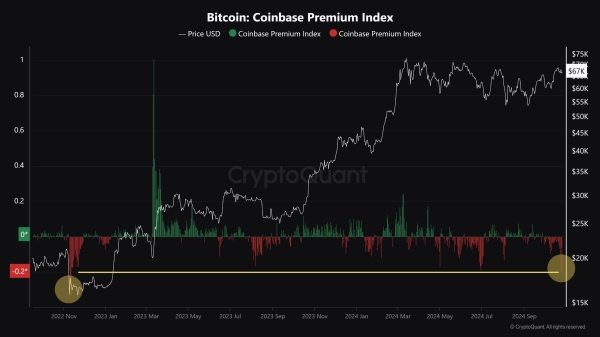

The price differential between Bitcoin on Coinbase and other exchanges is measured by the Coinbase Premium Index, which recently fell to -0.2%, its lowest level in two years. The institutional interest that passes through Coinbase is measured by the premium indicator. For now, the indicator’s value suggests that the U.S. based trading platforms such as Coinbase might be in decline.

It’s common to assume that U.S. buyers, compared to buyers from other areas, are selling more frequently, which might be a sign of lower institutional demand in the United States. In the past a positive Coinbase Premium indicated a significant institutional buying power, which typically raises the price of Bitcoin. On the other hand, if the trend persists, a negative premium may indicate impending price volatility or even a downturn.

This low premium may indicate a halt in the upward momentum of Bitcoin, which has experienced a resurgence in recent months, particularly if significant institutional interest in the asset doesn’t resurface. After emerging from the previous downtrend channel $65,500 is a key support level for Bitcoin, which is currently trading close to critical levels.

If selling pressure keeps rising, a decline below this level could push Bitcoin down to test the $63,000 range, which is another important support level from recent trading activity. On the plus side, Bitcoin may aim for $72,000, which many analysts consider to be the next significant resistance level if buyers regain control and the Coinbase Premium turns positive.

A reversal in the premium index would indicate a resurgence of institutional confidence even though Bitcoin has demonstrated resilience around its current price levels. For the time being traders should monitor the $65,500 and $63,000 support levels because a breakdown there might portend more significant corrections.