The cryptocurrency market may have to brace for potential turbulence in the coming months as several major Bitcoin (BTC) holders—including defunct exchanges and government entities—could liquidate substantial portions of their holdings.

This raises concerns about continued downward pressure on the world’s leading digital asset and its market liquidity.

According to a new report by crypto data provider Kaiko, the crypto market is currently grappling with a significant supply overhang. It’s been a persistent theme throughout the summer, with forced selling and the liquidation of bankrupt crypto estates causing selling pressure at various stages between May and August.

Speaking with Decrypt, Rob Hadick, general partner at Dragonfly, said the summer has seen significant BTC price pressure related to the Mt. Gox distributions, the Japanese yen carry trade, and simply slowing demand. “The market remains concerned about the overhang that government holdings and additional Mt. Gox distributions present,” he said.

One of the primary sources of market anxiety has been the ongoing redistribution of funds to Mt. Gox creditors. The bankrupt crypto exchange’s estate still holds over 46,000 BTC, valued at more than $2 billion, which is slated for eventual redistribution.

Elaborating on the potential impact of that distribution, Darren Franceschini, co-founder of Fideum, told Decrypt that according to predictions, nearly all of these Bitcoin, worth over $2.7 billion, might be sold—potentially adding $8.2 billion in additional selling pressure if creditors sell their entire holdings.

Other significant holders could potentially contribute to selling pressure in the near future. The U.S. government, for instance, holds Bitcoin worth over $2 billion.

“Although there is no official announcement about selling these Bitcoins, the possibility of their liquidation could exert substantial pressure on the market,” Franceschini said.

He added that other nations, including the UK, China, and Ukraine, also possess substantial Bitcoin reserves.

On the other hand, the Kaiko report emphasized the importance of looking beyond simple trading volumes when assessing market liquidity, such as market depth, which measures the market’s ability to absorb large orders without significant price impact.

The report also highlighted the significance of the volume-to-liquidity ratio and price slippage as key indicators of market health and efficiency.

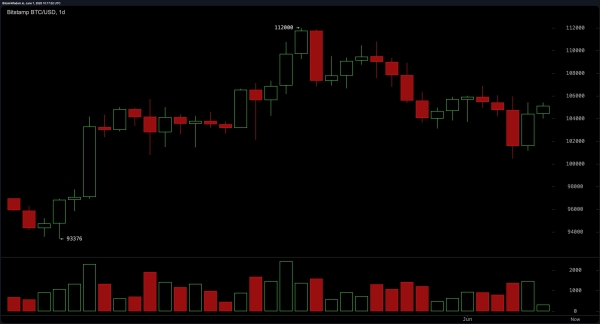

During the first weekend of August, Bitcoin experienced a significant price drop, briefly trading below $50,000 for the first time since February 2024.

Bartosz Lipiński, CEO of crypto trading platform Cube.Exchange says that given how fast crypto markets shift, it would be hard to predict which market participants would be the most active sellers, but that an educated guess is possible based on a handful of known factors.

He pointed to Mt. Gox trustees and outflows from Bitcoin ETFs as potential sources of selling pressure, adding, “If this trend continues, It would make sense for Bitcoin to struggle to maintain support at or above $60,000 in the near-to-medium-term future.”

Despite these challenges, some experts see the potential for market recovery.

“The election itself may present a catalyst for a friendlier regulatory environment and greater clarity leading to more interest from institutional buyers,” Hadick said. “The large wealth management distribution channels are just now able to start marketing ETFs, and the amount of long-term holders of BTC has risen quickly these past two months, which indicates accumulation.”

Meanwhile, cautioning about a potential wildcard, Lipiński also cited the election and the fact that the U.S. has been moving balances on exchanges, even as Donald Trump said he would not sell confiscated crypto and hold it in reserve.

“Should authorities begin mass liquidations of their holdings, the ‘Santa Rally’ that many crypto enthusiasts often see may fail to materialize this year for the first time in a while,” he said.