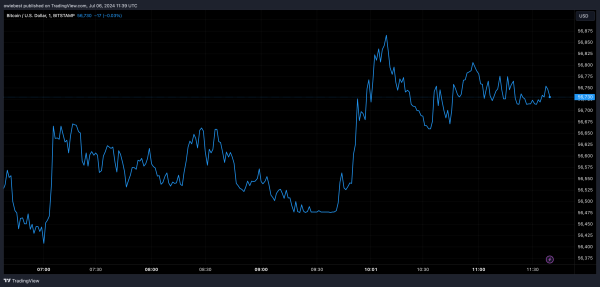

Although Bitcoin has reclaimed the $56,000 price level in the past few hours, its sudden drop below $54,000 on July 5 has reminded investors of the intense volatility associated with the market. In the larger timeframe, Bitcoin has been down by 7% and 20.25% in the past seven and thirty days, respectively.

While many crypto traders and analysts are still in the spirit of a bullish cycle in the long term, the sudden price drop wasn’t surprising to some. Notably, crypto trader @TheFlowHorse revealed that the drop to $53,000 resonated with his target of $52,000. Similarly, Ki Young Ju, CEO of CryptoQuant, noted the possibility of Bitcoin dropping to $47,000.

Bitcoin Could Crash To $47,000

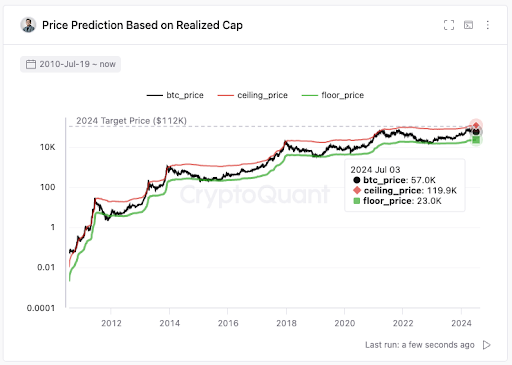

According to Ki Young Ju, Bitcoin is still in a bull market in the larger timeframe, which will continue until early 2025. This school of thought resonates with many other price outlooks for Bitcoin, especially in the long term. Despite this bullish projection, market participants are currently struggling with short-term bearish conditions.

As Ki Young Ju noted, this uncertainty opens up the possibility of the world’s leading digital currency plummeting to a chilling $47,000 before finding its footing again. With the crypto market in a prolonged slump since the beginning of June, this bearish case scenario seems increasingly plausible. Bitcoin, in particular, has shed billions in value, and investor confidence is wavering.

$112K at the peak of the cycle.https://t.co/beKpUVkNXL pic.twitter.com/Esj02BYms4

— Ki Young Ju (@ki_young_ju) July 5, 2024

Young Ju admonishes traders not to open high-leverage long or short positions based on his long-term bullish projections due to the prevailing uncertainty. When asked what his long-term price target for Bitcoin was, he noted a rise to $112,000 at the peak of the cycle. This prediction is based on the BTC realized market cap since July 2010.

Bearish Case For Bitcoin

At the time of writing, Bitcoin is trading at $56,520 and has rebounded by 4.67% since its recent fall below $54,000. However, despite this price recovery, the crypto faces a significant risk of falling further amid whale selloffs, which have amounted to over $1.7 billion in BTC in the past 30 days. Defunct crypto exchange Mt. Gox is also starting to repay its creditors in BTC after 10 years of inactivity. This is anticipated to unleash a $2.71 billion supply of Bitcoin onto the market, perhaps intensifying selling pressure.

A reversal to the downside is not out of the books yet. If Bitcoin were to fall to $47,000, it would represent a 16% decline from the current price level. Market participants continue to await how Bitcoin’s price action plays out in July, which has historically been a positive month.

Featured image created with Dall.E, chart from Tradingview.com

Source