Synopsis

In the last 24 hours, Bitcoin’s market cap fell to $1.907 trillion, with its dominance now at 59.91%. BTC’s trading volume during this period rose by 20% to $18.19 billion. Meanwhile, stablecoins made up $58.31 billion of this volume, or 91.06%, according to .

Major cryptocurrencies traded lower on Monday, February 17, with blue-chip tokens, including Bitcoin, Ethereum, XRP, Solana, and Dogecoin, declining by up to 6%.

As of 11:12 am IST, Bitcoin fell 1.5% to $96,122, while Ethereum dropped 2% to $2,656. The global cryptocurrency market cap declined 1.67% to $3.18 trillion in the past 24 hours.

“Bitcoin is holding steady near $96,000 as the market awaits a decisive catalyst. While positive factors like U.S. 10-year yields below 4.5% and the National Bank of Canada’s $2 million investment in Bitcoin ETFs boost market sentiment, the price impact is yet to be seen,” said Alankar Saxena, Co-founder and CTO of Mudrex.

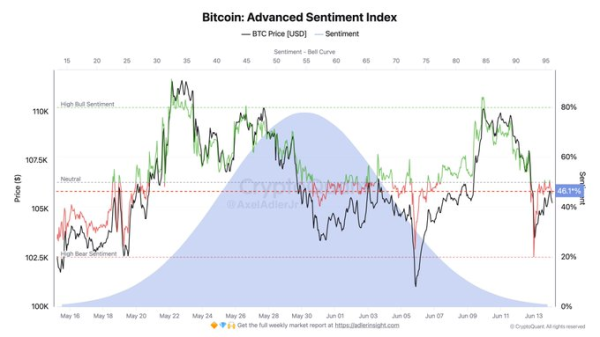

Crypto Tracker![]() TOP COIN SETSDeFi Tracker6.90% BuyWeb3 Tracker2.72% BuyNFT & Metaverse Tracker0.36% BuyBTC 50 :: ETH 50-0.50% BuyAI Tracker-3.87% BuyTOP COINS (₹) BNB58,427 (2.58%)BuyTether87 (0.1%)BuyEthereum233,023 (-0.74%)BuyBitcoin8,361,945 (-1.0%)BuyXRP232 (-3.7%)Buy”BTC’s RSI remains near the neutral 50 level, indicating a balance between bulls and bears. A breakout in either direction will determine the next trend, with resistance at $98,000 and support at $95,000,” Saxena added.

TOP COIN SETSDeFi Tracker6.90% BuyWeb3 Tracker2.72% BuyNFT & Metaverse Tracker0.36% BuyBTC 50 :: ETH 50-0.50% BuyAI Tracker-3.87% BuyTOP COINS (₹) BNB58,427 (2.58%)BuyTether87 (0.1%)BuyEthereum233,023 (-0.74%)BuyBitcoin8,361,945 (-1.0%)BuyXRP232 (-3.7%)Buy”BTC’s RSI remains near the neutral 50 level, indicating a balance between bulls and bears. A breakout in either direction will determine the next trend, with resistance at $98,000 and support at $95,000,” Saxena added.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »Vikram Subburaj, CEO of Giottus, noted, “Bitcoin continues to consolidate above $96,000. If it fails to hold, it may test support at $94,000. The Crypto Fear & Greed Index, at 51, signals overall market indecision.”![]()

Also Read: Rich Dad Poor Dad author Robert Kiyosaki hails Trump as ‘The First Bitcoin President’

Other major altcoins also declined, with XRP falling 4.3%, Solana down 6.3%, Dogecoin losing 3.8%, and Litecoin dropping 7.9%. Chainlink, Stellar, Avalanche, Sui, Tron, and Shiba Inu also traded lower, registering losses between 1.6% and 4.4%.

In the last 24 hours, Bitcoin’s market cap dropped to $1.907 trillion. Bitcoin’s dominance now stands at 59.91%. BTC volume in the same period rose 20% to $18.19 billion. Meanwhile, stablecoins accounted for $58.31 billion of this volume, or 91.06%, according to .

Also Read: US crypto policies under Trump: A new era for global innovation

Tech view by Sathvik Vishwanath, Co-Founder & CEO, Unocoin

Bitcoin remains steady between $96,000 and $97,000, reflecting low volatility amid a narrow trading range. Following its $109,356 peak, BTC consolidates between $96,000 and $98,000, with support at $89,000–$91,000 and resistance near $100,000.

Short-term indicators signal bearish pressure, with weak rebounds from $96,686 and resistance at $97,900–$98,000. While long-term EMAs suggest strength, declining momentum and MACD favor bears.

A breakout above $100,000 could revive bullish sentiment, targeting $102,000+, while failure to hold $96,500 may trigger declines toward $91,000. Market indecision persists as traders anticipate the next major move amid weakening selling pressure and cautious accumulation.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)