Machine learning algorithm predicts Bitcoin price for November 30

![]() Cryptocurrency Nov 12, 2024 Share

Cryptocurrency Nov 12, 2024 Share

Bitcoin’s (BTC) bullish momentum shows little sign of slowing down.

BTC currently trades at $87,710, with an impressive 6.68% rise in the last 24 hours and a 26.02% gain over the past week, Bitcoin is pushing into uncharted territory, bringing its market cap to a formidable $1.7 trillion.

Bitcoin 1-day price chart. Source: Finbold

Bitcoin 1-day price chart. Source: Finbold

The rally is driven by a confluence of factors, from the increasing scarcity of supply and aggressive whale accumulation to institutional flows, including a record-breaking $3.4 billion in Bitcoin ETF purchases over a span of four days.

Picks for you

Analyst says ‘the biggest crypto bull run ever’ is starting – Here’s why 2 mins ago Oasys emerges as a blockchain gaming leader, HashHub reports 44 mins ago Here's how much George Soros lost on his Bitcoin bet by selling MSTR stock early 51 mins ago 2 stocks set to benefit from post-election Bitcoin rally 1 hour ago

November 11th’s unprecedented single-day gain in Bitcoin’s price only underscores the strength of the current uptrend.

BTC records largest-ever daily price swing, with an $8,343 jump on Nov. 11

According to a report Cointelegraph on X, citing Galaxy Research data, Bitcoin (BTC) recorded its largest-ever daily price swing on Nov. 11. The opening price was $80,427.69, closing at $88,770.73,… pic.twitter.com/FEhfIqW9ZT

— CoinNess Global (@CoinnessGL) November 12, 2024

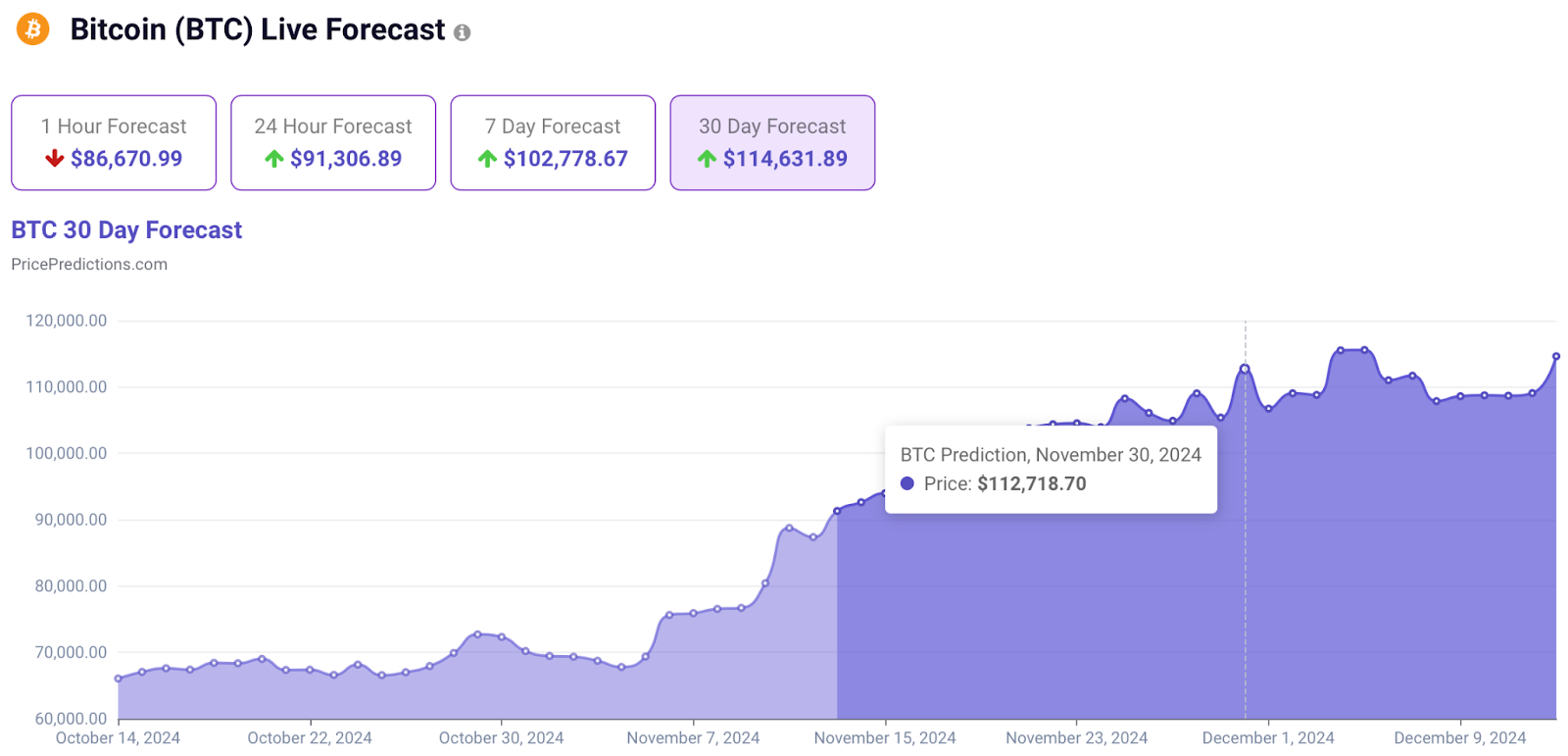

Looking forward, PricePredictions’ advanced machine learning algorithms suggest Bitcoin could reach $112,718 by November 30, 2024, as per data accessed by Finbold on November 12.

Bitcoin November 30 price forecast chart. Source: PricePredictions

Bitcoin November 30 price forecast chart. Source: PricePredictions

This projection, representing a further 28% climb from today’s price, is supported by a series of technical indicators, including Bollinger Bands (BB), which show expanding volatility, a favorable MACD, and an ATR signaling robust potential for continued upward movement.

On a technical level Bitcoin has established a solid support level at $84,011, while resistance lies at $90,826. A breakout above resistance could trigger further gains, while a retreat to support might offer a consolidation phase for market entry. However, it’s worth noting that Bitcoin’s recent surge has pushed it toward overbought territory, a signal that a correction could be on the horizon.

The broader market context also adds complexity. U.S. election developments and possible regulatory changes from the SEC are intensifying speculation around Bitcoin’s near-term prospects.

Recent liquidations totaling $655 million reflect heightened volatility. While the current momentum appears sustainable in the near term, seasoned analysts caution that Bitcoin’s trajectory could encounter turbulence.