Bullish analysis: Bitcoin will target $100,000 after August closes

![]() Cryptocurrency Aug 27, 2024 Share

Cryptocurrency Aug 27, 2024 Share

Despite Bitcoin (BTC) failing to break past the $65,000 mark, a trading expert has suggested that investors should anticipate a possible record high once August ends.

In a TradingView post on August 26, Trading Shot highlighted that, based on historical price movements, the end of August could be pivotal in pushing Bitcoin to reach the coveted $100,000 mark.

The expert noted that the flagship cryptocurrency has shown remarkable resilience by maintaining a critical support zone above the $50,000 mark for the past six months. This support level is significant as it coincides with the symmetrical pivot zone—a crucial area vital during the previous market cycle in late 2021.

Picks for you

Bitcoin draws ‘biggest cup and handle’ pattern that will ‘shock the world’ 7 hours ago Polyhedra integrates Flare with zkBridge to strengthen DeFi capabilities 8 hours ago Finance experts predict XRP price for end of 2024 9 hours ago Imminent breakout? XRP whales go on $30 million buying spree in 24 hours 10 hours ago

It acted as a resistance barrier back then. However, since the March 2024 breakout, this zone has become a solid support base, reinforcing Bitcoin’s upward momentum.

According to the analysis, Bitcoin’s interaction with this pivot zone reflects a strong upward trajectory. The one-month candle shows an aggressive rebound off the 50-week moving average (1W MA50). This rebound has bolstered bullish sentiment, suggesting that Bitcoin is preparing for a significant rally.

Bitcoin price analysis chart. Source: TradingView

Bitcoin price analysis chart. Source: TradingView

Another bullish indicator is the channel-up pattern observed over the past two years. This pattern consists of ascending waves, each contributing to Bitcoin’s upward trend. Therefore, as the end of August approaches, the pattern suggests that Bitcoin is well-positioned to continue climbing, potentially reaching the highly anticipated $100,000 level.

“The Bullish Waves on the 2-year Channel Up indicate that after this month closes, $100000 is well within reach,” the expert noted.

Bitcoin’s path to $100,000

It is worth noting that since Bitcoin reached its all-time high of over $73,000 earlier this year, market participants have maintained that the next possible target is the $100,000 milestone. Besides fundamental factors like economic performance, most analysts agree that Bitcoin’s push toward $100,000 will likely coincide with a post-halving rally.

In the short term, reclaiming the $65,000 resistance remains a crucial target for Bitcoin as it will anchor toward another all-time high. In this regard, crypto trading expert Ali Martinez pointed out that if Bitcoin closes above the critical resistance level of $65,440, it could signal a bullish trend that may propel the cryptocurrency to a new local top of around $86,910.

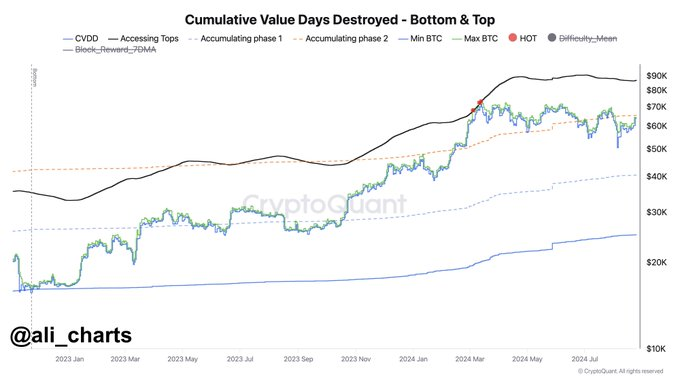

Bitcoin cumulative value days destroyed. Source: CryptoQuant/Ali_Charts

Bitcoin cumulative value days destroyed. Source: CryptoQuant/Ali_Charts

This projection is based on the Cumulative Value Days Destroyed (CVDD) alongside various other technical indicators, suggesting that Bitcoin is currently in an “Accumulating Phase 2.” This phase is typically characterized by gradual price increases as market participants continue to accumulate, often preceding a more substantial upward movement.

The analysis also highlighted that the current market conditions align with historical patterns seen during previous bull runs, adding weight to the possibility of Bitcoin reaching new highs in the coming months. However, Bitcoin must first conquer the $65,440 resistance level—a pivotal point that could determine the market’s short-term direction.

Bitcoin price analysis

As of press time, Bitcoin was trading at $61,754, reflecting daily losses of over 2%. On the other hand, after hitting a weekly high of about $64,700, Bitcoin surged over 3% within the same timeframe.

Bitcoin seven-day price chart. Source: Finbold

Bitcoin seven-day price chart. Source: Finbold

Overall, investors should closely monitor Bitcoin’s ability to maintain the $60,000 level, which could be crucial for reclaiming the $65,000 resistance.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.