Buy signal for two oversold cryptocurrencies amid Trump’s tariffs crash

![]() Cryptocurrency Feb 3, 2025 Share

Cryptocurrency Feb 3, 2025 Share

As risk-off sentiment takes hold, the cryptocurrency market has suffered one of its largest liquidation events in history, erasing over $2.24 billion in just 24 hours.

While panic selling has dominated, some analysts suggest that this sell-off could present a ‘buy-the-dip’ opportunity for investors looking to capitalize on the downturn.

“We are bracing for markets to go risk-off early this week, on the heels of the White House executive order of tariffs for Canada, Mexico, and China — but we would advise investors to buy this ‘fire, ready, aim’ panic,” – Tom Lee, Fundstrat head of research

Picks for you

Here's why Gold could 'go even higher' amid the tariff war and Fed stance 1 hour ago XRP enters death spiral as $25 billion wiped in a day 3 hours ago Crypto liquidations are 'lot more' than reported; Bybit CEO estimates up to $10B wipeout 4 hours ago $65M reportedly stolen from Coinbase users in past two months 4 hours ago

Against this backdrop, Finbold analyzed the Relative Strength Index (RSI) heatmap from CoinGlass on February 3 and identified two cryptocurrencies that have entered oversold territory, offering potential entry points for traders and investors.

Ethereum (ETH)

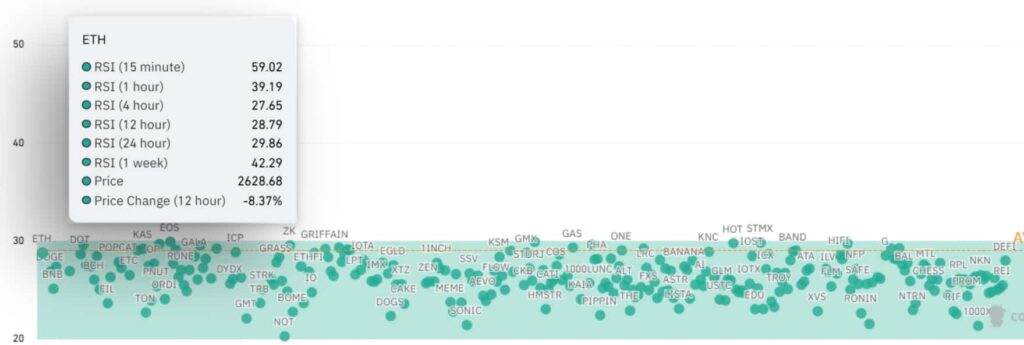

Ethereum (ETH) has entered the oversold territory, signaling a potential buying opportunity for traders and investors. With the broader market’s average RSI at 29.03, ETH’s 12-hour RSI of 28.79 and 24-hour RSI of 29.86 indicate its current oversold status.

Crypto Market RSI Heatmap: ETH. Source: CoinGlass

Crypto Market RSI Heatmap: ETH. Source: CoinGlass

Currently trading at $2,628.68, ETH has seen a sharp 8.37% drop over the past 12 hours. However, its weekly RSI of 42.29 suggests that the asset remains fundamentally strong over a longer time frame, hinting that the current dip may be a temporary correction rather than a prolonged decline.

Beyond technical indicators, institutional interest continues to support Ethereum’s recovery. Trump’s World Liberty Financial (WLFI) has been accumulating ETH for weeks, bringing its total holdings to 66.874K at press time.

Additionally, on-chain data shows that major whale investors accumulated 50,429 ETH valued at over $126 million in a single day.

With rising demand from institutional and large individual investors, ETH appears well-positioned for a potential rebound. The 15-minute RSI at 59.02 signals early buying interest, suggesting that ETH may be stabilizing after recent losses.

If buying pressure sustains and macroeconomic conditions remain favorable, the cryptocurrency could regain momentum in the coming weeks.

Dogecoin (DOGE)

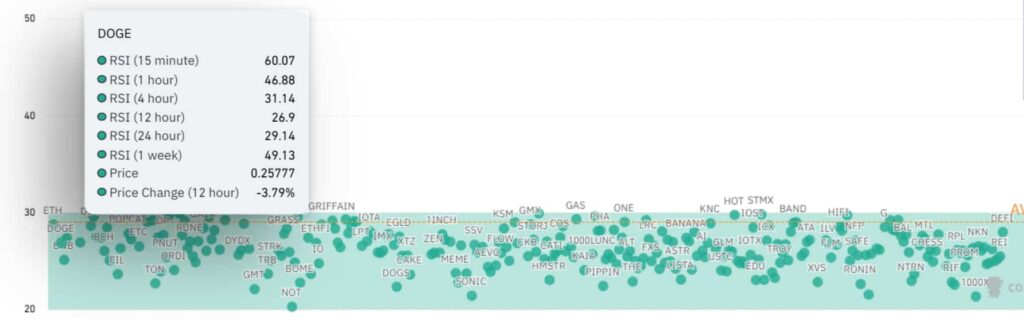

Dogecoin (DOGE) has slipped into oversold territory, setting the stage for a potential reversal. The meme cryptocurrency is currently trading at $0.25777, down 3.79% over the past 12 hours, with its 12-hour RSI at 26.9 and 24-hour RSI at 29.14 confirming heavy selling pressure, that has historically preceded rebounds.

Crypto Market RSI Heatmap: DOGE. Source: CoinGlass

Crypto Market RSI Heatmap: DOGE. Source: CoinGlass

Despite the downturn, DOGE’s weekly RSI at 49.13 suggests broader market stability, while its 15-minute RSI at 60.07 signals early accumulation, pointing to renewed buying interest.

Adding to the bullish outlook, analysts note that DOGE’s daily RSI has dropped below 30 for the first time since August 7, 2024, a key indicator of potential trend reversals.

Technical analysis now places the next upside target at $0.3800, just below the 0.786 Fibonacci retracement level, a critical resistance zone for potential breakouts.

That being said, both Ethereum and Dogecoin are flashing buy signals as they enter oversold territory, with technical indicators pointing to a potential rebound.

However, oversold conditions alone do not guarantee a recovery, if bearish sentiment persists and fundamentals weaken, both assets could see further declines.

Investors should watch for confirmation of a trend reversal before positioning for a sustained move higher.

Featured image via Shutterstock