Synopsis

Bitcoin held steady near $107,400 on Friday ahead of a $40 billion options expiry event, sparking caution in the crypto market. Ethereum and major altcoins declined, while analysts flagged potential short-term volatility. Despite near-term pressure, institutional buying and ETF inflows continue to support a bullish long-term outlook.

Bitcoin traded slightly lower on Friday, hovering near the $107,400 level ahead of a massive options expiry event that could inject fresh volatility into the market. As of 11:50 am IST, the world’s largest cryptocurrency was down 0.2% at $107,418, after hitting an intraday low of $106,519.

Ethereum, the second-largest digital asset, slipped 1.4% to $2,437, contributing to a broader decline in crypto markets. According to data, the total cryptocurrency market capitalisation dropped 0.7% to $3.28 trillion.

Several altcoins also witnessed a pullback. XRP led the losses among majors, falling 4%, while BNB, Solana, Tron, Dogecoin, Cardano, Hyperliquid, Sui, Chainlink, and Stellar declined up to 3%.

Crypto Tracker![]() TOP COIN SETSCrypto Blue Chip – 52.35% BuyNFT & Metaverse Tracker-0.08% BuyDeFi Tracker-0.30% BuyAI Tracker-1.00% BuyWeb3 Tracker-2.97% BuyTOP COINS (₹) BNB55,215 (-0.58%)BuyBitcoin9,185,222 (-0.62%)BuyEthereum209,239 (-1.7%)BuySolana12,052 (-2.97%)BuyXRP179 (-4.68%)BuyVikram Subburaj, CEO of Giottus, said Bitcoin is holding below $108,000 with a retest of key support levels in play. “Order book data shows concentrated sell pressure above current levels, while fresh bid liquidity near $105,700—around the 50-day moving average—is emerging as a potential buying zone. With whales adding exposure and long liquidations clustered near $107,000, short-term volatility may persist, but the underlying structure still favours accumulation over distribution,” he said.

TOP COIN SETSCrypto Blue Chip – 52.35% BuyNFT & Metaverse Tracker-0.08% BuyDeFi Tracker-0.30% BuyAI Tracker-1.00% BuyWeb3 Tracker-2.97% BuyTOP COINS (₹) BNB55,215 (-0.58%)BuyBitcoin9,185,222 (-0.62%)BuyEthereum209,239 (-1.7%)BuySolana12,052 (-2.97%)BuyXRP179 (-4.68%)BuyVikram Subburaj, CEO of Giottus, said Bitcoin is holding below $108,000 with a retest of key support levels in play. “Order book data shows concentrated sell pressure above current levels, while fresh bid liquidity near $105,700—around the 50-day moving average—is emerging as a potential buying zone. With whales adding exposure and long liquidations clustered near $107,000, short-term volatility may persist, but the underlying structure still favours accumulation over distribution,” he said.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details » Subburaj also noted that the $40 billion options expiry scheduled for Friday could bring sharp price moves. Nearly 40% of the contracts are set to expire, with a max pain point at $102,000, raising the risk of a downside drift if bulls fail to defend $105,000.

Live Events

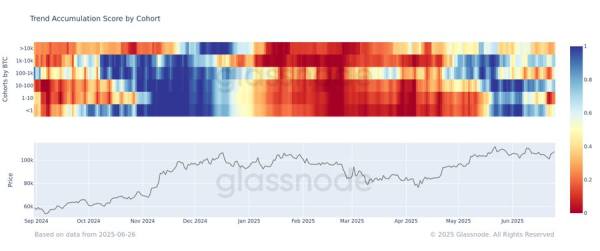

The CoinSwitch Markets Desk highlighted diverging investor behaviour in on-chain data. “Retail investors holding less than 1 BTC have trimmed their holdings by 54,500 BTC over the past year, averaging outflows of 220 BTC per day. In contrast, large holders with 1,000 BTC or more have accumulated 507,700 BTC, with average daily inflows of 1,460 BTC—signalling strong institutional confidence,” the desk noted.

They added that Ethereum continues to show weakness, slipping 2.5% to around $2,400.

Himanshu Maradiya, Founder & Chairman of CIFDAQ, pointed to macro and ETF-related drivers behind Bitcoin’s resilience. “Bitcoin has soared past $107,000 amid weakening dollar strength (DXY at 97.11) and record ETF inflows—$340 million to BlackRock’s IBIT alone on June 25. With 72% of the BTC supply now illiquid, the stage is set for a supply shock rally,” he said.

Maradiya also flagged Japan’s Metaplanet surpassing Tesla as the fifth-largest corporate BTC holder with 12,345 BTC, mirroring MicroStrategy’s strategy in Asia-Pacific. “Hong Kong is pushing forward with tokenised real-world asset regulations starting August 1, which could lead the next wave of innovation from the East,” he added.

Sathvik Vishwanath, Co-Founder & CEO of Unocoin, said Bitcoin continues to trade with a bullish undertone despite volatility. “Support lies strong at $100K, while resistance is seen near $108K. If BTC holds above $100K, it could test $112K soon. ETF flows and institutional interest remain key drivers. The Fear & Greed Index currently shows ‘Greed,’ indicating strong sentiment but also potential for pullback,” he said.

Vishwanath sees short-term targets in the $104K–$108K range, while long-term projections remain optimistic, with year-end estimates ranging from $150K to $200K.

On the regulatory front, a U.S. district court denied a joint request from the SEC and Ripple seeking an indicative ruling to reduce a $125 million civil penalty. Meanwhile, asset manager Invesco filed to launch a spot Solana ETF, becoming the ninth player to do so.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times)

Source