DeepSeek AI predicts Ethereum price as Eric Trump says ‘it’s a great time to add ETH’

![]() Cryptocurrency Feb 4, 2025 Share

Cryptocurrency Feb 4, 2025 Share

The first weeks of 2025 have been nothing short of turbulent for financial markets, with both cryptocurrencies and equities facing intense pressure. A major shake-up came from China’s DeepSeek AI, which rattled the tech sector promising superior performance at a fraction of competitors’ costs.

Meanwhile, President Donald Trump’s aggressive tariff policies further unsettled markets, triggering even greater turmoil. The cryptocurrency market suffered historic liquidation, erasing $2.24 billion in value within 24 hours, with estimates reaching up to $10 billion.

Ethereum (ETH) took the hardest hit, leading the liquidation spree with $617.35 million in losses, plunging 16% to a low of $2,476 on February 3.

Picks for you

AI predicts Cardano (ADA) price for February 28 as whales go on a selling spree 2 hours ago Is this the worst Congressional crypto trade yet? 2 hours ago Ripple prepares for what could be an $800 million XRP dump in February 3 hours ago Blaze switches from Snowlake to Space and Time 3 hours ago

However, ETH rebounded sharply above $2,900 after Trump temporarily suspended tariffs on Canada and Mexico to trade at $2,802 at the press time. The recovery gained momentum as Eric Trump called it ‘a great time to add ETH,’ fueling further optimism among investors.

Ethereum one-day price chart. Source: Finbold

Ethereum one-day price chart. Source: Finbold

As the market searches for direction, Finbold turned to DeepSeek AI to analyze Ethereum’s near-term trajectory and predict where ETH could stand amid the shifting sentiment.

