Synopsis

Institutions are increasingly embracing cryptocurrencies, driven by regulatory clarity, robust security measures, and client demand. This shift enhances market liquidity and stability, integrating digital assets with traditional finance. Notable early investors and collaborations highlight the growing legitimacy and investment opportunities in the crypto market.

The landscape of finance is undergoing a profound transformation as cryptocurrencies, once viewed with skepticism, are increasingly embraced by institutions. This shift signifies a paradigm change in investment strategies and financial services, reflecting a broader recognition of the potential of digital assets to reshape the global economy. In a recent live stream, Manav Varanasi from Sales & Trading at Mudrex discussed this remarkable transition and the factors driving institutional acceptance of cryptocurrencies.

The Early Days of Cryptocurrency

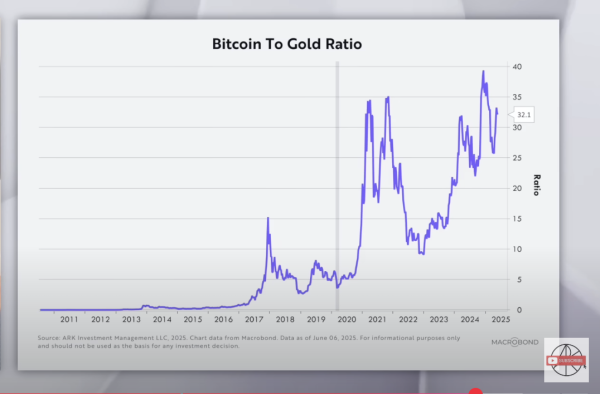

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, emerged in the wake of the 2008 global financial crisis, a period that exposed significant flaws in traditional banking systems. Initially attracting a niche audience of tech enthusiasts, Bitcoin was often seen as an experimental project rather than a legitimate asset class. However, as the digital currency matured, its potential for value appreciation and broader utility gained traction, leading to increased institutional interest.

Key Developments Paving the Way for Institutional Adoption

Varanasi highlighted several milestones that have contributed to the institutional acceptance of cryptocurrencies. The gradual establishment of clear regulatory frameworks has been a significant catalyst, providing institutions with a better understanding of the legal landscape. This increased regulatory transparency has reduced perceived risks, encouraging institutional participation.

Crypto Tracker![]() TOP COIN SETSAI Tracker5.78% BuySmart Contract Tracker4.02% BuyDeFi Tracker3.86% BuyCrypto Blue Chip – 53.07% BuyWeb3 Tracker0.93% BuyTOP COINS (₹) BNB48,940 (3.48%)BuyEthereum204,763 (0.45%)BuyBitcoin5,231,967 (0.03%)BuyTether84 (0.01%)BuySolana12,025 (-0.12%)BuyA key example of this shift was the SEC’s approval of Bitcoin and Ethereum ETFs, which opened a regulated pathway for institutional investment, attracting billions of dollars. Moreover, the introduction of sophisticated instruments, such as crypto futures and options, has allowed institutions to manage risk while gaining exposure to digital assets.

TOP COIN SETSAI Tracker5.78% BuySmart Contract Tracker4.02% BuyDeFi Tracker3.86% BuyCrypto Blue Chip – 53.07% BuyWeb3 Tracker0.93% BuyTOP COINS (₹) BNB48,940 (3.48%)BuyEthereum204,763 (0.45%)BuyBitcoin5,231,967 (0.03%)BuyTether84 (0.01%)BuySolana12,025 (-0.12%)BuyA key example of this shift was the SEC’s approval of Bitcoin and Ethereum ETFs, which opened a regulated pathway for institutional investment, attracting billions of dollars. Moreover, the introduction of sophisticated instruments, such as crypto futures and options, has allowed institutions to manage risk while gaining exposure to digital assets.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Addressing Security Concerns

Security has always been a primary concern for institutional investors. Fortunately, the rise of secure custodial services, including platforms like Coinbase Custody and Bitco, has provided robust solutions. These services, equipped with cutting-edge security measures, have played a crucial role in making the crypto market more accessible to institutions.![]()

Responding to Client Demand

As high-net-worth individuals and ultra-high-net-worth individuals express increasing interest in cryptocurrencies, institutions have adapted by incorporating digital assets into their portfolios and product offerings. This shift is vital for driving further institutional adoption.

The Impact of Institutional Investment

The influx of institutional capital has significantly impacted market maturity. Increased institutional involvement has improved liquidity in the crypto market, making it easier for large-scale investors to participate without causing significant price fluctuations. This increased liquidity has also reduced overall market volatility, making digital assets more appealing for long-term investors.

Collaborations with Traditional Finance

The integration of traditional finance with the crypto ecosystem has fostered innovation. Partnerships, such as PayPal’s collaboration with Paxos, highlight the willingness of traditional financial institutions to enable digital assets. By integrating decentralized finance with established financial frameworks, these collaborations open new avenues for investment.

Notable Early Institutional Investors

Early institutional investors in Bitcoin, primarily venture capital firms and technology-focused companies, recognized the potential of digital assets. Notable examples include Founders Fund, which aggressively purchased Bitcoin in 2014, and Grayscale, which launched the Bitcoin Investment Trust to provide accredited investors with regulated exposure to Bitcoin.

The role of Coinbase has been pivotal in facilitating institutional investments, particularly with the launch of Coinbase Custody in 2018, designed specifically for institutional investors. Similarly, Fidelity’s announcement of cryptocurrency services marked a significant shift in how traditional financial institutions view digital assets.

Implications for Retail Investors

Varanasi underscored the importance of these developments for retail investors. Institutional involvement signals that cryptocurrencies are no longer merely speculative assets; they are legitimate investment opportunities. The introduction of products designed for easier investment, such as ETFs and trusts, allows retail investors to gain exposure to digital assets through familiar and regulated channels.

Higher institutional investment also enhances market liquidity, leading to reduced volatility and a more stable environment, which benefits retail investors seeking long-term growth. Moreover, as institutions navigate compliance issues, they influence the regulatory landscape for the entire crypto space, reducing uncertainty for retail investors.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)

Source