EigenLayer, a well-known restaking platform with a TVL of 10.8 billion dollars, has just announced the addition of Bitcoin as an enabled asset for deposits.

Thanks to the collaboration with the decentralized autonomous organization Threshold Network, tBTC, a derivative of BTC on the Ethereum network, has landed on the platform.

This is a great milestone for EigenLayer that opens the doors for the first time to economic incentives for the reassurance of the network through the restaking of Bitcoin.

The demand for this type of product could reach very high levels right away, given the success recorded in other competitor protocols.

Let’s see all the details of the news below.

tBTC can now be deposited on @EigenLayer 🔥

Get T rewards via @TheTNetwork for depositing your tBTC on EigenLayer, making it the first incentivized BTC asset.

This cements tBTC’s position in Bitcoin staking and the broader BitcoinFi ecosystem. 🧵👇 pic.twitter.com/NfW4m3kATk

— tBTC (@tBTC_project) September 17, 2024

Summary

- EigenLayer starts the restaking of Bitcoin with tBTC on its platform in collaboration with Threshold Network

- New important incentives on EigenLayer

- Bitcoin and DeFi: distribution of BTC deposited in restaking

EigenLayer starts the restaking of Bitcoin with tBTC on its platform in collaboration with Threshold Network

According to the latest cryptographic updates, EigenLayer has introduced Bitcoin restaking in its application by enabling deposits in tBTC.

The asset in question represents an equivalent version of BTC developed by Threshold Network, whose value reflects a 1:1 ratio with the underlying asset.

For each BTC deposited with the Threshold Network, a tBTC is issued, potentially tradable on Kraken and other decentralized exchanges.

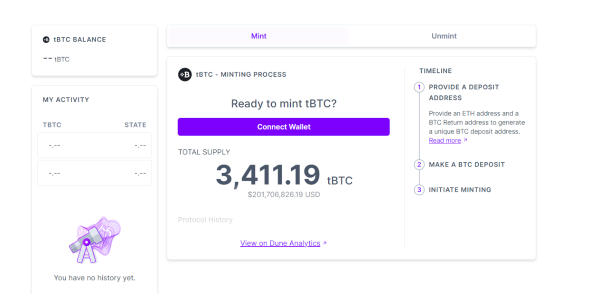

This resource is already quite widespread in the market and has a capitalization of 200 million dollars. About 3411 Bitcoin have been locked on the cryptographic provider by 1432 different addresses.

tBTC, active since January 2023 but only exploded in the current year, represents 2.1% of the supply of “wrapped token bitcoin” on Ethereum,

Source: https://dashboard.threshold.network/tBTC/mint

His entry into the EigenLayer pools represents a milestone in the world of restaking as it unlocks numerous hybrid opportunities in DeFi.

First and foremost, the platform marks the first time the introduction of a currency that reflects the value of Bitcoin, with incentives in connected tokens.

Then this new model opens the doors to new scenarios in which economic security is guaranteed by the bets of Bitcoin restakers

On the one hand, therefore, the search for capital maximization is pursued through the holding and commitment of the most capitalized cryptocurrency in the world.

On the other hand, a new type of cryptographic stability is offered in the Proof-of-Stake of Ethereum, which is diversified and enhanced with less unpredictable collateral.

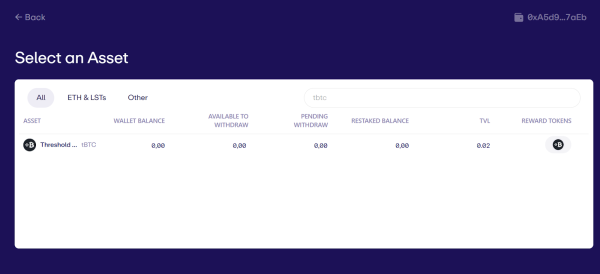

The pool in tBTC is already operational on EigenLayer, but there are just 0.02 Bitcoin deposited in restaking.

Probably from now on there will be a substantial increase in deposits in tBTC by users, given the rewards offered as prizes

Source: https://app.eigenlayer.xyz/?flow=true

New important incentives on EigenLayer

The debut of the Bitcoin derivative tBTC in the EigenLayer market unlocks new investment opportunities in the Ethereum restaking sector.

To accompany the launch of its token, Threshold Network DAO has announced that it will offer economic incentives of up to 45,000 dollars in token T in the first 3 months.

Users who deposit tBTC on EigenLayer from now on earn a share of the governance coin of the Threshold project.

Obviously, the more participants there are, the less the incentive becomes appealing for the staker, who do not receive a native reward.

