Synopsis

Bitcoin and Ethereum gained after Trump’s tariff exemptions boosted sentiment. Bitcoin hovered near $85,800 amid strong institutional buying and favorable macro conditions. Analysts see bullish momentum with resistance at $86,000. Altcoins showed mixed movement, while stablecoin activity remained dominant. Cautious optimism persists with BTC eyeing a breakout above $85,500.

Bitcoin and Ethereum edged higher on Tuesday after US President Donald Trump announced exemptions for certain electronics from steep “reciprocal” tariffs, lifting market sentiment.

Trump said on Monday he was considering modifying the 25% tariffs on auto and auto parts imports from Mexico, Canada, and other countries. The move followed an earlier exemption for smartphones, computers, and other electronics. However, his administration has also stepped up probes into semiconductor imports, with Trump indicating tariff decisions would be announced within a week.

As of 11:14 AM IST, Bitcoin was trading at $85,804, up 1.7% in the past 24 hours, while Ethereum gained 1.3% to $1,645. The global cryptocurrency market capitalization rose 0.51% to $2.7 trillion.

Crypto Tracker![]() TOP COIN SETSCrypto Blue Chip – 511.89% BuyBTC 50 :: ETH 5010.57% BuyNFT & Metaverse Tracker10.25% BuyWeb3 Tracker-15.24% BuyDeFi Tracker-28.75% BuyTOP COINS (₹) Bitcoin7,324,282 (0.91%)BuyEthereum140,415 (0.63%)BuyXRP183 (0.35%)BuyBNB50,414 (-0.38%)BuySolana11,247 (-1.12%)Buy“Bitcoin is hovering around the $85,000 mark as investors await a fresh catalyst. Macro conditions are supportive, with declining US Treasury yields and a weaker dollar reducing the appeal of fixed-income assets, prompting more flow into risk-on assets like BTC,” said Edul Patel, Co-founder and CEO of Mudrex.

TOP COIN SETSCrypto Blue Chip – 511.89% BuyBTC 50 :: ETH 5010.57% BuyNFT & Metaverse Tracker10.25% BuyWeb3 Tracker-15.24% BuyDeFi Tracker-28.75% BuyTOP COINS (₹) Bitcoin7,324,282 (0.91%)BuyEthereum140,415 (0.63%)BuyXRP183 (0.35%)BuyBNB50,414 (-0.38%)BuySolana11,247 (-1.12%)Buy“Bitcoin is hovering around the $85,000 mark as investors await a fresh catalyst. Macro conditions are supportive, with declining US Treasury yields and a weaker dollar reducing the appeal of fixed-income assets, prompting more flow into risk-on assets like BTC,” said Edul Patel, Co-founder and CEO of Mudrex.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »He added that institutional interest remains firm, citing Strategy’s recent purchase of 3,459 BTC worth $285.8 million. “BTC needs to break past the $86,000 resistance for sustained momentum, with support at $83,000,” he noted.

Live Events

Vikram Subburaj, CEO of Giottus, said Bitcoin continues to trade in a tight range, holding the key $85,000 level. “Institutional activity is strong, with Strategy and Metaplanet purchasing Bitcoin worth $285 million and $26 million, respectively. This is backed by a 15% weekly jump in trading volumes, as per CryptoCompare,” he said. “With rising institutional participation, Bitcoin could move towards $88,000.”

Among altcoins, BNB, XRP, Toncoin, and Litecoin rose up to 3%, while Solana, Tron, Dogecoin, Cardano, Sui, and Shiba Inu slipped up to 2%.

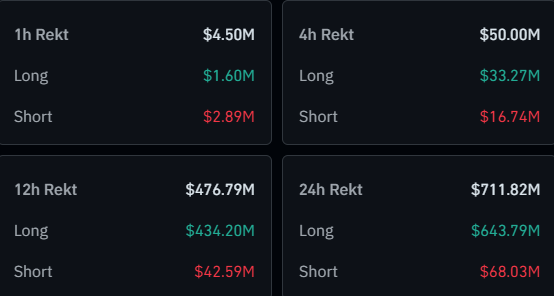

Bitcoin’s market capitalization climbed to $1.701 trillion, with its dominance increasing to 62.9%. Daily trading volume fell 3.3% to $29.37 billion. Stablecoin activity accounted for 93% of overall crypto trading volume, reaching $73 billion, according to .

Also Read: Bitcoin was born out of the 2008 financial crisis, will die in the 2025 crisis, says Peter Schiff

Technical View by Sathvik Vishwanath, Co-Founder & CEO, Unocoin

The market remains cautiously bullish. Bitcoin’s RSI is near 63, and prices are holding above the 50-day and 200-day moving averages—classic bullish indicators. Whales continue to accumulate during dips, while retail traders remain hesitant amid broader macro concerns.

“The Fear & Greed Index at 31 still indicates fear, often a contrarian signal for opportunity,” Vishwanath said. “A breakout above $85,500 could push Bitcoin toward the $90,000 mark. Holding above $84,000 in the short term is crucial as institutional interest and the upcoming halving continue to support the market.”

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)