Synopsis

Bitcoin is stable above $105,000, while Ethereum jumps 5% amid positive altcoin sentiment. Market capitalization increases to $3.31 trillion, with institutional interest remaining strong through strategic purchases. Analysts suggest potential Bitcoin reversal points, influenced by upcoming U.S. macroeconomic data, as both Bitcoin and Ethereum consolidate on daily charts.

Bitcoin held steady above the $105,000 mark on Tuesday, trading at $105,452 as of 11:27 AM IST, up 0.6% over the past 24 hours. Ethereum outperformed with a 5% jump to $2,616, as positive sentiment extended across altcoins including Solana, XRP, Dogecoin, and Cardano, which rose between 1.5% and 3%.

The global cryptocurrency market capitalization rose by 1.2% to $3.31 trillion, according to , with Bitcoin’s dominance remaining unchanged at 63.2%.

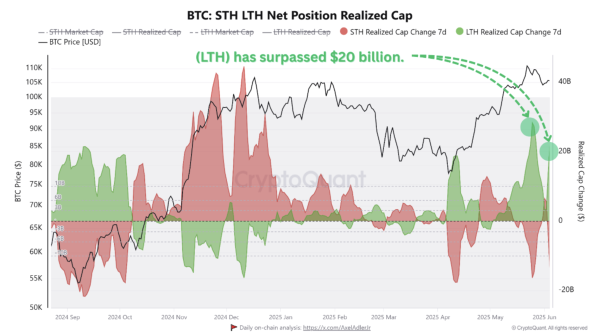

“Bitcoin is holding strong at $105K, with some analysts suggesting it might be nearing a potential reversal point,” said Shivam Thakral, CEO of BuyUcoin. “The Realized HODL Ratio has recently dropped, indicating that the price may not have hit its cyclical peak yet.” He added that key U.S. macroeconomic indicators due this week — including April’s JOLTS report, the ADP employment report, and the Non-Farm Payrolls — will influence investor sentiment across risk assets.

Crypto Tracker![]() TOP COIN SETSBTC 50 :: ETH 50-3.55% BuySmart Contract Tracker-4.76% BuyWeb3 Tracker-6.06% BuyDeFi Tracker-9.53% BuyNFT & Metaverse Tracker-11.10% BuyTOP COINS (₹) Ethereum223,552 (4.45%)BuyBNB56,990 (1.2%)BuyXRP188 (1.14%)BuyBitcoin9,006,865 (0.11%)BuyTether86 (0.07%)Buy“Bitcoin continues to trade within a narrow band of $103,500–$106,500,” noted Edul Patel, CEO and co-founder of Mudrex. “This comes amid mixed global cues, such as rising tensions in the Russia-Ukraine conflict and easing trade concerns between the U.S. and China.”

TOP COIN SETSBTC 50 :: ETH 50-3.55% BuySmart Contract Tracker-4.76% BuyWeb3 Tracker-6.06% BuyDeFi Tracker-9.53% BuyNFT & Metaverse Tracker-11.10% BuyTOP COINS (₹) Ethereum223,552 (4.45%)BuyBNB56,990 (1.2%)BuyXRP188 (1.14%)BuyBitcoin9,006,865 (0.11%)BuyTether86 (0.07%)Buy“Bitcoin continues to trade within a narrow band of $103,500–$106,500,” noted Edul Patel, CEO and co-founder of Mudrex. “This comes amid mixed global cues, such as rising tensions in the Russia-Ukraine conflict and easing trade concerns between the U.S. and China.”

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Institutional interest remains robust, Patel said, citing recent purchases by firms like Strategy and Metaplanet, which acquired 705 and 1,088 BTC respectively. Ethereum, meanwhile, has seen its supply on centralized exchanges fall to a seven-year low — a signal of reduced selling pressure and potential for further upside toward the $3,000 level.

Live Events

Vikram Subburaj, CEO of Giottus, said that while Bitcoin briefly dipped below $104,000 before rebounding, the broader market posture remains “neutral to constructive.”

“There’s evidence of accumulation — more than $500 million in combined BTC and ETH outflows from exchanges last week — pointing to investor confidence,” Subburaj said. He added that altcoins have quietly rallied, with Ethereum and Hyperliquid gaining 4–6%, and XRP climbing 2% after VivoPower’s announcement to acquire $121 million worth of XRP.

Technical Outlook

Riya Sehgal, Research Analyst at Delta Exchange, said both Bitcoin and Ethereum are consolidating on their daily charts. Bitcoin faces resistance at $106,417 and support at $103,124, with a potential breakout paving the way toward $108,500–$110,000. A breakdown, however, could trigger a correction to $100,000.

Ethereum, meanwhile, trades between $2,478 support and $2,651 resistance. A move above the resistance zone could open the door to $2,750–$2,800, while a drop below may lead to a decline toward $2,350.

On the institutional side, crypto investment products saw $286 million in net inflows last week, largely driven by Ethereum, which attracted $321 million. Bitcoin saw modest outflows of $8 million. Despite retail selling, institutions have added over 417,000 BTC year-to-date in 2025, with BlackRock recently purchasing 19,070 ETH worth $48.4 million.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)