Is Bitcoin price following Trump’s betting odds?

![]() Cryptocurrency Oct 14, 2024 Share

Cryptocurrency Oct 14, 2024 Share

As the 2024 U.S. presidential election approaches, an intriguing pattern is emerging, showing a correlation between Bitcoin’s (BTC) price and the rising odds of a potential Donald Trump victory.

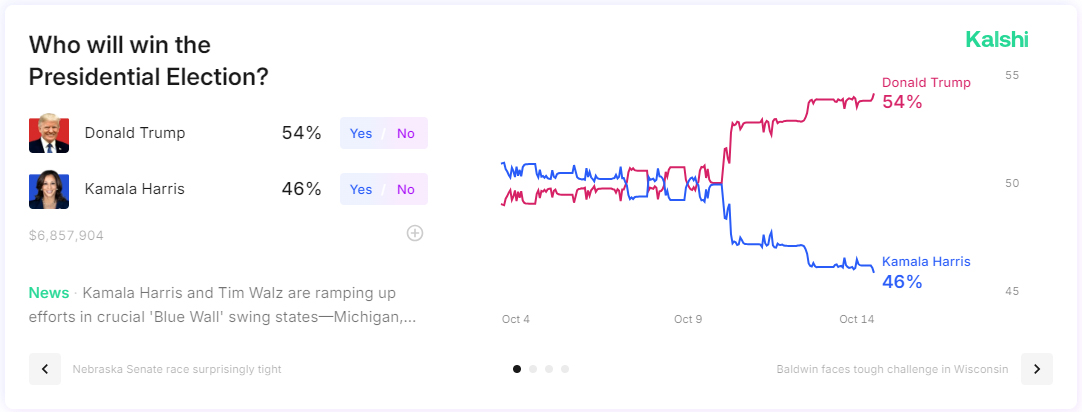

A comparison of Trump’s betting odds to win the election against Vice President Kamala Harris indicates that the former president’s chances have been climbing since October 10, reaching 53% as of press time, according to data from Kalshi.

Between October 10 and 14, Trump’s odds increased from around 50% to 54%. During this same period, the price of Bitcoin surged from approximately $60,300 to around $65,000, reflecting an over 7% increase.

Picks for you

Prediction markets see a 16% chance of no rate cut in November 48 mins ago Ethereum creator Vitalik Buterin sells over $2 million worth of tokens 22 hours ago Is this Bitcoin rally the fruit of manipulation? 22 hours ago This is what Gold markets are telling us 22 hours ago  U.S. presidential elections betting odds. Source: Kalshi

U.S. presidential elections betting odds. Source: Kalshi

Impact of Trump’s pro-Bitcoin stance

It appears that Trump’s pro-Bitcoin stance may be influencing market sentiment. During the current presidential campaigns, Trump has emerged as a strong proponent of Bitcoin, actively embracing the asset and aiming to position the U.S. as a global leader in the crypto space.

His support has included accepting Bitcoin for campaign donations, advocating for a deregulated approach to crypto, and promoting pro-Bitcoin policies at major conferences.

At the same time, the former president has opposed the possible rollout of central bank digital currencies (CBDCs), which he believes threaten financial freedom.

To support his political stance on cryptocurrency, Trump is also involved in related crypto initiatives. For instance, on October 15, he will unveil the sale of the World Liberty Financial (WLF) token, a project he has described as a “chance to help shape the future of finance.”

.@WorldLibertyFi Token Sale goes live on Tuesday morning, October 15th! This is YOUR chance to help shape the future of finance. Be there on Monday, October 14th at 8 AM EST for an Exclusive Spaces to learn more. Join the whitelist today and be ready for Tuesday:…

— Donald J. Trump (@realDonaldTrump) October 12, 2024

On the other hand, VP Harris has been scrutinized by the crypto sector for not doing enough to win the industry’s support. Her recent moves to appeal to the digital assets community have been viewed as playing catch-up.

In late September, Harris made her first public pledge on crypto, vowing that if elected, she would protect emerging technologies like artificial intelligence and digital assets.

What next for Bitcoin’s price

Based on Bitcoin’s price correlation with Trump’s winning odds, Bernstein analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia projected that if he clinches the White House, the outcome could push the leading cryptocurrency to a new all-time high of $80,000 to $90,000.

Initially, Standard Chartered had predicted Bitcoin would reach $125,000 by the end of 2024 if Trump wins and $75,000 if Harris wins, both of which would be record highs.

As of press time, Bitcoin was trading at $65,368, with daily gains of over 4%. In the past seven days, the asset has increased by 2%.

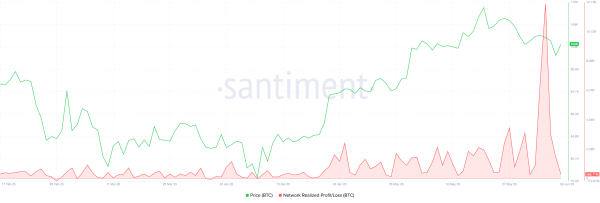

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

With Bitcoin reclaiming the $65,000 level, crypto analyst Benjamin Cowen noted in an X post on October 14 that the asset has shown resilience by maintaining its position above the bull market support band for several weeks. This steady support has bolstered market confidence.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Therefore, technical analysis suggests that if the typical late-October bullish seasonality takes hold, Bitcoin could target the $67,000 to $68,000 range as the next key level.