In any case, the integration of a wrapped resource of Bitcoin on Eigenlayer represents a crucial step towards a more efficient management of one’s crypto portfolio.

The flexibility with which the resource merges with the Ethereum ecosystem also creates a competitive advantage compared to the canonical restaking practices from a diversification perspective.

As MacLane Wilkison, a collaborator of Threshold, indeed commented on the news:

“It is a testament to the strength of tBTC in protecting the BitcoinFi ecosystem through the diversification of available assets. To date, the main protocols including Curve, GMX, and Compound, among others, have integrated the resource for its flexibility as one of the most decentralized wrapped assets on the market.”

Not to forget the way in which the “stability” of BTC as the most capitalized asset in the sector offers greater protection to investors.

Following the emergence of Bitcoin staking projects such as Babylon, Lombard, and Acre, the adoption of tBTC by EigenLayer is a testament to the power of Bitcoin restaking in incentivizing users to use Bitcoin beyond a store of value. The ability of tBTC to bridge the Bitcoin and Ethereum ecosystems makes it the optimal solution to drive the development of the BitcoinFi ecosystem.

Sreeram Kannan, founder and CEO of Eigen Labs, expressed optimism about the news:

“The inclusion of Threshold’s tBTC as a restakable asset on EigenLayer is another important step forward towards open innovation by building connectivity with the bitcoin ecosystem, expanding the range of assets that can contribute to securing decentralized networks, and providing greater optionality and utility for AVS and restakers”

Bitcoin and DeFi: distribution of BTC deposited in restaking

Although tBTC turns out to be the first asset denominated in Bitcoin to offer incentives on EigenLayer, we cannot say the same for the broader landscape of restaking.

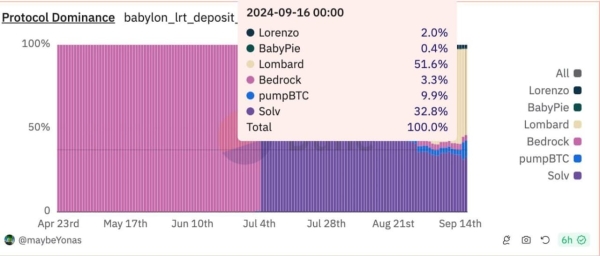

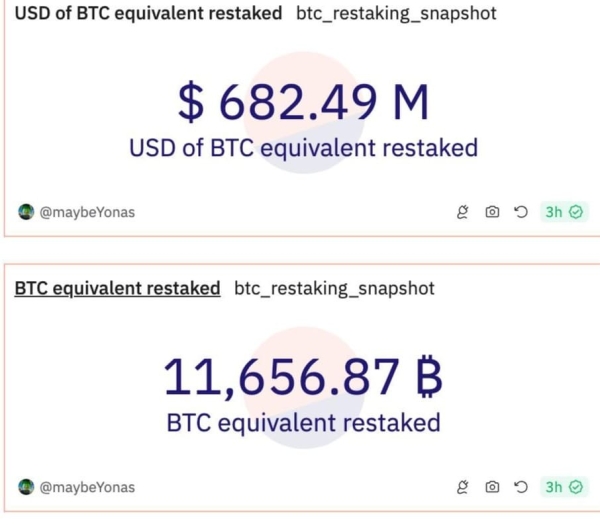

Currently, as indicated on Dune Analytics by “MayBeYonas”, approximately 11,657 BTC have been locked in restaking, with a value of 682.5 million dollars.

We are talking about a share of less than 0.05% of all BTC currently in circulation on the original chain. It is therefore a market trend that should not be ignored, also considering the potential on the airdrop front, but that does not put the security of the cryptographic network at risk.

Source: https://x.com/Mars_DeFi/status/1835690743295275238

The most used protocols for restaking on Bitcoin are Symbiotic, Babylon, Swell, Pell, and Mellow. The first two enjoy the highest liquidity presence and are the most chosen by users themselves. In particular, on Symbiotic there are 1,980 BTC in restaking of which 1,650 in WBTC, 165 in LBTC, and 104.8 in tBTC. On Babylon, we find instead 9,902 BTC locked.

With the introduction of tBTC on Eigenlayer, we might also see this latest platform join the aforementioned list.

We emphasize how on Babylon the TVL depends on various secondary protocols that perform liquid restaking of resources in Bitcoin.

The main ones are Lombard with a share of 51.6%, Solv Protocol with 32.8%, pumpBTC with 9.9% and bedrock with 3.3%. There are also minority shares for Lorenzo and BabyPie.

The majority of these platforms offer special airdrop rewards for early users who will deposit assets in these months.