Prominent author Adam Livingston has urged investors to fire their “stupid financial advisor” and buy Bitcoin, citing its exceptional ROI since 2015.

This comes at a time when Bitcoin’s price saw a decline, dropping below $101,000 from last week’s range of $103,000 to $106,000. Despite this short-term decrease, Bitcoin’s long-term growth potential continues to attract the attention of analysts.

A market watcher is now comparing Bitcoin’s future prospects with traditional assets, offering a broader view on where investors should have directed their capital.

Bitcoin vs. Traditional Assets

Adam Livingston, author of The Bitcoin Age and The Great Harvest, shared an illustrative comparison. He pointed out that a $10,000 investment in the S&P 500 in 2015 would have grown to $31,694 today, yielding a 216% return. In 2015, the S&P 500 traded at an average of $2,000 and has since risen to around $5,900.

Your idiot financial advisor told you to put your $10,000 in the S&P 500 in 2015.

✅ $10,000 -> $31,694 (216% return)

Meanwhile, one asymmetric decision into Bitcoin:

🚀 $10,000 -> $3,326,125 (33,000% return)

They sold you “diversification.”

What you needed was vision.…

— Adam Livingston (@AdamBLiv) June 6, 2025

In contrast, the same amount invested in Bitcoin at a price of $300–$400 in 2015 would have surged to a staggering $3,326,125 today. Livingston suggests that investors focused on “diversification” have missed out on the true asymmetric gains Bitcoin has offered.

Livingston emphasizes that instead of relying on traditional financial advice, investors should focus on the long-term potential of Bitcoin, urging them to fire their “stupid financial advisor” and buy Bitcoin.

Shifting Views on Bitcoin’s Potential

Other market voices, such as Bitcoin Purple, have echoed Livingston’s sentiments. They contend that “diversification” is a concept used to keep investors from realizing the full wealth-building potential.

According to Purple, building wealth isn’t about balancing risks in multiple assets but focusing on the high-reward potential that Bitcoin offers.

A separate individual pointed out that Bitcoin in 2015 was not what it is today, sharing their own journey of discovering Bitcoin in 2016 and initially trading it before realizing its true potential in 2020.

They speculated that many early holders from 2015 might have forgotten about their investments. In response, Adam Livingston acknowledged that while the circumstances surrounding Bitcoin have evolved, the core value proposition has remained the same.

Another user asked Livingston for advice on how to steer his brother away from altcoins, to which Livingston sharply advised him to encourage his brother to invest in Bitcoin, which is increasingly attracting institutional wealth. He emphasized that the time for speculative altcoin trading ended in 2017, urging a shift toward Bitcoin for long-term success.

Bitcoin’s Outlook vs. Traditional Investments

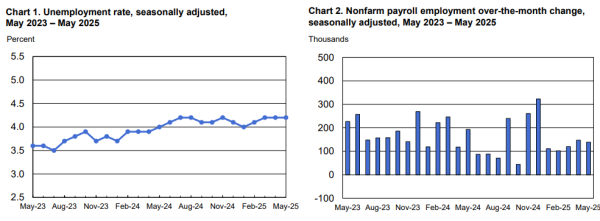

Further supporting Bitcoin’s appeal, André Dragosch, the European Head of Research at Bitwise, recently presented a new forecast on the future of various investment assets. Dragosch predicts that Bitcoin will see an annual return of 53.1% over the next decade, far outpacing traditional investments.

In comparison, gold is projected to yield -3.6% annually, while residential real estate in the U.S. is expected to offer -1.9% returns. The S&P 500, which tracks the broader U.S. stock market, has a more optimistic outlook, with a 3.3% annual return.

U.S. Treasury bonds, on the other hand, are expected to provide 4.5% annual returns.