Synopsis

Bitcoin reserves are gaining traction globally, with nations like the US and El Salvador integrating crypto into financial policies. India could benefit by diversifying reserves, enhancing financial resilience, and fostering blockchain innovation while carefully managing volatility and regulatory concerns.

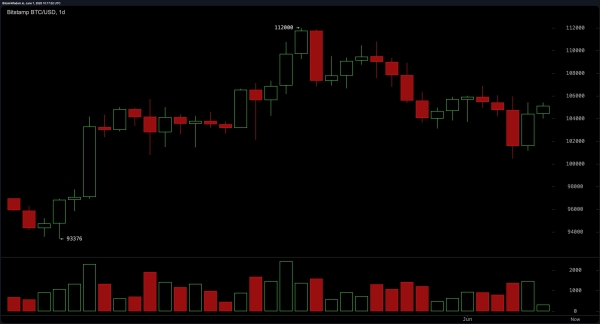

Bitcoin Reserves are currently the talk of the town. These new-gen reserves around crypto assets shows the on-going paradigm shift in financial technology, and its adoption worldwide utilized in stabilizing national funds.

Governments can now validate the proof of digital assets for the public and at the same time diversify portfolios, mitigating risks associated with traditional market risks. This approach has gained traction globally, with recent developments in the United States potentially influencing other nations and maybe can do the same in India.

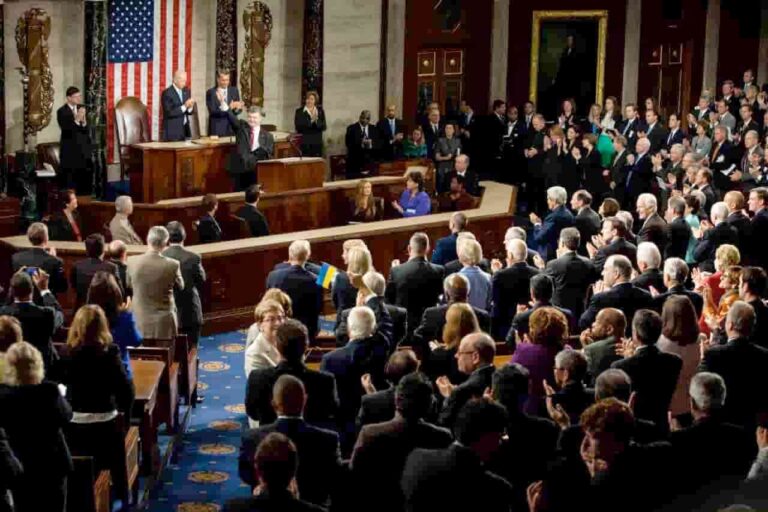

The US administration’s move to create a strategic crypto reserve marks a crucial moment in financial policies worldwide. By acquiring Bitcoin and various top crypto assets to integrate it into national reserves, the government positions itself as a key player in the digital asset space. This aligns with efforts to provide regulatory clarity, encourage institutional participation, and establish a framework for crypto-driven financial stability.

Crypto Tracker![]() TOP COIN SETSNFT & Metaverse Tracker13.24% BuyDeFi Tracker10.37% BuyAI Tracker8.26% BuySmart Contract Tracker7.23% BuyBTC 50 :: ETH 506.79% BuyTOP COINS (₹) XRP212 (7.27%)BuySolana11,632 (6.62%)BuyEthereum173,995 (3.9%)BuyBitcoin7,421,061 (3.19%)BuyBNB54,270 (1.71%)BuyThe Securities and Exchange Commission (SEC) and the Internal Revenue Service (IRS) are expected to define compliance measures and taxation policies, ensuring a structured approach to managing these digital holdings. The upcoming White House Crypto Summit is anticipated to offer further insights into this strategy, potentially shaping global discourse on national Bitcoin reserves.

TOP COIN SETSNFT & Metaverse Tracker13.24% BuyDeFi Tracker10.37% BuyAI Tracker8.26% BuySmart Contract Tracker7.23% BuyBTC 50 :: ETH 506.79% BuyTOP COINS (₹) XRP212 (7.27%)BuySolana11,632 (6.62%)BuyEthereum173,995 (3.9%)BuyBitcoin7,421,061 (3.19%)BuyBNB54,270 (1.71%)BuyThe Securities and Exchange Commission (SEC) and the Internal Revenue Service (IRS) are expected to define compliance measures and taxation policies, ensuring a structured approach to managing these digital holdings. The upcoming White House Crypto Summit is anticipated to offer further insights into this strategy, potentially shaping global discourse on national Bitcoin reserves.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »India, as one of the largest economies with a rapidly growing digital payments ecosystem, could significantly benefit from a similar approach. Looking at the stats of how UPI is widely used in the region making it one of the fastest digital payment driven countries, crypto has a wide scope.

Live Events

If India were to establish its own Bitcoin reserve, it could diversify foreign exchange holdings, reducing dependence on the US dollar while leveraging Bitcoin as an alternative asset. This move would align with the government’s push toward digital finance, complementing initiatives like the Digital Rupee while positioning India as a leader in blockchain adoption. A Bitcoin reserve could enhance financial resilience, providing a hedge against inflation and currency depreciation too. Although, the impact of the US strategy on India’s crypto policies remains to be seen.

With President Trump’s pro-Bitcoin stance influencing global regulatory shifts, India may need to reconsider its cautious approach to digital assets. The Reserve Bank of India (RBI) has historically expressed concerns over cryptocurrency volatility and financial stability. However, if more governments begin integrating Bitcoin into national reserves, India may face growing pressure to reassess its regulatory stance to remain competitive in the evolving digital asset landscape.

As of 2025, several nations have adopted Bitcoin as a strategic reserve asset and otherwise. El Salvador holds 6,000+ BTC ($569M), aligned with its pro-Bitcoin stance. Bhutan has been mining Bitcoin since 2019, and has accumulated 12,206 BTC ($1B), a significant share of its GDP. The United States recently launched a Digital Fort Knox, holding 200,000 BTC (~$17B), primarily from legal seizures. Meanwhile, the Czech National Bank is exploring a 5% Bitcoin allocation within its €140B reserves. These moves show Bitcoin’s growing role in global finance.

A national Bitcoin reserve could also attract institutional investment into India’s crypto ecosystem, fostering innovation in blockchain-based financial services. A more progressive stance on Bitcoin reserves could enhance a country’s appeal as a hub for digital asset innovation, driving economic growth and positioning the country at the forefront of the Web3 revolution.

However, the implementation of such reserves would require careful risk management. Bitcoin’s volatility remains a key concern, necessitating a structured approach to reserve allocation and liquidity management. Additionally, the selection of digital assets for inclusion in national reserves would require thorough evaluation, as seen in the US, where debates have emerged over incorporating altcoins like XRP, Solana, and Cardano.

The global shift toward Bitcoin reserves shows the beginning of a new era of financial integration between traditional and digital assets. For India, the question is not whether to embrace this transformation, but how to do so in a way that aligns with its economic and regulatory priorities. As the landscape evolves, a country’s approach to crypto reserves could determine its role in shaping the future of its digital economy.

(Disclaimer: Recommendations, suggestion