Not long ago, the Bitcoin blockchain released 94.42% of its total supply, leaving only—or 174,583.24 bitcoins—to be mined until 20 million are in circulation. Calculations indicate that this milestone will be reached before the fifth Bitcoin halving, expected to occur in April 2028.

Algorithmic Scarcity: Bitcoin Nears 20 Million

The commonly cited total supply of bitcoin (BTC) is 21 million, yet the actual number destined to exist is slightly lower—approximately 20,999,999.97 BTC. This variation results from rounding errors in the Bitcoin protocol. Even with the differing figures, the authentic total remains very close to the frequently mentioned 21 million.

Recently, 94.42% of the supply has been mined, and as of now, 19,825,416.76 BTC has been issued. Because Bitcoin’s issuance rate is mathematically predictable and we can approximate dates such as the fifth block subsidy halving event, we can also determine when the network will mine the remaining 174,583.24 bitcoins to reach 20 million.

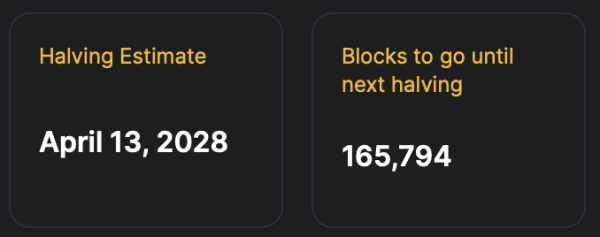

Halving estimate according to hashrateindex.com.

Halving estimate according to hashrateindex.com.

Projections indicate that the fifth block halving will occur on or around April 13, 2028, at which point the block subsidy will drop from 3.125 BTC to 1.5625 BTC per block.

This estimation relies on block interval averages that typically hover around ten minutes. Applying the same block interval calculation and considering that the network’s mining difficulty maintains this steady rhythm, the 20 million BTC milestone is expected on or around March 12, 2026, at block height 940,217.

At that moment, with only 1 million—or roughly 999,999.97 BTC—will remain to be mined. Given these estimates, the milestone should be reached roughly halfway between the upcoming halving events, with the 20 million mark likely occurring two years prior to the next halving.

Satoshi Nakamoto’s genius crystallizes in Bitcoin’s unyielding issuance mechanics—halvings, difficulty adjustments, and rhythmic block intervals—orchestrating scarcity with algorithmic precision. These self-regulating protocols transmute network volatility into predictable issuance, ensuring seamless progression toward the supply cap.

Through a symphony of code, Nakamoto’s design defies chaos, embedding trust in mathematical inevitability. In this world, scarcity isn’t mined; it’s engineered, cementing decentralized consensus as humanity’s most audacious ledger.