Synopsis

The crypto market is experiencing a bullish surge, with Bitcoin nearing $100,000 after surpassing Google’s market cap briefly. Altcoins like Ethereum and Solana are also showing strength. This rally is fueled by a weakening US economy, increased institutional buying, and positive on-chain metrics.

The crypto market has moved into bullish territory over the past two weeks, gaining about $300 billion in market cap. Bitcoin briefly became the fifth most-valuable of all financial assets this week, surpassing Google’s market cap for the first time. Currently trading above the $96,500 mark, BTC is just 3.7% away from reclaiming the $100,000 milestone, while other major altcoins like Ethereum and Solana are also showing strength, holding above the resistance of $1,800 and $150, respectively, driven by sustained buying interest.

Additionally, the macroeconomic factors have also created a favourable environment for crypto, helping in this rally. With the market starting a new month on an optimistic note, let’s take a look at what drove the upward momentum in the asset class and what investors could do going forward.

Changing Economic Outlook

Over the past week, multiple economic factors have led investors towards the crypto markets. Firstly, the US GDP (Gross Domestic Product) for the last quarter had seen a 0.3% contraction, pointing towards an increased risk of stagflation. Additionally, factors like weakening US consumer confidence index and lower-than-expected job openings for March increased the fears of a recession soon.

Crypto Tracker![]() TOP COIN SETSBTC 50 :: ETH 501.26% BuyCrypto Blue Chip – 50.80% BuySmart Contract Tracker-0.06% BuyAI Tracker-2.10% BuyWeb3 Tracker-2.55% BuyTOP COINS (₹) BNB50,786 (0.92%)BuyEthereum155,419 (0.81%)BuyTether85 (0.81%)BuyXRP188 (0.65%)BuyBitcoin8,174,964 (0.56%)Buy

TOP COIN SETSBTC 50 :: ETH 501.26% BuyCrypto Blue Chip – 50.80% BuySmart Contract Tracker-0.06% BuyAI Tracker-2.10% BuyWeb3 Tracker-2.55% BuyTOP COINS (₹) BNB50,786 (0.92%)BuyEthereum155,419 (0.81%)BuyTether85 (0.81%)BuyXRP188 (0.65%)BuyBitcoin8,174,964 (0.56%)Buy

Meanwhile, the odds of a Fed rate cut at the June Federal Open Market Committee(FOMC) meeting have risen from 57% to 60% in just a week, further fueling investor optimism. With lower interest rates, investors would have comparatively more money in hand, which often boosts interest in risk-on assets like crypto.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Live Events

The April non-farm jobs report, which is due later today, may reflect the broader economic pause triggered by inflation and protectionist trade measures. Weak job numbers could lead to some short-term volatility across risk assets, influencing the marketing sentiment for the next few weeks.

Increased Institutional Buying

In the last two weeks alone, institutional investors have been aggressively increasing their exposure to crypto. Bitcoin spot Exchange Traded Funds(ETFs) saw net positive inflows of over $4.2 billion, largely helping in the upward momentum. Additionally, Ethereum ETFs have also seen close to $250 million in inflows, ending the streak of outflows during early April. Meanwhile, Solana’s futures open interest climbed to 40.5 million SOL this week, marking a 5% increase from the previous month and nearing its all-time high, pointing towards growing institutional interest in SOL as well.

On the other hand, Bitcoin Whales have accumulated over 43,100 $BTC in the past two weeks, worth nearly $4 billion. With such huge inflows, Bitcoin’s weekly volatility hit a 563-day low on April 30, according to a report by K33 Research. This shows the growing maturity of Bitcoin as a global financial asset.

Improving On-chain Metrics

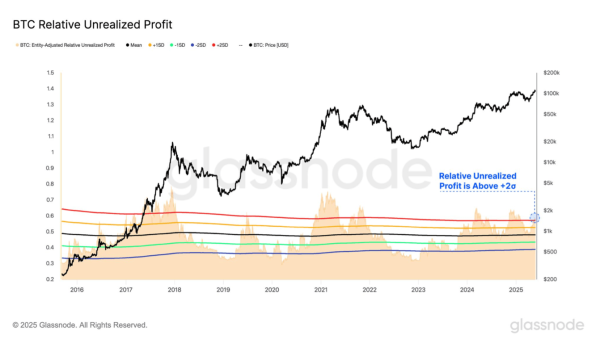

According to on-chain data, around 86.9% of all Bitcoin in circulation was in profit by the end of April. Historically, when this metric rises into the 85–90% range, it often reflects a shift in market sentiment, from healthy optimism to a more euphoric phase. This zone tends to coincide with strong price rallies and heightened bullish momentum. Supporting this trend, data from Glassnode reveals that both first-time buyers and Momentum Buyers (those entering during recent uptrends) are actively accumulating Bitcoin.

Furthermore, Profit Takers are remaining relatively quiet indicating that fresh demand is flowing in without significant selling pressure. This suggests that bulls are currently in control. If this dynamic continues, it could make way for a sustained rally in the days ahead.

Way Forward

There has been a significant change in the momentum of the market and the sentiment of the investors over the past few weeks. This change has positioned the crypto market back in a bullish trend. With most factors like geopolitical tensions, trade escalations that caused a market downturn, easing, we are likely to see healthy momentum taking assets like Bitcoin to new highs in the coming months. However, investors must continuously monitor the situation. As we re-enter the bull market, the risks of rug-pulls and volatility could increase. It is advisable to keep a long-term purview and to do your own research before investing.

Top 3 crypto gainers during the week:

- Virtuals Protocol is up 98.02%

- Monero is up 21.8%

- Bonk is up 13.94%

Top 3 crypto losers during the week:

- Ethena is down 16.8%

- Ondo is down 11.15%

- Celestia is down 10.1%

(The author is Co-founder and Chief Product Officer of Mudrex, a global crypto investing platform. )

Source