Synopsis

Crypto market displays strength despite global tensions. Bitcoin almost reached a new high. Institutional investors are back, stabilizing prices. Macroeconomic data impacts market moves. Geopolitical concerns cause temporary dips. Market shows resilience. Retail interest is also increasing. Investors should be cautious. Systematic investment is advised for long-term gains. SPX, Uniswap, and Hyperliquid are top gainers.

The crypto market saw considerable price action in the past week, with Bitcoin coming just 1.2% away from a new all-time high. Bulls showed a strong hold over the market, helping major coins gain back the upward momentum. The developments in the US-China trade talks further added fuel to the rally, pushing Bitcoin by 4%. While Bitcoin and the broader market witnessed some profit-taking towards the end of the week as geopolitical tensions escalated in the Middle East, the market sentiment remains on the positive end, given the macroeconomic factors and institutional activity playing crucial roles.

Currently trading at $104,500, Bitcoin is showing early signs of a recovery trend. While the trend appears to be healthy, many factors can influence the direction of the market in the short term. These factors could set the precedent for how the markets could behave in the coming weeks.

Increasing Institutional Activity

Institutional investors have come back to the markets, helping Bitcoin and Ethereum stabilise the price at the support levels. In this week alone, Bitcoin spot ETFs saw over $1 billion in net inflows, increasing nearly 30% from the previous week. Additionally, Strategy also acquired 1,045 Bitcoins, increasing its holdings to 582,000 BTC. This has also impacted the overall market sentiment, contributing to the rally during the week. Alongside institutional buying, Bitcoin Whales have also contributed to the momentum. New data from CryptoQuant reveals that large Bitcoin holders now hold a balance of 3.57 million BTC. When whales steadily add to their reserves, they act as powerful demand sinks. Their increasing accumulation reduces the available supply and provides price support.

Crypto Tracker![]() TOP COIN SETSDeFi Tracker4.54% BuyBTC 50 :: ETH 500.81% BuyCrypto Blue Chip – 50.07% BuyWeb3 Tracker-5.13% BuyAI Tracker-6.76% BuyTOP COINS (₹) Solana12,659 (2.0%)BuyXRP186 (1.96%)BuyEthereum220,027 (1.45%)BuyBitcoin9,076,439 (1.05%)BuyBNB56,200 (0.58%)Buy

TOP COIN SETSDeFi Tracker4.54% BuyBTC 50 :: ETH 500.81% BuyCrypto Blue Chip – 50.07% BuyWeb3 Tracker-5.13% BuyAI Tracker-6.76% BuyTOP COINS (₹) Solana12,659 (2.0%)BuyXRP186 (1.96%)BuyEthereum220,027 (1.45%)BuyBitcoin9,076,439 (1.05%)BuyBNB56,200 (0.58%)Buy

Another interesting trend among the institutional activity is the consecutive net inflows into the Ethereum Spot ETFs. Since the beginning of this month, ETH ETFs have seen $812 million in net inflows, helping Ether maintain its current bull run. This institutional interest in ETH could be the catalyst for ETH to reclaim the $3000 mark soon.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »

Live Events

Impact of Macroeconomic Data

During the week, many macroeconomic indicators also played a role in the price movements. The US Dollar Index (DXY) fell to its lowest point in seven weeks, indicating that investors are retreating from the dollar. This drop typically points to declining confidence in the Federal Reserve’s capacity to manage economic risks and heightened concern over the country’s fiscal trajectory, bringing in fresh liquidity into the markets.

On the other hand, the Consumer Price Index (CPI) data coming in cooler than expected at 2.4% year-on-year helped Bitcoin rally as the hopes for a rate cut during the upcoming Federal Open Market Committee (FOMC) meeting increased. However, the US Producer Price Index (PPI) data that came out the following day rose to 2.6% (higher than expected), leading to profit booking among investors.

Increasing Geopolitical Tensions

The rising geopolitical concerns are another factor that could influence the direction of the crypto market. Israel’s airstrikes on Iran have led to fear of war, resulting in a 4% decline in the overall crypto market cap. While the prices have started recovering as investors digest the news, any escalation from Iran in the next few days could lead to a fresh downward trajectory with Bitcoin testing the $100,000 levels. On the other hand, any de-escalation attempts could push the market back up, helping Bitcoin reclaim the $110,000 mark along with a boost in the broader market.

Way Forward

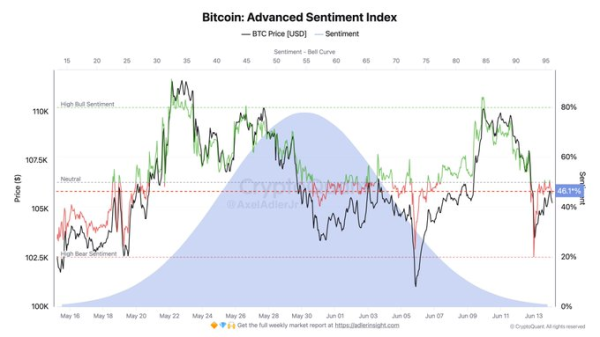

The crypto market is showing strong resilience despite the growing geopolitical uncertainty. While institutional inflows have played a crucial role in stabilising the prices, the retail interest is also increasing with BTC’s bullish sentiment reaching a seven-month high, as positive social media comments, tracked across X and Reddit, doubled. However, investors must remain cautious and continue to invest only after thorough research, as such uncertainty might lead to high price swings. For long-term investors, such volatility is an accumulation opportunity to generate better risk-adjusted returns. It is advised to invest systematically to take advantage of any volatility that comes in the investment journey, helping build long-term wealth.

Top 3 crypto gainers during the week:

- SPX is up 24.6%

- Uniswap is up 21.7%

- Hyperliquid is up 14.8%

Top 3 crypto losers during the week:

- Celestia is down 14.10%

- Jupiter is down 13.07%

- Story (IP) is down 10.5%

The author is Co-founder and CEO of Mudrex, a global crypto investment platform.

Source