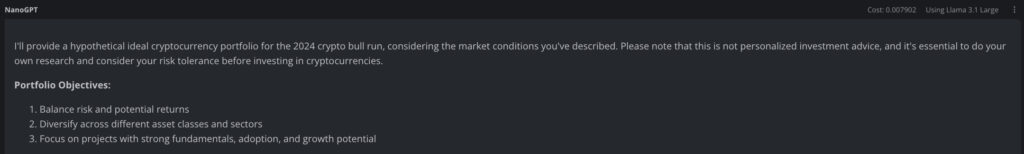

Notably, the Meta AI offered a complete portfolio subdivided in four tiers. First, large-cap cryptocurrencies representing 40% of the investment and three others separated by categories, with 20% allocation each.

Picks for you

Analyst says Bitcoin’s 2024 ‘capitulation is not over’, sets new bearish targets 3 hours ago Manipulation alert on Donald Trump vs. Kamala Harris prediction market 5 hours ago Bitcoin reaches ‘downside target’ and BTC ‘full bull gear’ can start 8 hours ago Elon Musk lost his power? Posts about DOGE, nothing happens 11 hours ago

As disclosed, the objective is to balance the risks and potential returns through diversification, focusing on solid fundamentals and growth.

Meta AI Llama 3.1 portfolio objectives. Source: NanoGPT / Finbold

Meta AI Llama 3.1 portfolio objectives. Source: NanoGPT / Finbold

Meta AI’s crypto portfolio for the 2024 bull run

The rationale behind the tiers aims to provide a solid foundation with the “Tier 1;” bet on growth potential and adoption through DeFi, lending, gaming, NFTs, metaverse; and eyes long-term success of the cryptocurrency industry with scalability and interoperability.

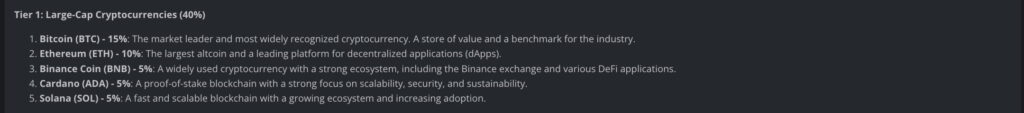

Tier 1: Large-cap cryptocurrencies (40%)

Starting with the solid foundation offered by “Tier 1” large-cap cryptocurrencies, Meta AI’s allocates 15% in Bitcoin (BTC). Ethereum (ETH) is the second-largest allocation, with 10%, followed by three others with 5% allocation each.

They are BNB Chain (BNB), Cardano (ADA), and Solana (SOL), competing for the same market share of Ethereum.

Meta AI Llama 3.1 portfolio allocations – Tier 1. Source: NanoGPT / Finbold

Meta AI Llama 3.1 portfolio allocations – Tier 1. Source: NanoGPT / Finbold

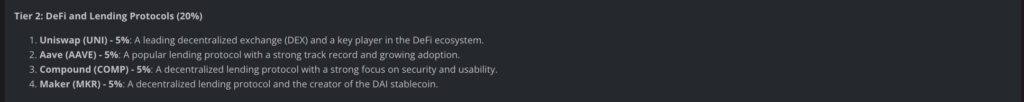

Tier 2: DeFi and lending protocols (20%)

Second, “Tier 2” is made of decentralized finance (DeFi) and lending protocols, offering a promising opportunity for growth. With 5% allocation each, Meta AI picks Uniswap (UNI), Aave (AAVE), Compound Finance (COMP), and MakerDAO (MKR) – now Sky (SKY).

Meta AI Llama 3.1 portfolio allocations – Tier 2. Source: NanoGPT / Finbold

Meta AI Llama 3.1 portfolio allocations – Tier 2. Source: NanoGPT / Finbold

Tier 3: DeFi and lending protocols (20%)

As follows, Meta AI believes community engagement will have a core role in the 2024 crypto bull run, investing accordingly. On that note, the “Tier 3” has cryptocurrencies focused on gaming, non-fungible tokens (NFTs), and metaverse.

Four projects equally compose the 20% allocation, being: The Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS), and Enjin Coin (ENJ).

Meta AI Llama 3.1 portfolio allocations – Tier 3. Source: NanoGPT / Finbold

Meta AI Llama 3.1 portfolio allocations – Tier 3. Source: NanoGPT / Finbold

Tier 4: Scalability and interoperability (20%) for the 2024 crypto bull run

Finally, another four cryptocurrencies feature in Meta AI’s “Tier 4” of the ideal crypto portfolio for the 2024 bull run. This tier has 5% of Polkadot (DOT), Cosmos (ATOM), Near Protocol (NEAR), and Harmony (ONE), summing up to 20%.

Llama 3.1 named it as the scalability and interoperability tier, doubling down on the technological potential of the space.

Meta AI Llama 3.1 portfolio allocations – Tier 4. Source: NanoGPT / Finbold

Meta AI Llama 3.1 portfolio allocations – Tier 4. Source: NanoGPT / Finbold

In conclusion, Meta AI provided one of the most complete and well thought cryptocurrency portfolios we have covered on Finbold. Yet, investors should take all that with a grain of salt, considering artificial intelligence models are limited to public data and could be outdated.

With the 2024 crypto bull run approaching, building a solid portfolio can make a difference in achieving good results. Therefore, people can learn with this framework while deciding on their particular allocations according to their investment profile and goals.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.