Crypto market wipes out $100 billion over the weekend

![]() Cryptocurrency Mar 31, 2025 Share

Cryptocurrency Mar 31, 2025 Share

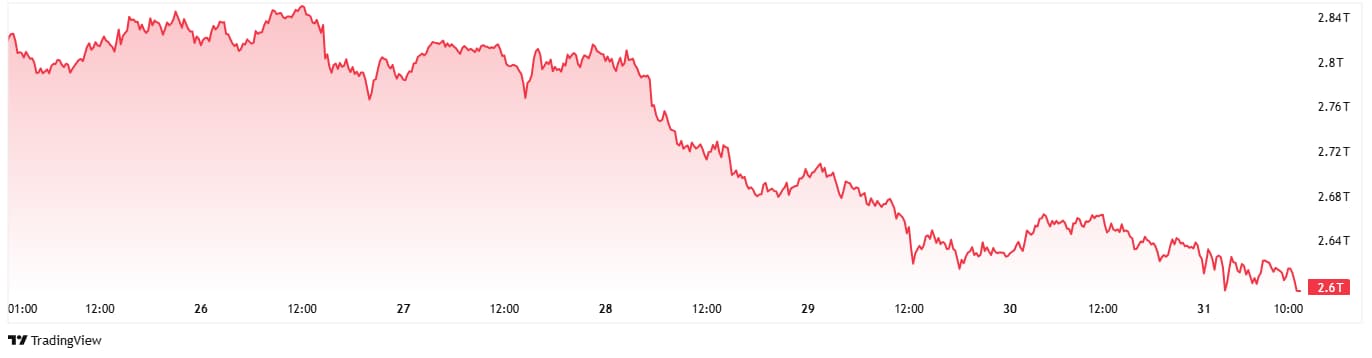

After hitting its monthly lows on March 11, the cryptocurrency market entered an accelerating uptrend, which, within approximately two weeks, ensured its market capitalization grew more than $350 billion from about $2.48 trillion to roughly $2.85 trillion.

On Wednesday, March 26, the upswing abruptly ended, and trading between Thursday and Friday proved particularly damaging. Digital assets erased more than $100 billion within a single day. Furthermore, weekend movements quashed any hopes of a swift positive correction.

Indeed, between Friday and Monday, the total cryptocurrency market capitalization plunged another $110 billion, with the 24 hours leading to the morning of March 31 alone erasing nearly $38 billion.

Picks for you

Whales dump over 1 billion XRP ahead of Ripple unlock 2 hours ago Anxiety grips Dogecoin holders as major sentiment flips into bear territory 18 hours ago XRP’s 5-year pattern builds path to $6.50 20 hours ago Bear market is within 'striking distance' in a few weeks, warns strategist 22 hours ago  Total cryptocurrency market cap one-week price chart. Source: TradingView

Total cryptocurrency market cap one-week price chart. Source: TradingView

The relative shock of the turn – and the sentiment driving the preceding climb – can be gauged based on the community ‘ideas’ Finbold retrieved from TradingView on March 31.

Crypto community weighs in on the market crash

Specifically, most recent cryptocurrency market cap chart analyses paint a bullish picture, though there have been several bears as well.

VictoriaCobra, a popular analyst on the platform, posted a rather grim estimate that ‘the good crypto narrative is over.’ The community expert pointed to a set of factors backing the idea that the current cycle is out of opportunities for a true breakout.

