Synopsis

Bitcoin’s 3% drop to $58,271 comes amid investor uncertainty following the Trump assassination attempt, leading to over $116M in liquidations. All eyes now turn to the Fed’s interest rate decision, with markets split between a 25 and 50 bps rate cut, Avinash Shekhar, Co-Founder & CEO at Pi42 said.

Bitcoin prices (BTC) fell over 2% on Monday and were trading at $58,826.93 around 1 pm IST ahead of the Federal Reserve’s rate-setting committee meeting which begins on Tuesday. Major altcoins Ethereum (ETH), Tether, BNB, Solana, XRP, Dogecoin, Toncoin, Cardano, Avalanche, and Shiba Inu were trading with up to 5% losses around this time.

Among gainers was Tron which was trading up by over 1% meanwhile.

Source:

Crypto Tracker![]() TOP COIN SETSAI Tracker3.61% BuyCrypto Blue Chip – 51.88% BuyDeFi Tracker0.45% BuyNFT & Metaverse Tracker-0.33% BuySmart Contract Tracker-0.51% BuyTOP COINS (₹) Tether84 (0.04%)BuyBNB46,092 (-0.84%)BuyBitcoin4,947,420 (-1.86%)BuySolana11,059 (-3.63%)BuyEthereum194,427 (-4.09%)Buy

TOP COIN SETSAI Tracker3.61% BuyCrypto Blue Chip – 51.88% BuyDeFi Tracker0.45% BuyNFT & Metaverse Tracker-0.33% BuySmart Contract Tracker-0.51% BuyTOP COINS (₹) Tether84 (0.04%)BuyBNB46,092 (-0.84%)BuyBitcoin4,947,420 (-1.86%)BuySolana11,059 (-3.63%)BuyEthereum194,427 (-4.09%)Buy

BTC has been on a gaining spree for over a week, rising by more than 7%.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »![]()

Bitcoin’s 3% drop to $58,271 comes amid investor uncertainty following the Trump assassination attempt, leading to over $116M in liquidations. All eyes now turn to the Fed’s interest rate decision, with markets split between a 25 and 50 bps rate cut, Avinash Shekhar, Co-Founder & CEO at Pi42 said.

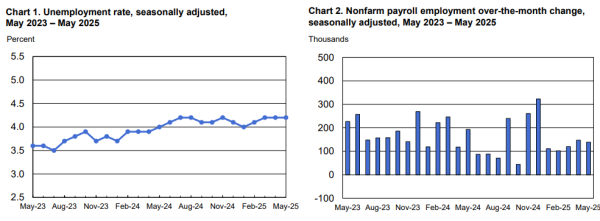

The US Federal Reserve’s two-day Federal Open Market Committee (FOMC) meeting will begin on Tuesday and the outcome will be announced on Wednesday. It is widely believed that the largest Central Bank could cut interest rates by 25 bps.

The rate cut is expected to be a positive development for cryptos.

Bitcoin experienced steady growth over the past week recovering from a low of $54,000 to currently trading at $58,000, Edul Patel, CEO & Co-founder of Mudrex said. “The week began with the Federal Bureau of Investigation (FBI) releasing a comprehensive report on global crypto scams in 2023, revealing staggering losses. The US topped the list, with over $4.8 billion lost to crypto scams, followed by Canada and the UK,” Patel said.

The Mudrex Co-founder highlighted India’s ranking at fifth position with reported losses exceeding $44 million. His advice to investors is to do thorough research before investing to avoid falling prey to such scams. Avoid too-good-to-be-true offers and only use trusted platforms for investing, he opined.

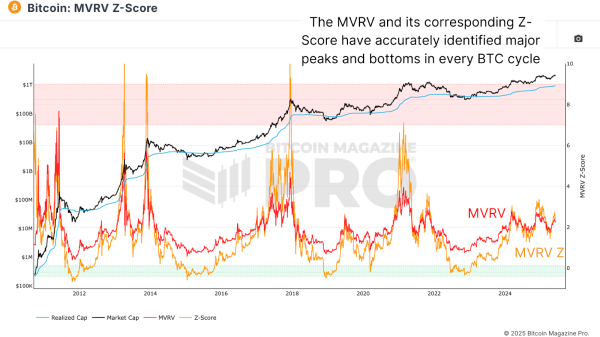

Lately, momentum has been developing in the cryptocurrency market because analysts argue we may be approaching the bottom of the prolonged bearish phase, a PTI report said. This possible recovery means that there is great potential for altcoins to push further toward an eventual market recovery.

With these predictions, both Ethereum (ETH) competitors Solana (SOL) and Rexas Finance (RXS) can capitalize. Both assets could make some serious runs in the way of growth, taking advantage of the expected conditions prevailing in the market and growing interest in the assets in the upcoming months, the report said.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)