Recent statistics reveal a notable surge in Bitcoin (BTC) transactions, reaching a peak not seen in six months. Insights from blockchain analysis firm IntoTheBlock attribute this spike to a rising number of wallets that hold BTC, which has been shared through their social media channels.

Contents hide 1 Why Are Bitcoin Addresses Increasing? 2 What Drives Short-Term Bitcoin Trading?

Why Are Bitcoin Addresses Increasing?

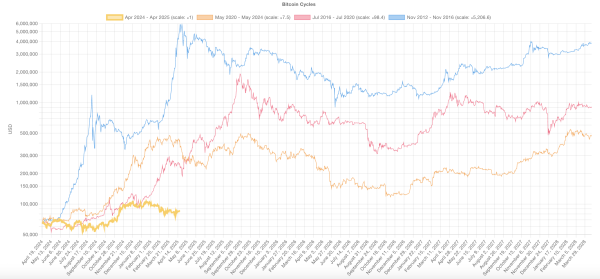

IntoTheBlock points out that the number of addresses accumulating BTC for under 30 days has been a significant factor in this upward trend. Such a pattern typically signals a bullish market atmosphere. Current developments are being likened to the market behaviors observed during the prosperous years of 2017 and 2020/21.

What Drives Short-Term Bitcoin Trading?

Data suggests that short-term Bitcoin traders are actively participating in the market and boosting their holdings. This trend is generally interpreted as a positive indicator, as these investors seek to capitalize on immediate price movements.

Key takeaways from the rising Bitcoin activity include:

- Increased short-term trading activity signals positive market sentiment.

- A surge in open positions in the derivatives market shows growing investor confidence.

- Historical parallels suggest potential upcoming bullish trends, similar to previous market peaks.

The latest data offers valuable insights for traders and market participants, indicating a possible bullish trajectory for Bitcoin. Observing these patterns could prove essential for future trading strategies.