Synopsis

On Friday, major cryptocurrency tokens experienced declines amidst a strengthening U.S. dollar, which reached an eight-week high. The Federal Reserve’s cautious stance on interest rate cuts diverged from more accommodative approaches taken by other central banks.

Major crypto tokens declined on Friday as the U.S. dollar surged to a fresh eight-week high, with the Federal Reserve’s patient approach to cutting interest rates contrasting with more dovish stances elsewhere.

Bitcoin was trading 1.3% lower at $64,592 as of 11:56 a.m. IST, while Ethereum was below the $3,550 level.

The dollar index, which measures the currency against six major peers including the yen, sterling, euro, and Swiss franc, spiked 0.41% overnight.

Crypto Tracker![]() TOP COIN SETSWeb3 Tracker9.28% BuyNFT & Metaverse Tracker6.86% BuyBTC 50 :: ETH 505.83% BuyCrypto Blue Chip – 55.81% BuyAI Tracker1.30% BuyTOP COINS (₹) Bitcoin5,303,812 (3.25%)BuySolana12,368 (3.14%)BuyEthereum290,978 (2.43%)BuyBNB48,518 (0.98%)BuyTether83 (0.16%)BuyThe dollar last traded 0.05% stronger at 159.015 yen. The U.S. currency added 0.07% to 0.89165 Swiss franc, following a 0.78% surge overnight.

TOP COIN SETSWeb3 Tracker9.28% BuyNFT & Metaverse Tracker6.86% BuyBTC 50 :: ETH 505.83% BuyCrypto Blue Chip – 55.81% BuyAI Tracker1.30% BuyTOP COINS (₹) Bitcoin5,303,812 (3.25%)BuySolana12,368 (3.14%)BuyEthereum290,978 (2.43%)BuyBNB48,518 (0.98%)BuyTether83 (0.16%)BuyThe dollar last traded 0.05% stronger at 159.015 yen. The U.S. currency added 0.07% to 0.89165 Swiss franc, following a 0.78% surge overnight.

Did you Know?

The world of cryptocurrencies is very dynamic. Prices can go up or down in a matter of seconds. Thus, having reliable answers to such questions is crucial for investors.

View Details »The dollar index was little changed at 105.66, on course for a slight weekly gain that would extend its winning streak to three weeks.

A rise in the dollar index is generally negative for Bitcoin because it indicates a stronger U.S. dollar, leading investors to move away from riskier assets like cryptocurrencies.

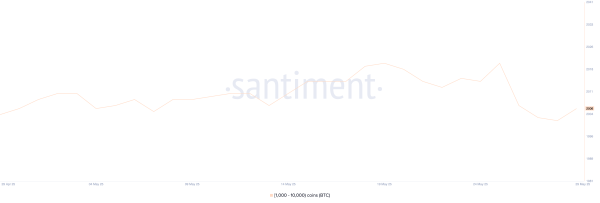

Meanwhile, Sathvik Vishwanath, Co-Founder & CEO of Unocoin, said, “Bitcoin’s fall below $65,000 was partly due to crypto hedge funds reducing their exposure to Bitcoin to 0.37, the lowest since October 2020. This cautious approach by hedge funds, driven by expected volatility, macroeconomic conditions, or regulatory uncertainties, increased selling pressure.”

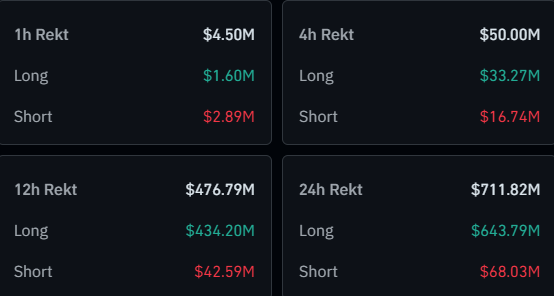

Edul Patel, CEO of Mudrex, said, “Bitcoin traded below the $65,000 level over the past day, breaking its support at $66,809 due to increased liquidations. The next support level is set at $64,000.”

Also Read: FIU slaps Rs 18.82 cr penalty on crypto exchange Binance

Other popular cryptocurrencies like BNB (3.1%), Solana (2.8%), XRP (1%), Dogecoin (0.5%), Shiba Inu (3.1%), and Polkadot (3.5%) declined.

The global cryptocurrency market cap declined by 1.5% to around $2.36 trillion in the last 24 hours.

The volume of all stablecoins is now $63.49 billion, which is 92.62% of the total crypto market 24-hour volume, as per data available on CoinMarketCap.

In the last 24 hours, the market cap of Bitcoin, the world’s largest cryptocurrency, fell to $1.273 trillion. Bitcoin’s dominance is currently 54.12%, according to CoinMarketCap. BTC volume in the last 24 hours rose 33.8% to $25.5 billion.

“BTC is consolidating around the $65,000 mark, and its direction remains uncertain. This is a critical level because a drop below it could lead BTC to fall to $60,000. Altcoins are generally weaker compared to BTC and ETH,” said CoinDCX Research Team.

(Disclaimer: The views expressed by experts are their own and do not necessarily reflect those of The Economic Times)

Source