Synopsis

Bitcoin experienced a correction following the Fed’s hawkish stance, but institutional interest shifted towards Ethereum ETFs. Russia’s adoption of crypto for international trade highlights its utility beyond speculation. Retail investor interest remains strong, with increased “buy the dip” sentiment.

Over the past week, Bitcoin saw its first Price Discovery Correction of this bull run following the Fed’s hawkish comments on the Bitcoin Strategic Reserve and weak inflation forecast for 2025. This correction, while giving the investors an attractive entry point and opportunity for Dollar Cost Averaging, slowed Bitcoin’s momentum towards the $110,000 mark. Despite the correction, the ETF space saw some action, creating more milestones for the crypto market towards the end of the year.

On the other hand, we also saw crypto becoming a solution for major economies like Russia in international payments, increasing the scope for real-world adoption of crypto.

Ethereum ETFs Hits the $2.5 Billion AUM

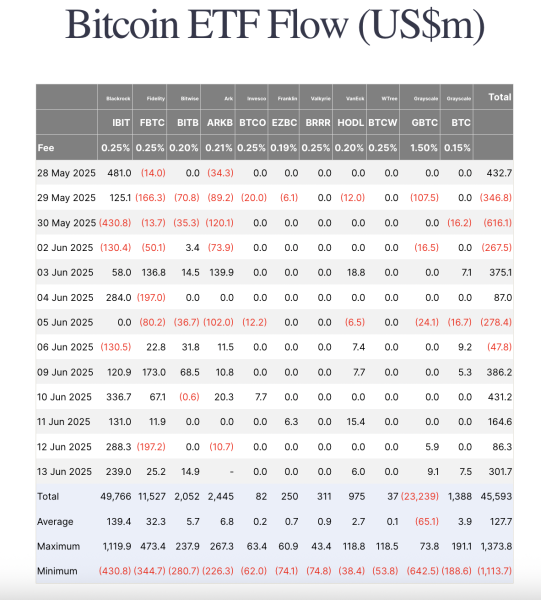

Ever since the Fed’s meeting, most tokens have been trading sideways with investors waiting for a positive catalyst to pick up the momentum. During the correction, even the institutional investors saw a shift in preference with Ethereum ETFs seeing inflows of $301.4 million in the past week, hitting $2.5 billion in AUM. At the same time, Bitcoin ETFs saw an outflow of $1.1 billion. This shows a clear shift in institutional sentiment, indicating a strategic move toward diversification. The outperformance of Ethereum ETFs could also mean that the institutions are getting ready for other ETFs that are in talks such as Solana ETFs and Ripple ETFs.

Crypto Tracker![]() TOP COIN SETSNFT & Metaverse Tracker0.43% BuySmart Contract Tracker-0.45% BuyWeb3 Tracker-1.83% BuyBTC 50 :: ETH 50-2.07% BuyDeFi Tracker-4.19% BuyTOP COINS (₹) BNB59,387 (-0.02%)BuyTether85 (-0.25%)BuyXRP184 (-0.66%)BuyEthereum285,187 (-1.28%)BuyBitcoin8,061,123 (-1.97%)Buy

TOP COIN SETSNFT & Metaverse Tracker0.43% BuySmart Contract Tracker-0.45% BuyWeb3 Tracker-1.83% BuyBTC 50 :: ETH 50-2.07% BuyDeFi Tracker-4.19% BuyTOP COINS (₹) BNB59,387 (-0.02%)BuyTether85 (-0.25%)BuyXRP184 (-0.66%)BuyEthereum285,187 (-1.28%)BuyBitcoin8,061,123 (-1.97%)Buy

In the last week, we also saw the SEC approving the first-ever hybrid ETFs combining Bitcoin and Ethereum ETFs. This along with Vivek Ramaswamy’s Strive filing for “Bitcoin Bond ETFs” indicates strong institutional interest in crypto-related investment products, giving rise to a diversified crypto portfolio.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »![]()

Russia Adopts Crypto for International Trade

One of the major developments for the crypto markets in the past week is Russia using Bitcoin and other tokens for international payments. Just a few weeks after approving the new crypto tax law, the country has started making the most of its newer regulations. By leveraging crypto, Russia has effectively bypassed sanctions imposed by traditional financial systems, showcasing the utility of digital assets in addressing global challenges like restricted access to international trade. This move could encourage other nations as well to explore crypto as an alternative payment system, further driving global adoption.

Retail Investors Show Renewed Enthusiasm

Bitcoin saw increased retail interest towards the last week of the year with Bitcoin’s popularity on X (formerly Twitter) growing by a massive 65% year-on-year. Additionally, data from blockchain analysis firm Santiment reveals that mentions of “buying the dip” across social media platforms reached an eight-month high showing renewed buying interest from the retail segment despite the correction. While the growing popularity of Bitcoin can be attributed to the $100k milestone and the new all-time high of $108,000, it is interesting to observe the increasing maturity in the investors capitalising on the market fluctuations.

What Investors Need to Keep in Mind

Just like any other financial market, the crypto market also has its cycles controlled by the bulls and bears. In order to minimize risk during such market corrections, one must invest systematically, averaging the entry point to make the most of their investments. Even during a bull market, there would be instances where the market would take a breather to further gain momentum. It is important to keep yourself updated about the markets to safeguard your positions from unexpected corrections.

Another crucial aspect is to do thorough research before investing and setting a clear methodology for investing with a diversified portfolio. This helps the investor in making calculated investment decisions to meet the individual financial goals.

Top 3 crypto gainers during the week:

1) BitGet Token is up 135.16%

2) Virtuals Protocol is up 48.66%

3) Pudgy Penguins is up 46.39%

Top 2 crypto losers this week:

1) Aptos is down 10.89%

2) Ondo is down 2.89%

(The author Edul Patel is CEO and Co-founder of Mudrex, a global crypto investment platform. Views are own.)

(Disclaimer: Recommendations, suggestions, views, and opinions given by experts are their own. These do not represent the views of the Economic Times)