Synopsis

Robert Kiyosaki, known for predicting financial collapses since the early 2000s, continues to urge investors to shift towards gold, silver, and Bitcoin. Last month, he warned of the “biggest stock market crash in history” by February 2025, expecting a major sell-off in equities and bonds. A critic of fiat currencies, he calls Bitcoin “people’s money” and gold and silver “God’s money,” viewing them as safeguards against market instability.

Rich Dad Poor Dad author Robert Kiyosaki doubled down on his bullish stance on Bitcoin on Friday, saying he would “back up the truck” and buy more if a market-wide crash drives prices lower.

Warning of an impending collapse across stocks, bonds, real estate, gold, silver, and cryptocurrencies, Kiyosaki said Bitcoin would be the fastest asset to recover from what he describes as the ongoing burst of the “Everything Bubble”.

“If the price of Bitcoin crashes I will back up the truck and buy more,” Kiyosaki wrote on X (formerly Twitter) on Friday, reiterating his view that Bitcoin remains a key hedge against economic instability and inflation.

Crypto Tracker![]() TOP COIN SETSAI Tracker2.84% BuyBTC 50 :: ETH 501.42% BuyCrypto Blue Chip – 5-0.34% BuyDeFi Tracker-2.15% BuyNFT & Metaverse Tracker-2.82% BuyTOP COINS (₹) Ethereum241,114 (1.89%)BuyBNB56,990 (1.39%)BuyBitcoin8,516,516 (1.02%)BuyTether87 (0.09%)BuyXRP230 (-1.46%)Buyhttps://x.com/theRealKiyosaki/status/1892686186495524973

TOP COIN SETSAI Tracker2.84% BuyBTC 50 :: ETH 501.42% BuyCrypto Blue Chip – 5-0.34% BuyDeFi Tracker-2.15% BuyNFT & Metaverse Tracker-2.82% BuyTOP COINS (₹) Ethereum241,114 (1.89%)BuyBNB56,990 (1.39%)BuyBitcoin8,516,516 (1.02%)BuyTether87 (0.09%)BuyXRP230 (-1.46%)Buyhttps://x.com/theRealKiyosaki/status/1892686186495524973

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Kiyosaki’s comments came as Bitcoin (BTC/USD) traded at $98,420, climbing 1.5% on Friday and holding above the crucial $95,000 support level but facing significant resistance in breaking higher. Despite the gains, Bitcoin remains stuck in a narrow trading range as markets await stronger signals for the next major price move.![]()

A history of crash warnings

Kiyosaki, who has been predicting financial collapses since the early 2000s, has repeatedly urged investors to shift toward assets like gold, silver, and Bitcoin. Earlier last month, he warned of the “biggest stock market crash in history” by February 2025, forecasting a widespread sell-off in equities and bonds.

A vocal critic of fiat currencies, Kiyosaki has long championed Bitcoin as “people’s money,” alongside gold and silver, which he refers to as “God’s money,” viewing them as hedges against traditional market instability.

Although many of Kiyosaki’s past predictions have yet to materialize, his warnings continue to resonate with those concerned about government debt and inflation.

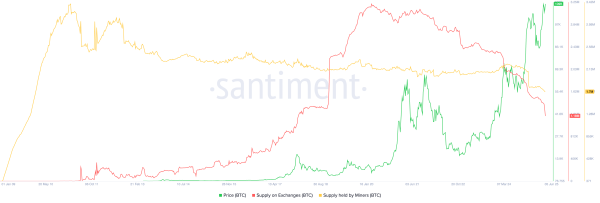

Bitcoin finds support amid ETF outflows

Despite Bitcoin’s recent consolidation, which has left the cryptocurrency rangebound, its resilience around the $95,000 mark suggests the potential for a renewed rally. This follows a period of weakness driven by consistent net outflows from spot Bitcoin ETFs, according to Market Pulse.

While Bitcoin ETFs have attracted a substantial $5.6 billion in investments since their launch, recent data reflects a cooling in speculative appetite as macroeconomic uncertainty lingers.

Analysts suggest that a potential catalyst could come from institutional demand, especially with reports that Michael Saylor’s Strategy is considering a major Bitcoin purchase following a $2 billion fundraising round, Market Pulse reported.

Fed’s cautious tone caps market gains

The U.S. Federal Reserve’s minutes from its January meeting revealed that policymakers are in no hurry to cut interest rates, citing ongoing inflation risks and potential economic fallout from new tariffs under the Trump administration. The central bank kept rates steady at a target range of 4.25% to 4.5%, following a full percentage-point reduction in 2024.

While diplomatic talks between the U.S. and Russia earlier this week offered brief relief for markets, overall sentiment has remained cautious. Bitcoin’s failure to sustain rallies highlights broader investor hesitation amid uncertainty over global economic policy.

Also read | Explained: Why banks are flying gold worth billions from London to New York amid Trump tariff fears

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)