The world’s most prominent cryptocurrency, Bitcoin (BTC), surged to $73,072 today, edging closer to new heights after bouncing from a critical support level last week. Current projections suggest the cryptocurrency might shatter previous records with an ambitious target of $82,336, aligning with the 1.272 Fibonacci extension level.

Driving this rally is a powerful wave of institutional demand fueled by renewed inflows into Bitcoin ETFs, which brought in over $472 million on Monday alone. This marks a fourth consecutive day of gains, showcasing a robust appetite from major players keen on strengthening last week’s momentum.

Rising On-Chain Metrics Signal BTC’s Bullish Surge

Delving into the token’s on-chain signals, the data reflects growing optimism. Coinglass data reveals that the cryptocurrency’s futures Open Interest (OI) across major exchanges reached an all-time high of $42.23 billion, up 6.66% in just a single day. This uptick signals an influx of fresh capital, sparking buying pressure across the market.

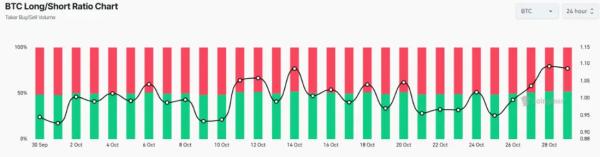

Additionally, the token’s long-to-short ratio stands at 1.0859, nearing a monthly high of 1.09, reflecting a confident, bullish bias as traders increasingly position themselves for further gains. A glance at Bitcoin’s weekly chart further highlights the importance of its latest moves. Last week, the BTC token broke out of a descending parallel channel at $67,640, a crucial resistance level. As of press time, BTC sits at $73,072, an 8.9% increase since the start of the week, signaling sustained bullish momentum.

Eyes on the Prize: Bitcoin’s Path to $82K

From a technical standpoint, the Relative Strength Index (RSI) on the weekly chart rests comfortably at 62.08, above the neutral 50 mark but well below the overbought threshold. This suggests Bitcoin’s upward momentum has ample room to grow before it hits resistance.

The daily chart further solidifies this view, as the BTC cryptocurrency found key support at $65,380 on Friday, climbing over 7% into Monday and extending gains into Tuesday. Should the token maintain this bullish push, it could soon challenge its next major hurdle at $73,750, its all-time high from March.

A close above this could open the door to the 1.272 Fibonacci extension level of $82,336. Yet, with the daily RSI peaking at 71, the cryptocurrency reflects an overbought territory. As a result, traders might consider holding off on additional long positions as the risk of a pullback increases.

However, if the BTC token continues to soar and the RSI sustains its overbought status, a new all-time high may be within reach. Conversely, a close below $67,640 could spark a retracement, possibly falling 6.47% to retest the $63,196 support zone, tied to the 61.8% Fibonacci retracement level seen in mid-October.