Synopsis

Robert Kiyosaki, author of Rich Dad Poor Dad, criticizes Bitcoin ETFs, calling them “fake” and reiterates his belief in holding physical assets like gold, silver, and Bitcoin for true financial security. He argues that ETFs, managed by Wall Street institutions, are part of a flawed system. Kiyosaki advocates for direct ownership of assets to protect against economic instability.

Robert Kiyosaki, author of Rich Dad Poor Dad, has once again voiced his skepticism toward traditional financial systems, this time targeting Bitcoin ETFs. In his latest tweet, he reaffirmed his belief in holding physical assets like gold, silver, and Bitcoin rather than investing in ETFs, which he described as “fake.”

Kiyosaki has long warned about economic instability and the risks of traditional investments. He believes financial institutions, particularly Wall Street, are designed to keep investors “financially naive.” According to him, true financial security comes from owning real assets, not relying on ETFs, which he claims lack intrinsic value.

“Do what is best for you, but I would never buy gold, silver, or Bitcoin ETFs. In my opinion, ETFs are as fake as the U.S. dollar and U.S. bonds,” he stated.

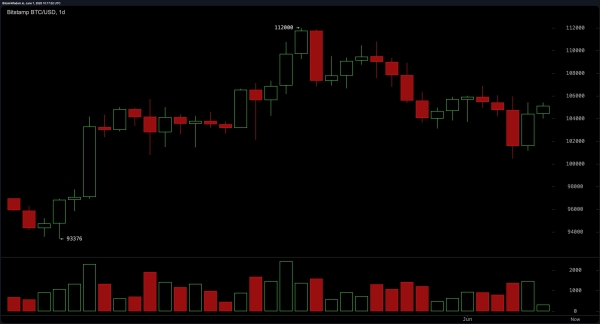

Crypto Tracker![]() TOP COIN SETSCrypto Blue Chip – 5-12.45% BuySmart Contract Tracker-14.97% BuyWeb3 Tracker-17.65% BuyNFT & Metaverse Tracker-21.28% BuyAI Tracker-23.50% BuyTOP COINS (₹) Ethereum190,213 (1.91%)BuyTether87 (0.03%)BuyBitcoin7,491,675 (-0.59%)BuyXRP203 (-1.51%)BuyBNB50,939 (-2.19%)Buyhttps://x.com/theRealKiyosaki/status/1898587119263879202

TOP COIN SETSCrypto Blue Chip – 5-12.45% BuySmart Contract Tracker-14.97% BuyWeb3 Tracker-17.65% BuyNFT & Metaverse Tracker-21.28% BuyAI Tracker-23.50% BuyTOP COINS (₹) Ethereum190,213 (1.91%)BuyTether87 (0.03%)BuyBitcoin7,491,675 (-0.59%)BuyXRP203 (-1.51%)BuyBNB50,939 (-2.19%)Buyhttps://x.com/theRealKiyosaki/status/1898587119263879202

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Bitcoin vs. ETFs: What’s the Difference?

While Bitcoin ETFs offer exposure to the cryptocurrency without requiring investors to handle private keys or navigate the complexities of self-custody, Kiyosaki sees them as an extension of the traditional financial system. He argues that these ETFs are managed by the same Wall Street firms that he believes exploit retail investors.![]()

In contrast, direct ownership of Bitcoin allows investors to have full control over their assets, free from intermediaries. “If you don’t hold it, you don’t own it,” is a mantra that resonates with Kiyosaki’s investment philosophy, echoing similar sentiments in the gold and silver markets.

Kiyosaki has been a vocal critic of the financial system, repeatedly warning about market crashes and systemic risks. In his 2014 book Rich Dad’s Prophecy, he predicted a major stock market collapse, which he now claims is unfolding, putting millions of retirees at risk. He blames financial education gaps and what he calls a rigged system for leaving investors vulnerable.

For Kiyosaki, the solution lies in the direct ownership of tangible assets. He advocates for holding physical gold and silver instead of ETFs that merely track their prices and extends this logic to Bitcoin. Rather than relying on financial products managed by institutions, he urges investors to take direct custody of their BTC to protect themselves from economic uncertainty.

While Bitcoin ETFs offer convenience and regulatory oversight, Kiyosaki’s warning reflects his broader belief that real wealth lies in direct ownership. As cryptocurrency adoption grows, his stance adds to the ongoing debate over whether Bitcoin ETFs align with the principles of decentralization and financial independence.

Also Read: Trump’s Strategic Bitcoin Reserve plan: What’s next for crypto? Here’s what experts think

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)