Synopsis

Cryptocurrencies saw notable declines, with Bitcoin dropping by 2.3% and Ethereum falling by 2.8%, ahead of key U.S. economic data. Anticipated policy moves and labor data revisions could influence market directions. Experts suggested potential rallies for Bitcoin if jobless claims decrease, while other major cryptocurrencies like BNB and Solana also faced downturns.

Major cryptocurrencies experienced declines on Wednesday, ahead of key U.S. economic data and speeches from policymakers that are expected to advocate for interest rate cuts.

As of 12:15 pm IST, Bitcoin was down 2.3%, trading at $59,656, while Ethereum fell 2.8% to $2,602. The global cryptocurrency market cap also dropped by 1.9%, settling at around $2.11 trillion over the last 24 hours.

Later on Wednesday, preliminary revisions to U.S. labor data are expected, with a significant downward adjustment anticipated, potentially supporting the case for cutting interest rates. Federal Reserve minutes are also expected to reinforce a dovish stance.

Crypto Tracker![]() TOP COIN SETSDeFi Tracker4.41% BuySmart Contract Tracker2.21% BuyWeb3 Tracker1.34% BuyAI Tracker1.10% BuyCrypto Blue Chip – 51.09% BuyTOP COINS (₹) Tether84 (0.17%)BuyBNB47,144 (-1.03%)BuyBitcoin5,008,465 (-1.91%)BuySolana12,039 (-2.3%)BuyEthereum218,428 (-2.51%)Buy”Bitcoin had another unsuccessful attempt at breaching the $60,700 critical resistance and is now consolidating below $60,000. The market remains cautious ahead of the U.S. jobless claims data release tomorrow. There’s a strong chance that Bitcoin could rally toward $61,000 if the data indicates a drop in claims,” said Vikram Subburaj, CEO of Giottus.

TOP COIN SETSDeFi Tracker4.41% BuySmart Contract Tracker2.21% BuyWeb3 Tracker1.34% BuyAI Tracker1.10% BuyCrypto Blue Chip – 51.09% BuyTOP COINS (₹) Tether84 (0.17%)BuyBNB47,144 (-1.03%)BuyBitcoin5,008,465 (-1.91%)BuySolana12,039 (-2.3%)BuyEthereum218,428 (-2.51%)Buy”Bitcoin had another unsuccessful attempt at breaching the $60,700 critical resistance and is now consolidating below $60,000. The market remains cautious ahead of the U.S. jobless claims data release tomorrow. There’s a strong chance that Bitcoin could rally toward $61,000 if the data indicates a drop in claims,” said Vikram Subburaj, CEO of Giottus.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Edul Patel, CEO of Mudrex, commented, “Bitcoin is trading at $59,000 due to a lack of momentum for significant upward movements, largely influenced by stronger confidence in the global economy, ongoing geopolitical tensions, and a downturn in spot Bitcoin ETFs. BTC has yet to gather enough strength for a sharp move. The support level now lies at $58,100, with resistance at $60,600.”

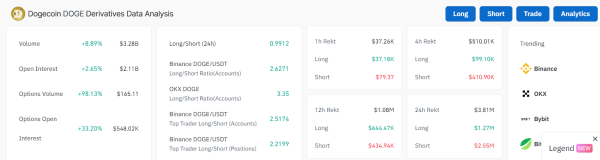

Other popular cryptocurrencies like BNB (-1.7%), Solana (-2.5%), XRP (-2.2%), Dogecoin (-0.7%), Chainlink (-0.7%), and Litecoin (-4.5%) also saw declines.

The volume of all stablecoins is currently $57.09 billion, making up 93.18% of the total crypto market’s 24-hour volume, according to .

Over the past 24 hours, the market cap of Bitcoin, the world’s largest cryptocurrency, dropped to $1.176 trillion, with Bitcoin’s dominance standing at 55.81%, per . BTC’s 24-hour trading volume decreased by 7.2% to $26.9 billion.

“Bitcoin is currently trading at $59,600. Breaking the $60,000 level could push BTC toward $61,000; however, if it fails, it might drop lower towards the $54,000 range in the short term,” said Sathvik Vishwanath, Co-Founder & CEO of Unocoin.

(Disclaimer: The views expressed by experts are their own and do not necessarily reflect those of The Economic Times.)