Synopsis

The cryptocurrency market rebounded modestly, with Bitcoin rising to $55,027 and Ethereum to $2,317. Toncoin and Avalanche saw notable gains over 4%. Despite recent bearish trends, upcoming U.S. CPI and PPI data could influence future market direction.

The cryptocurrency market saw a modest rebound, with Bitcoin trading above $55,000 and Ethereum rising to $2,317. Notable gains were also recorded by Toncoin and Avalanche, which both saw increases of over 4%.

As of 1:31 pm IST, Bitcoin was trading 1% higher at $55,027, while Ethereum had surged 1% to $2,317. Other notable gains included Dogecoin up 1.6%, Tron rising 1.7%, Toncoin by 5.7%, Avalanche by 4.7%, Shiba Inu by 1.5%, and Chainlink leading with a 3.5% increase.

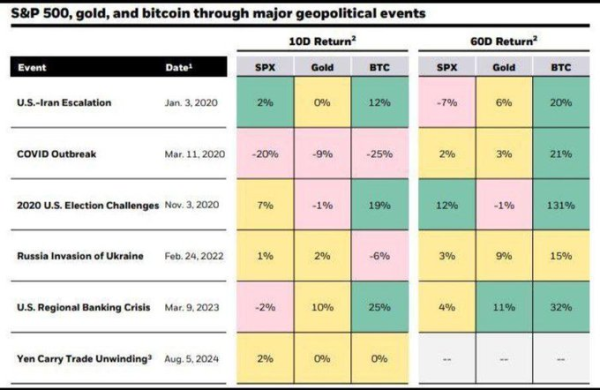

“Over the weekend, the crypto market remained bearish, with Bitcoin dropping below $53,000 for the first time in recent months. It’s still uncertain if Bitcoin has reached its bottom, as no solid confirmation is available yet. This week’s focus will be on the U.S. CPI and PPI data releases, which could impact market direction,” said the CoinDCX Research Team.

Crypto Tracker![]() TOP COIN SETSDeFi Tracker0.33% BuyWeb3 Tracker-0.90% BuySmart Contract Tracker-4.84% BuyCrypto Blue Chip – 5-6.58% BuyBTC 50 :: ETH 50-7.46% BuyTOP COINS (₹) Bitcoin4,643,593 (1.33%)BuyEthereum195,297 (1.11%)BuyBNB42,695 (0.91%)BuyTether84 (0.03%)BuySolana10,930 (-0.15%)Buy”For Bitcoin, key support levels are around $54,500 and $52,650, while resistance levels are at $59,650 and $61,600,” CoinDCX added.

TOP COIN SETSDeFi Tracker0.33% BuyWeb3 Tracker-0.90% BuySmart Contract Tracker-4.84% BuyCrypto Blue Chip – 5-6.58% BuyBTC 50 :: ETH 50-7.46% BuyTOP COINS (₹) Bitcoin4,643,593 (1.33%)BuyEthereum195,297 (1.11%)BuyBNB42,695 (0.91%)BuyTether84 (0.03%)BuySolana10,930 (-0.15%)Buy”For Bitcoin, key support levels are around $54,500 and $52,650, while resistance levels are at $59,650 and $61,600,” CoinDCX added.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Shivam Thakral, CEO of BuyUcoin, commented, “The market is showing optimism due to expectations of an interest rate cut, as new data suggests the Federal Reserve might act soon. Investors have reacted positively in the past 24 hours, with many anticipating a rate reduction in September. This could stimulate economic activity and boost the markets.”![]()

The global cryptocurrency market capitalization increased by 0.8% to $1.95 trillion over the last 24 hours. The volume of stablecoins reached $44.65 billion, making up 90.30% of the total 24-hour crypto market volume, according to .

In the last 24 hours, the market cap of Bitcoin, the world’s largest cryptocurrency, rose to $1.09 trillion. Bitcoin’s dominance is currently 56.64%, according to . BTC volume in the last 24 hours Rose 36.65% to $22.51 billion.

Tech view by ZebPay Trade Desk

On September 6th, Bitcoin broke below its key support range of $55,724 to $73,777, triggering a sharp decline to an intraday low of $49,000, last seen on August 5th. The crypto market experienced a major downturn, with BTC plunging to a one-month low of approximately $53,000, fueling bearish sentiment. This drop led to over $295 million in liquidations within 24 hours. Despite the pullback, Bitcoin has posted modest gains, helping the global crypto market cap reclaim the $2 trillion level.

.com

.com

BTC continues to trade in a ‘Descending channel’ pattern where the upper downsloping line is acting as the resistance and the lower downsloping line is the support. The lower longer shadows around $52,000 indicate buying around these levels. Once BTC gives a breakout above the Descending channel pattern then we may expect the prices to rally and cross the previous all-time high of $73,777. The asset has a strong support zone from $52,000 to $48,000 whereas $56,000 & $62,500 will act as a strong resistance.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Source