Synopsis

Jetking Infotrain, an IT hardware training firm based in Mumbai, has invested in Bitcoin. The company raised ₹6.10 crore through a share sale. It then used these funds and existing cash to purchase Bitcoin. As of May 28, 2025, Jetking holds 21 Bitcoins valued at ₹13.6 crore.

Mumbai: In a rare instance, Jetking Infotrain, a Mumbai-based firm in the business of IT hardware training, raised money through a share sale to buy virtual digital asset Bitcoin.

On Wednesday, the company with a market value of ₹79 crore informed exchanges that it had completed a preferential issue of shares, raising ₹6.10 crore by allotting 3.96 lakh shares at ₹154 each. The company did not disclose to whom it sold the shares. Jetking said it deployed the entire corpus and used its cash to buy the cryptocurrency.

Jetking shares rose 2% to close at ₹133.60.

Crypto Tracker![]() TOP COIN SETSDeFi Tracker2.00% BuyCrypto Blue Chip – 5-1.86% BuyWeb3 Tracker-2.42% BuyNFT & Metaverse Tracker-6.26% BuyAI Tracker-9.01% BuyTOP COINS (₹) Tether85 (-0.06%)BuyXRP192 (-1.15%)BuyEthereum224,734 (-1.79%)BuyBNB57,652 (-1.81%)BuyBitcoin9,024,442 (-1.99%)BuyAs of March 31, 2025, the company held 15.02 bitcoins on its balance sheet. As of May 28, 2025, the company holds 21 bitcoins acquired at an average purchase price of ₹64.6 lakh, valuing it at ₹13.6 crore.

TOP COIN SETSDeFi Tracker2.00% BuyCrypto Blue Chip – 5-1.86% BuyWeb3 Tracker-2.42% BuyNFT & Metaverse Tracker-6.26% BuyAI Tracker-9.01% BuyTOP COINS (₹) Tether85 (-0.06%)BuyXRP192 (-1.15%)BuyEthereum224,734 (-1.79%)BuyBNB57,652 (-1.81%)BuyBitcoin9,024,442 (-1.99%)BuyAs of March 31, 2025, the company held 15.02 bitcoins on its balance sheet. As of May 28, 2025, the company holds 21 bitcoins acquired at an average purchase price of ₹64.6 lakh, valuing it at ₹13.6 crore.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

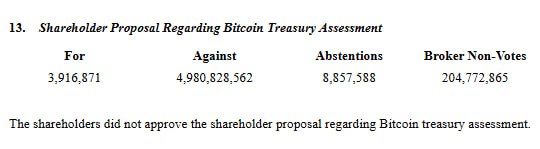

View Details »Generally, listed firms stick to traditional investments. Jetking’s move echoes the bold treasury strategies of US firms like Tesla, but is unheard of in India’s stringently regulated, crypto-cautious environment.

Live Events

“A company is also a legal entity, can invest in bitcoins, as long as they are disclosing it properly and upfront to the exchanges their purpose of raising money via preferential issue,” said Shriram Subramanian, founder and MD of InGovern Research Services.

Jetking also held approximately ₹2.2 crore worth of Ethereum as of March 31, 2024. In December 2024, the company said it formally adopted bitcoin as its primary treasury reserve asset.

Jetking reported net sales of ₹5.4 crore for the March 2025 quarter, as against ₹4.4 crore in the same quarter last year. The company posted a net loss of ₹1.3 crore as against a ₹0.6 crore loss recorded in March 2024.