DeepSeek sets Ethereum’s short-term price target

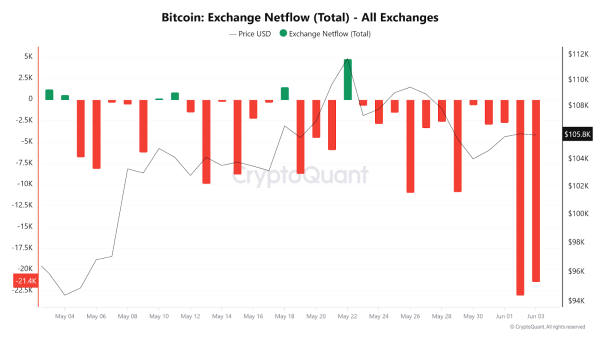

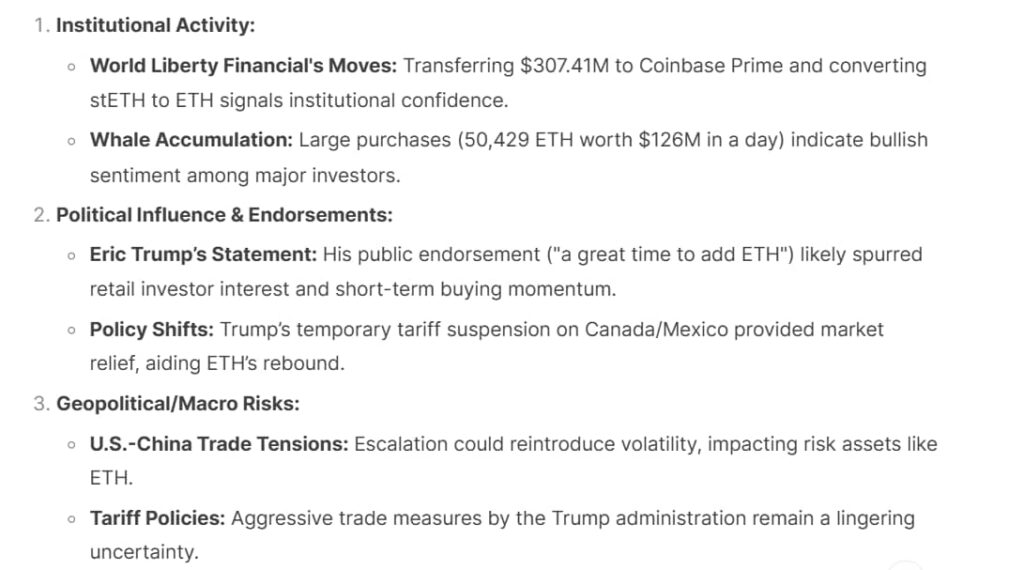

With search functionality and DeepThink (R1) enabled, and after analyzing the broader market context, DeepSeek AI identified institutional activity as a critical driver of Ethereum’s next move.

World Liberty Financial (WLF) transferred $307.41 million in assets to Coinbase Prime as a part of its treasury management and business operations.

DeepSeek AI on Ethereum. Source: DeepSeek/Finbold

DeepSeek AI on Ethereum. Source: DeepSeek/Finbold

Shortly after, WLF unstaked 19,423 stETH into ETH and spent $5 million USDC to acquire 1,826 ETH at $2,738, a move that DeepSeek AI interprets as strong institutional confidence in Ethereum’s upside potential.

Adding to this bullish sentiment, on-chain data revealed a surge in whale accumulation, with major investors purchasing 50,429 ETH worth over $126 million in a single day, further supporting expectations of further price appreciation.

DeepSeek AI also flagged Eric Trump’s public endorsement of Ethereum, as a catalyst for fresh speculative interest. Retail investors often react to such endorsements, potentially triggering short-term buying momentum and adding support to ETH’s recovery.

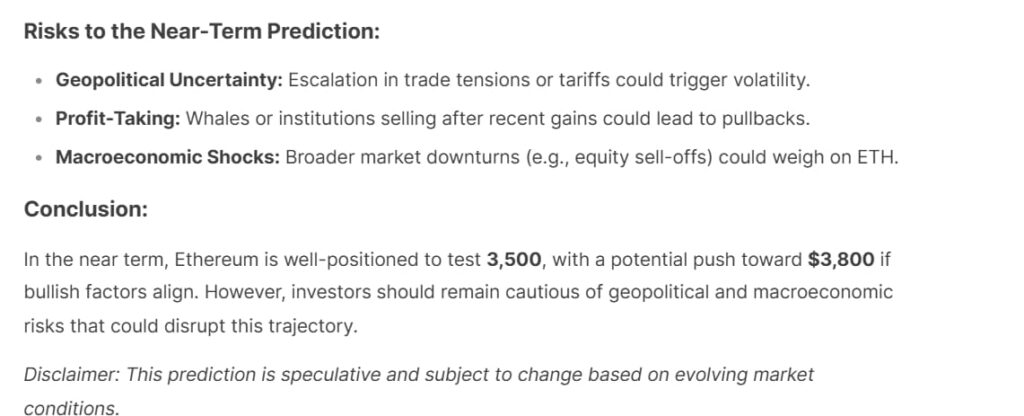

However, geopolitical and macroeconomic risks remain key factors influencing Ethereum’s trajectory.

While Trump’s temporary suspension of tariffs on Canada and Mexico has provided short-term relief, trade tensions with China continue to present a major uncertainty. Further escalation could introduce renewed volatility across risk assets, including cryptocurrencies, potentially creating headwinds for Ethereum’s upward trajectory.

Ethereum price prediction. Source: DeepSeek/Finbold

Ethereum price prediction. Source: DeepSeek/Finbold

Considering institutional accumulation, increased whale activity, and strengthening investor sentiment, DeepSeek AI projects Ethereum to reach between $3,500 and $3,800 within the next one to three months.

If buying momentum continues, ETH could test higher resistance levels, with technical analysis suggesting new highs in March, potentially surpassing $4,880.

However, macro uncertainties and market dynamics will play a crucial role in determining whether Ethereum can sustain its rally in the coming months.

Featured image via Shutterstock