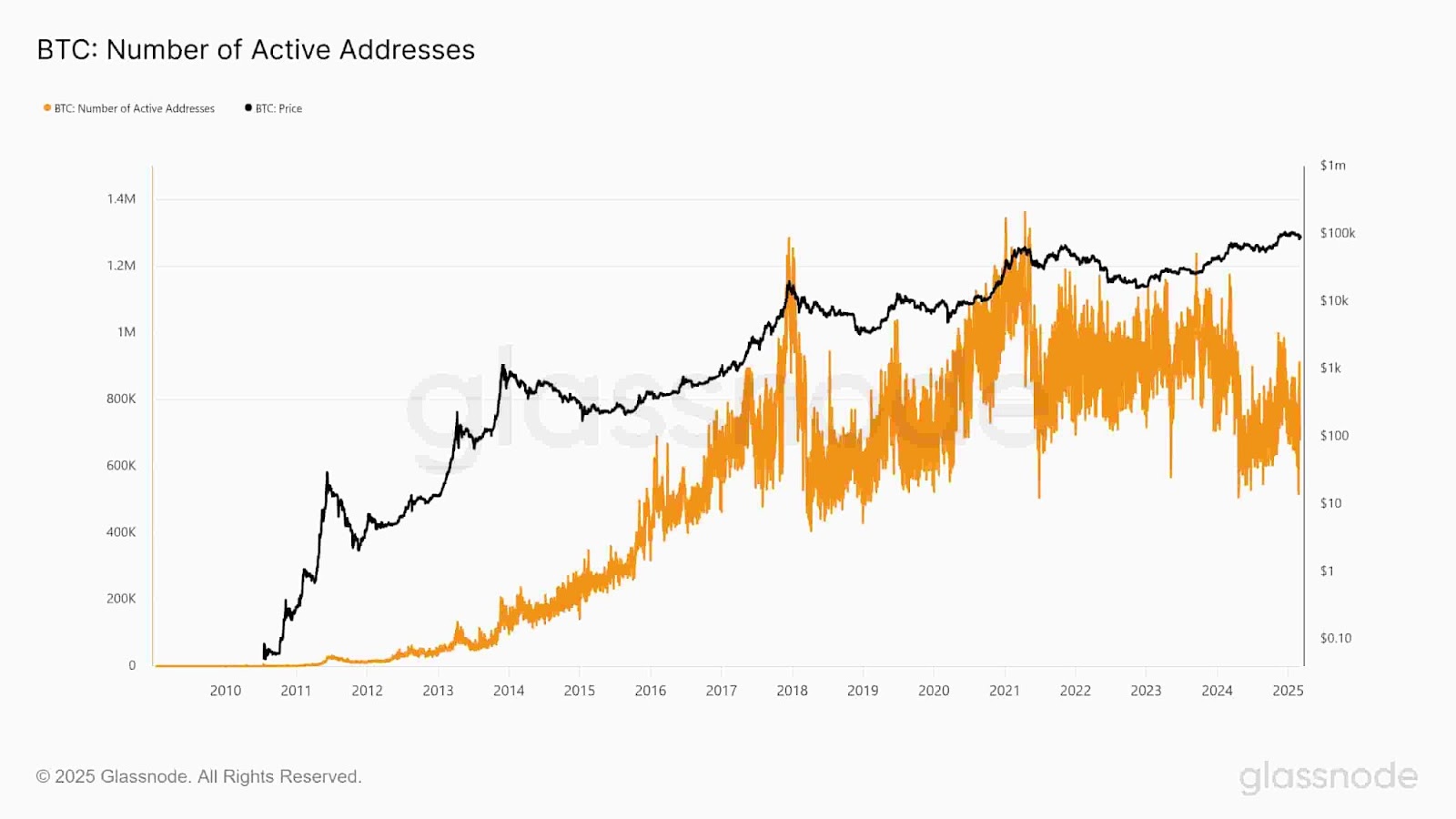

For example, they pointed out that total market capitalization is near the 2021 highs despite the 2024 bull market, while the number of active Bitcoin (BTC) addresses is close to the levels seen in 2017.

BTC price and active address chart. Source: Glassnode

BTC price and active address chart. Source: Glassnode

Furthermore, the discrepancy between gold’s and BTC’s performance was highlighted as doing much to undermine the ‘store of value’ argument, while President Donald Trump and Elon Musk’s actions have eroded digital assets’ credibility.

Lastly, the analyst concluded that despite the activity and the rise in valuation, cryptocurrencies lack a true footprint outside their own ecosystem.

Simultaneously, other prolific community experts have been bullish. CryptoNikkoid opined that a ‘storm’ is coming and that it would lead to a strong bull run while pointing out the relative strength index (RSI) of digital assets – painting them as oversold – and of the S&P 500 – positioning the index as overbought.

The analyst simultaneously pointed out that the dollar index (DXY) has been weakening along with the stocks.

Ultimately, the Trading View expert revealed that between the equity outflows and the situation with the DXY, a significant amount of cash has been freed up for the cryptocurrency market. They identified June at the latest as the time the bull market will restart and opined major digital assets, Bitcoin most notably, could double in value.

Is the crypto market more bullish or bearish in 2025?

Though the possibility of a renewed bull cycle almost always exists, recent trends appear to back the bear cases more strongly.

Cryptocurrencies have generally followed the stock market, with even the latest downturn coming mere days after new and adverse data center bubble and tariff news shook the more traditional assets.

Furthermore, while many would agree that the S&P 500 turned far more overbought than cryptocurrencies during 2024, money has been steadily flowing out from corporate equity and, unfortunately for blockchain optimists, appears to be fueling ‘legacy’ safe havens like gold far more than other risk assets.

Featured image via Shutterstock