Synopsis

Cantor Fitzgerald, Tether, and SoftBank are launching a $3.6 billion crypto venture, Twenty One Capital, to acquire bitcoin, anticipating increased interest under President Trump. Tether and Bitfinex will hold majority ownership, while SoftBank will have a minority stake. Twenty One aims to replicate Strategy’s success and will trade on the Nasdaq under the symbol “XXI”.

Cantor Fitzgerald is launching a crypto venture with Tether and Japanese technology investor SoftBank Group to buy bitcoin, wagering that interest in the digital currency will expand under U.S. President Donald Trump.

The deal, announced on Wednesday, has blank-check vehicle Cantor Equity Partners merging into newly formed Twenty One Capital.

The combined vehicle is valued at $3.6 billion, based on a bitcoin price of nearly $85,000 and Twenty One launching with more than 42,000 bitcoins, which will make it the world’s third-largest bitcoin treasury, Twenty One said.

Crypto Tracker![]() TOP COIN SETSAI Tracker19.50% BuyWeb3 Tracker16.71% BuyDeFi Tracker14.39% BuySmart Contract Tracker10.67% BuyCrypto Blue Chip – 59.05% BuyTOP COINS (₹) Ethereum153,807 (1.89%)BuySolana12,848 (1.85%)BuyBitcoin7,995,868 (1.0%)BuyXRP190 (0.95%)BuyBNB51,793 (-0.95%)Buy The venture deepens ties between the Wall Street brokerage – chaired by Brandon Lutnick, son of the former Cantor boss and current U.S. commerce secretary – and Tether, the company behind the world’s largest stablecoin.

TOP COIN SETSAI Tracker19.50% BuyWeb3 Tracker16.71% BuyDeFi Tracker14.39% BuySmart Contract Tracker10.67% BuyCrypto Blue Chip – 59.05% BuyTOP COINS (₹) Ethereum153,807 (1.89%)BuySolana12,848 (1.85%)BuyBitcoin7,995,868 (1.0%)BuyXRP190 (0.95%)BuyBNB51,793 (-0.95%)Buy The venture deepens ties between the Wall Street brokerage – chaired by Brandon Lutnick, son of the former Cantor boss and current U.S. commerce secretary – and Tether, the company behind the world’s largest stablecoin.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details » “We’re not here to beat the market, we’re here to build a new one. A public stock, built by Bitcoiners, for Bitcoiners,” said Twenty One Co-Founder and CEO Jack Mallers.

Live Events

The new business will seek to replicate the success of Michael Saylor’s bitcoin acquirer Strategy, whose market value surged late last year as crypto prices jumped following Trump’s presidential election victory. Trump has promised to support the crypto industry by easing regulations for digital assets.

Strategy, the biggest corporate holder of bitcoin, held 538,200 units of the world’s biggest cryptocurrency as of April 20, and has a market cap of around $91 billion.

Tether will contribute $1.6 billion worth of bitcoin to the venture, while Bitfinex, a crypto exchange linked to Tether, and SoftBank will put up $600 million and $900 million, respectively, according to an investor presentation.

The companies will raise $585 million in additional capital through a combination of convertible bonds and equity financing.

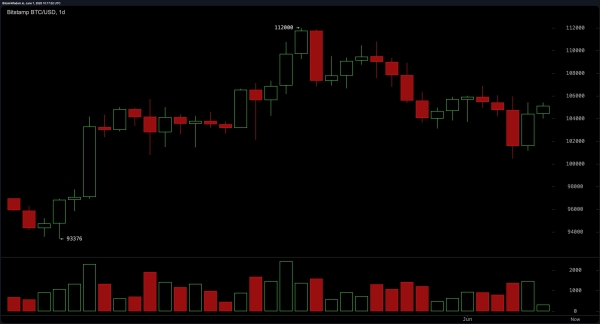

Some analysts have touted bitcoin, currently trading at $93,780, as a hedge against global economic risks. It has gained more than 40% in the past six months but fell this month along with stock markets and other asset prices when Trump sparked a global trade war.

Matt Mena, crypto research strategist at 21Shares, said macro and global conditions highlighted the need for a “digital, next-generation store of value”, and claimed bitcoin was stepping into that role.

However, gold has been among the biggest beneficiaries of a flight to safety during the trade war, with the precious metal’s price soaring to record highs while bitcoin’s price is down this year.

TETHER-CANTOR TIES

Twenty One will be majority owned by Tether and cryptocurrency exchange Bitfinex. SoftBank will have a minority ownership.

Tether and Cantor have long-standing ties from when Howard Lutnick was the brokerage’s boss.

Cantor holds much of the dollar-denominated reserves Tether says it has for every token it creates for its stablecoin.

Of the U.S. Treasury bills Tether holds, 99% are held with Cantor, Tether CEO Paolo Ardoino told last month.

Twenty One will trade on the Nasdaq under the symbol “XXI” after the deal closes.