Max Keiser, a Bitcoin advocate and advisor to the president of El Salvador, has shared his view on the future of Bitcoin in a recent post on the X platform.

Keiser took jabs at traditional assets holders, including luxury properties. In his view, fiat money, stock and gold do not stand a chance against BTC, because no one will trade those assets for Bitcoin.

“Everything goes to zero against Bitcoin,” he concluded.

World War Bitcoin has started.

Everyone with Bitcoin wins.

Everyone holding fiat money, Gold, bonds, stocks, fine art, Aspen ski lodges, loses — because no one will trade their Bitcoin for any of these things.

Everything goes to zero against Bitcoin.

— Max Keiser (@maxkeiser) July 27, 2024

BTC bull run ahead?

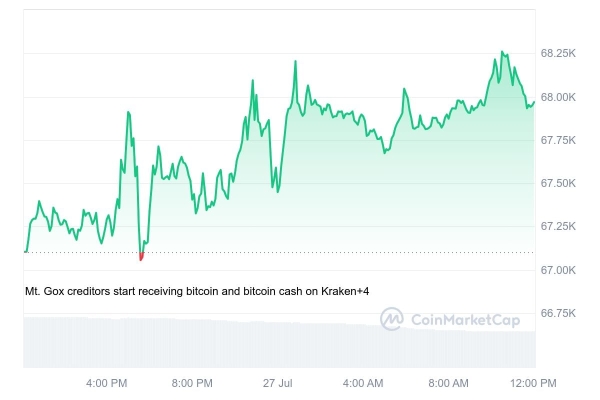

Bitcoin, which traded near $65,000 yesterday, was recently back above $67,000. At press time, BTC is traded at almost $68,000.

The optimistic market sentiment comes after one of the biggest declines that the BTC price saw this past week. On Wednesday, the BTC price dropped below $64,000, while a total of $300 million worth of the cryptocurrency was liquidated.

Despite concerns, the distribution of 95K bitcoins from Mt. Gox’s insolvency did not negatively impact the market, with Bitcoin prices regaining stability.

Bitcoin 2024

Bitcoin 2024 Conference in Nashville has sparked many debates on the future of Bitcoin and the crypto market in general.

During his opening keynote, Michael Saylor stated that he sees the world’s largest crypto’s price rising to $13 million by 2045 in his base case scenario.

Saylor predicted Bitcoin could reach $13 million by 2045, requiring a 29% annual return and a market cap of $280 trillion. In a bullish scenario, it could hit $49 million, while the bearish case suggests $3 million.

Financial analyst and Bitcoin skeptic Peter Schiff responded to Saylor in a series of posts, claiming that Saylor for the government Bitcoin bailout.

“He knows the Bitcoin blockchain letter is running out of chain and wants the U.S. government to become the buyer of last resort, leaving American taxpayers as the ultimate bag holders in the Bitcoin pyramid scheme,” Schiff posted.